European gas prices have softened sharply into the start of winter, with market dynamics overriding weather-driven demand strength, writes Greg Molnár.

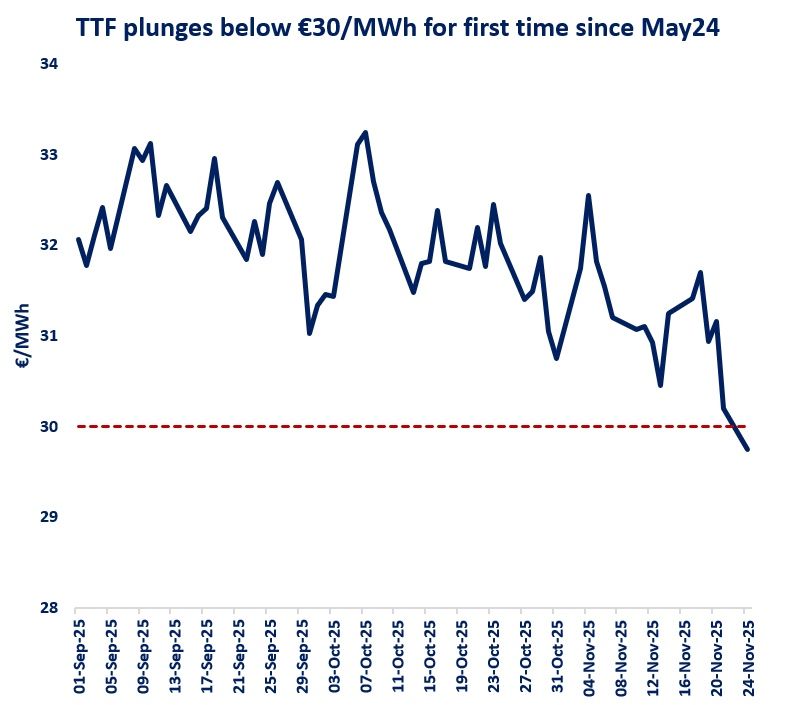

TTF month-ahead prices settled below the €30/MWh threshold yesterday for the first time since May 2024, further confirming the downward trend despite the recent cold spell.

TTF prices fell by more than 10% since early October, which officially marks the start of the heating season in Europe. The downward trend continued through the recent cold spell and despite Europe’s widening 5-year storage deficit (standing at 9 bcm now).

There are several driving forces behind this downward trend:

(1) The LNG wave is unfolding: global LNG supply grew by a staggering 20% yoy in the first 20 days of November, with the US alone accounting for nearly half of the incremental production.

(2) Ukraine peace talks: hopes on a potential peace deal are adding to the downward pressure on prices, with many observers considering the potential impact on gas trade with Russia, including the easing of the sanctions environment.

(3) Weather matters: after last week’s cold spell, weather models are shifting to a milder outlook, especially for the first half of December.

(4) Finance bros: the combined net short positions of financial players on TTF increased nearly tenfold since the start of August, and their short positions continued to rise through Oct/Nov, which is further reinforcing the overall downward trend.

What is your view? How will the winter play out for TTF? It’s all about bears — or could we see the return of the bulls once colder weather bites in? Or is it a one-way ticket to lower prices?

Source: Greg MOLNAR (LinkedIn)