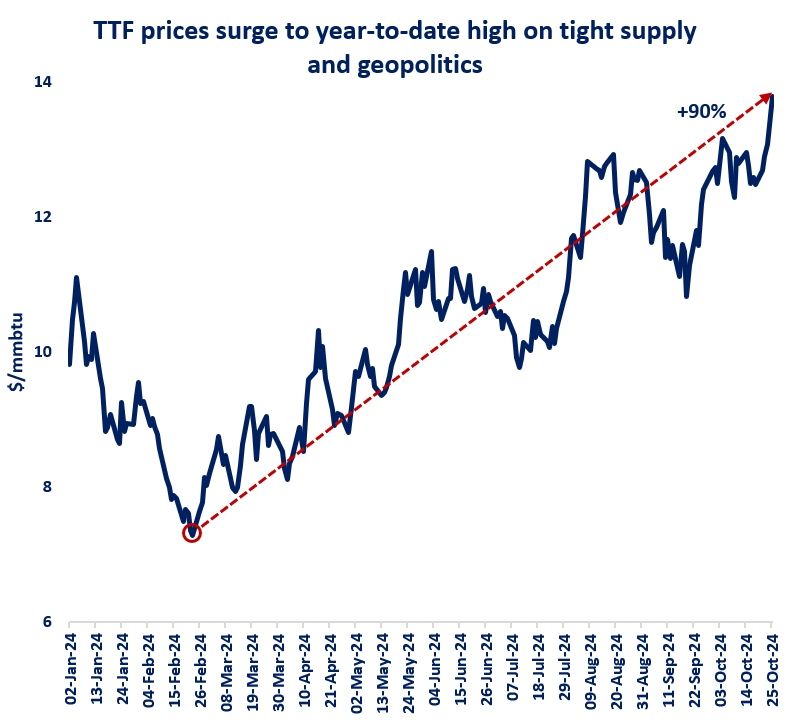

TTF prices surged yesterday to their highest level year-to-date, supported by tighter supply fundamentals and rising geopolitical tensions.

TTF prices rose by almost 90% since mid-February to near $14/mmbtu yesterday -which is above the coal-switching price channel and the price range of oil-indexed LNG contracts.

Passing through these resistance bands clearly indicates that we are now in a tight market, just ahead the start of the winter season.

There are several factors which have been driving TTF’s most recent bull run:

(1) LNG underperformance: project delays, feedgas supply issues and unplanned outages are weighing on LNG supply, which grew by less than 2% compared to last year -its weakest growth rate since 2020. US LNG feedgas flows were also down this week, due to lower deliveries to Cameron LNG;

(2) Unplanned outages in Norway: the Oseberg and Sleipner fields were out, further limiting piped flows to the European market;

(3) EU storage sites turned to withdrawals: partly due to lower imports, partly due to seasonal demand, EU storage sites shifted from injections to withdrawals this week;

(4) Russia’s Arctic LNG 2 shut down: the plant stopped producing LNG according to sources, with sanctions making apparently impossible to market LNG from the plant. according to sources, the plant would be shut over the winter season;

(5) Geopolitics: the intensification of the conflict in the Middle East is putting additional upward pressure on gas prices. this morning’s events (and their consequences) could fuel further price volatility next week.

What is your view? How will gas prices evolve over the winter season? Renewed market tightness is here to stay?

Source: Greg MOLNAR