European gas market enters price downturn as LNG supply rises and demand weakens

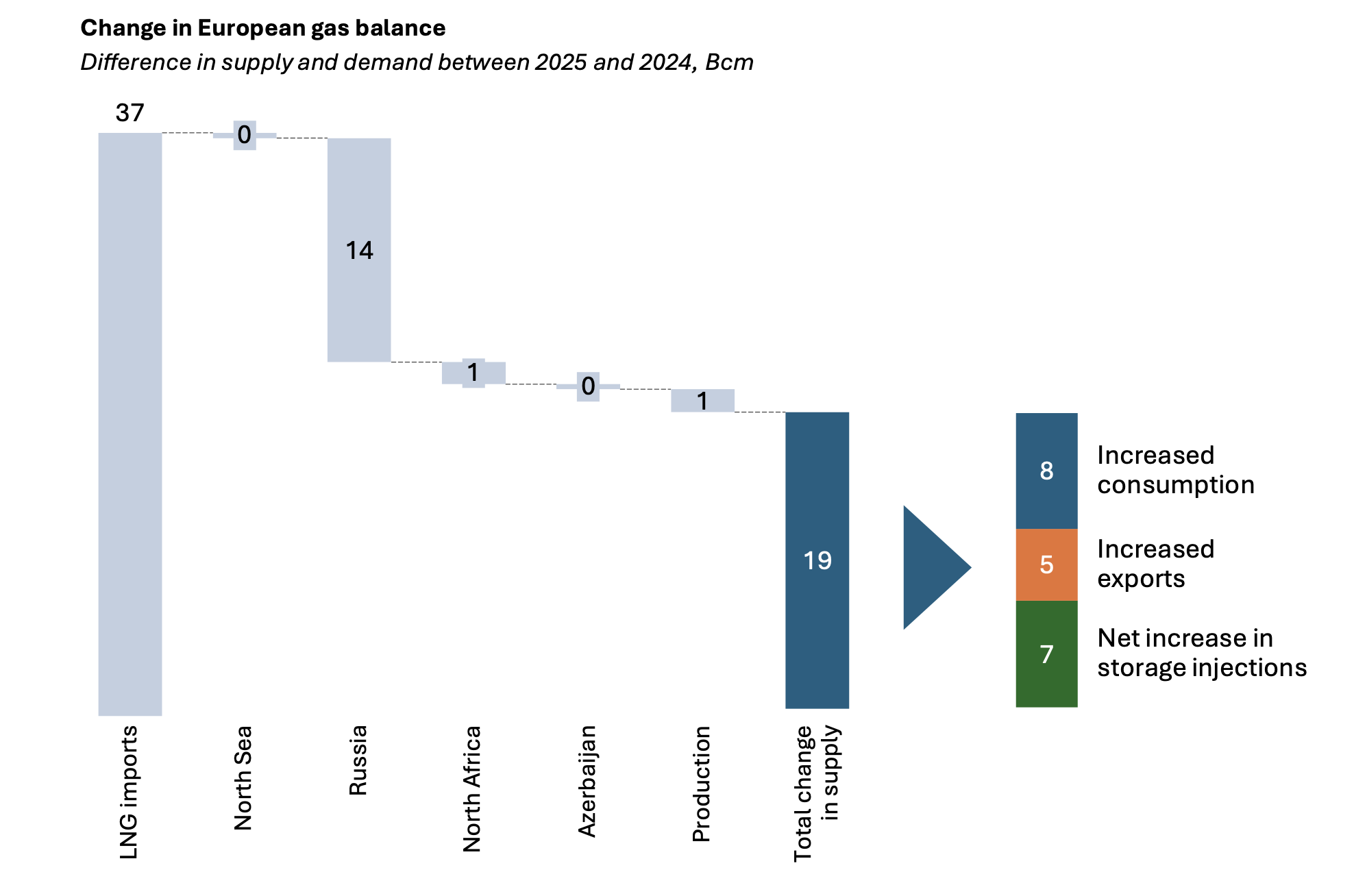

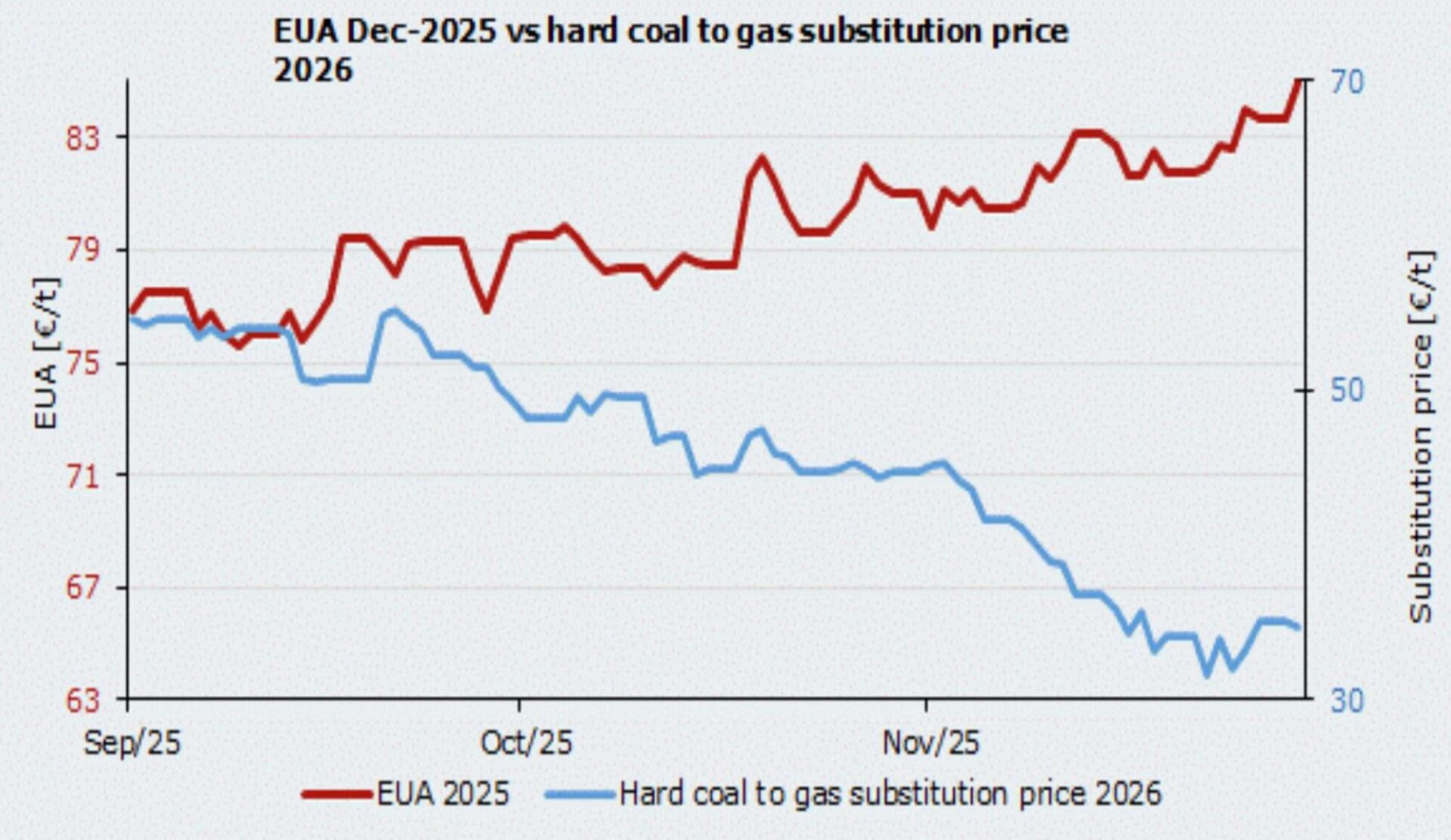

