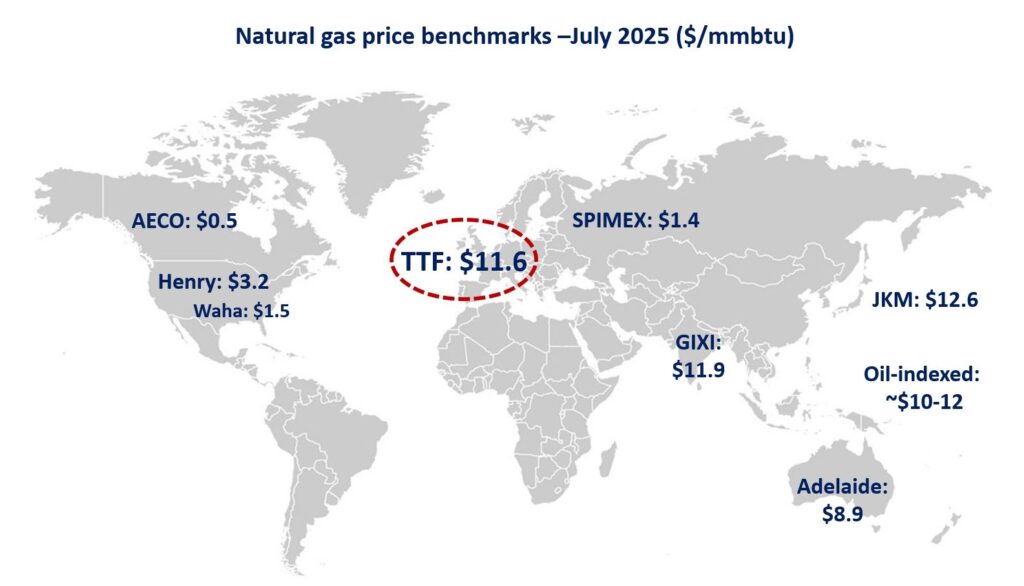

Summer heat, tight supply fundamentals and high storage injections kept gas prices above last year’s levels in July across all key markets.

In Europe, TTF month-ahead prices rose by 12% yoy to an average of $11.6/mmbtu, amid lower Russian piped gas imports, high storage injection needs and continued strong gas burn in the power sector.

In Asia, JKM prices rose by just 2% yoy to $12.6/mmbtu. sizzling heatwaves in China are supporting some demand recovery in the world’s largest gas importing country. after months of steep decline, China’s LNG imports recovered close to last year’s levels. this could indicate that we could see a stronger competition for LNG in the second half of the year.

In the US, Henry Hub prices were up by 55% yoy to an average of $3.2/mmbtu, supported by stronger gas burn in the power sector, high storage injections and all-time LNG exports. in contrast, in Canada AECO collapsed to $0.5/mmbtu -its lowest July average on record. strong domestic production together with high storage levels depressed gas prices.

What is your view? how could gas prices evolve through the remainder of the summer? will China’s gas demand recover after months of decline?

Source: Greg MOLNAR