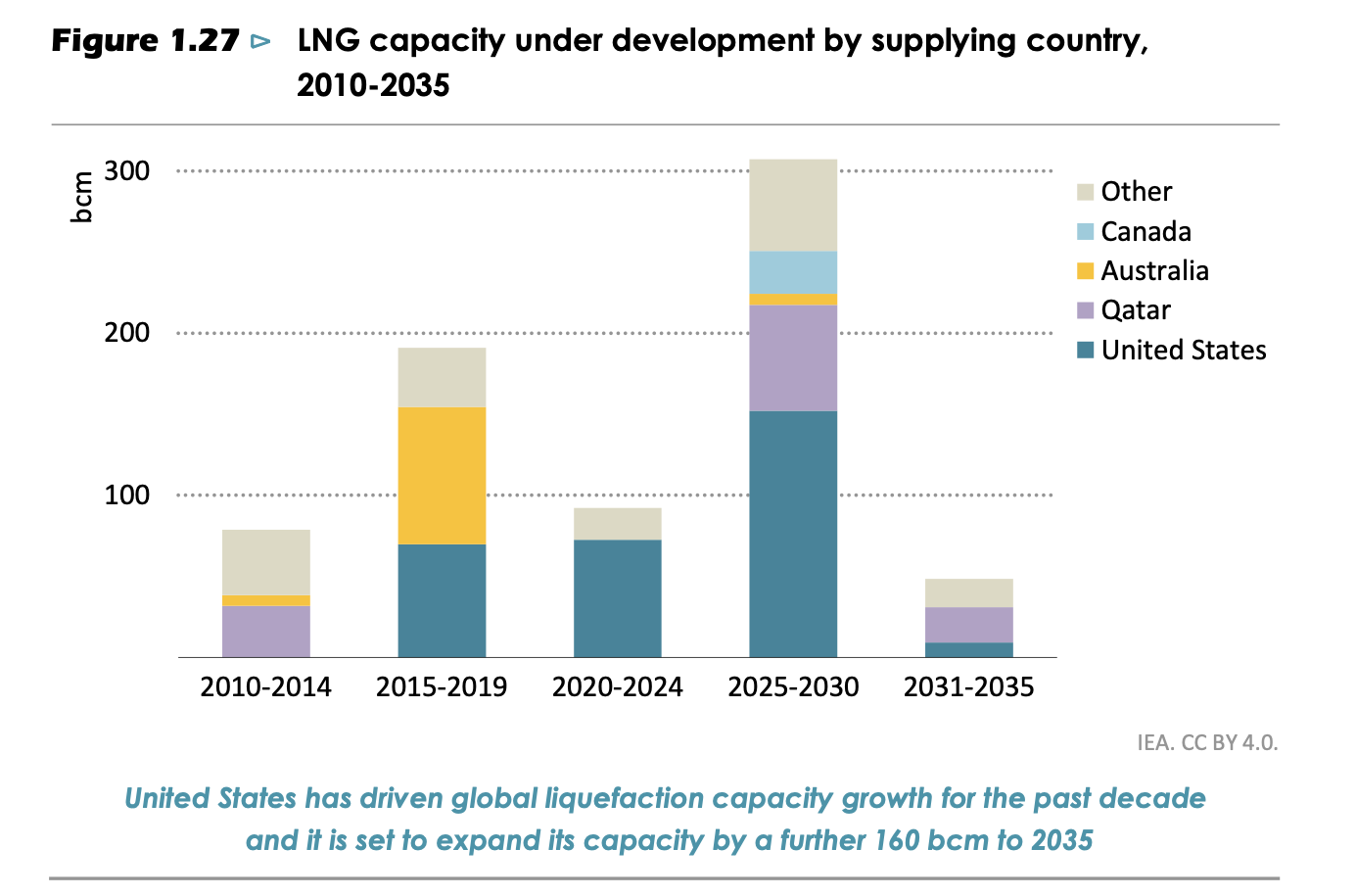

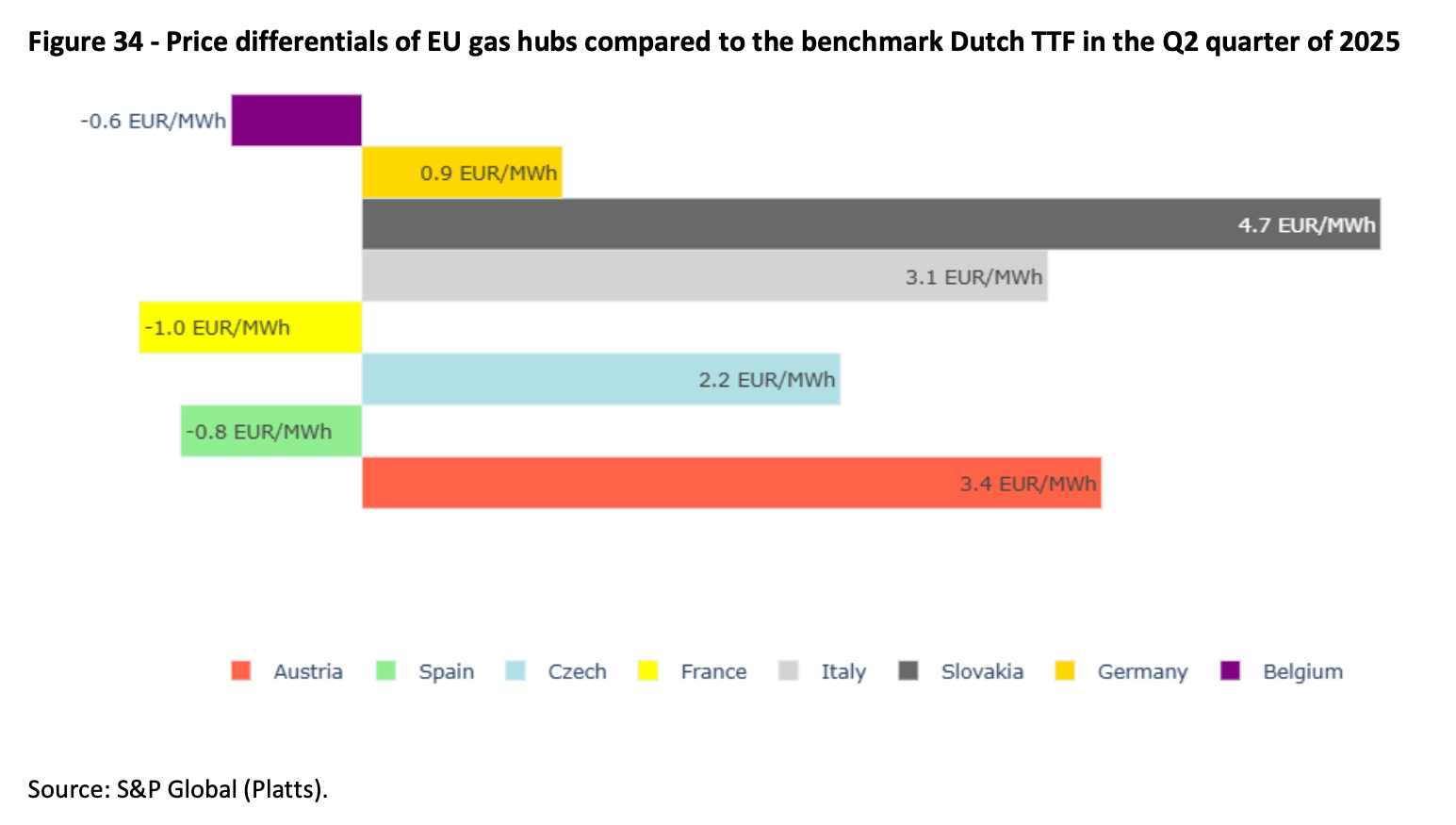

The European gas market shifted direction in the second quarter of 2025, with wholesale prices beginning to decline after three consecutive quarters of increases. Average wholesale prices fell quarter-on-quarter despite remaining above year-ago levels, signalling the start of a broader downward trend driven by rising global LNG supply, lower gas demand and milder seasonal conditions. Gas consumption declined year-on-year, reinforcing […]