Premium natural gas intelligence for market professionals

Curated reports, white papers, studies, and presentations from leading natural gas commentators, market analysts, research organisations, and industry experts.

Full access is available to premium subscribers.

Start with a FREE 30-day trial — cancel anytime.

Get instant access to our premium library of 2,000+ natural gas reports, white papers, and industry presentations, with new content added every week.

Subscribers use European Gas Hub to stay informed, compare market viewpoints, and save hours of research time — with trusted insights all in one place.

Already a subscriber ? Log in

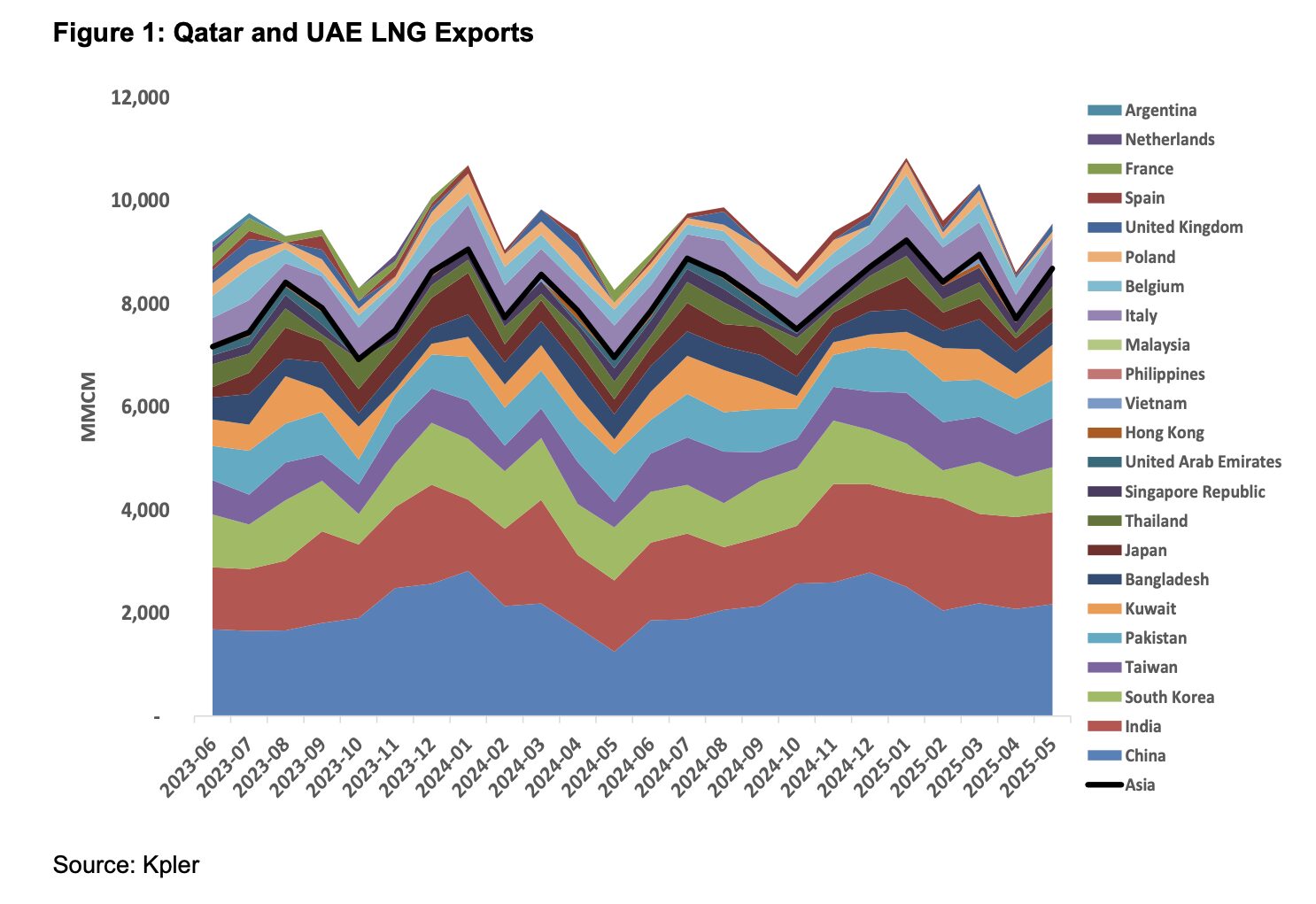

A Strait of Hormuz closure could remove 15% of global LNG supply and trigger a 2022-style gas price shock. The Strait remains unlikely to close, but modelling suggests the consequences for the global gas market would be severe if it did. Around 20% of global LNG supply — primarily from Qatar and the UAE — passes through the Strait. A […]

FREE TRIAL

Already a subscriber ? Log in

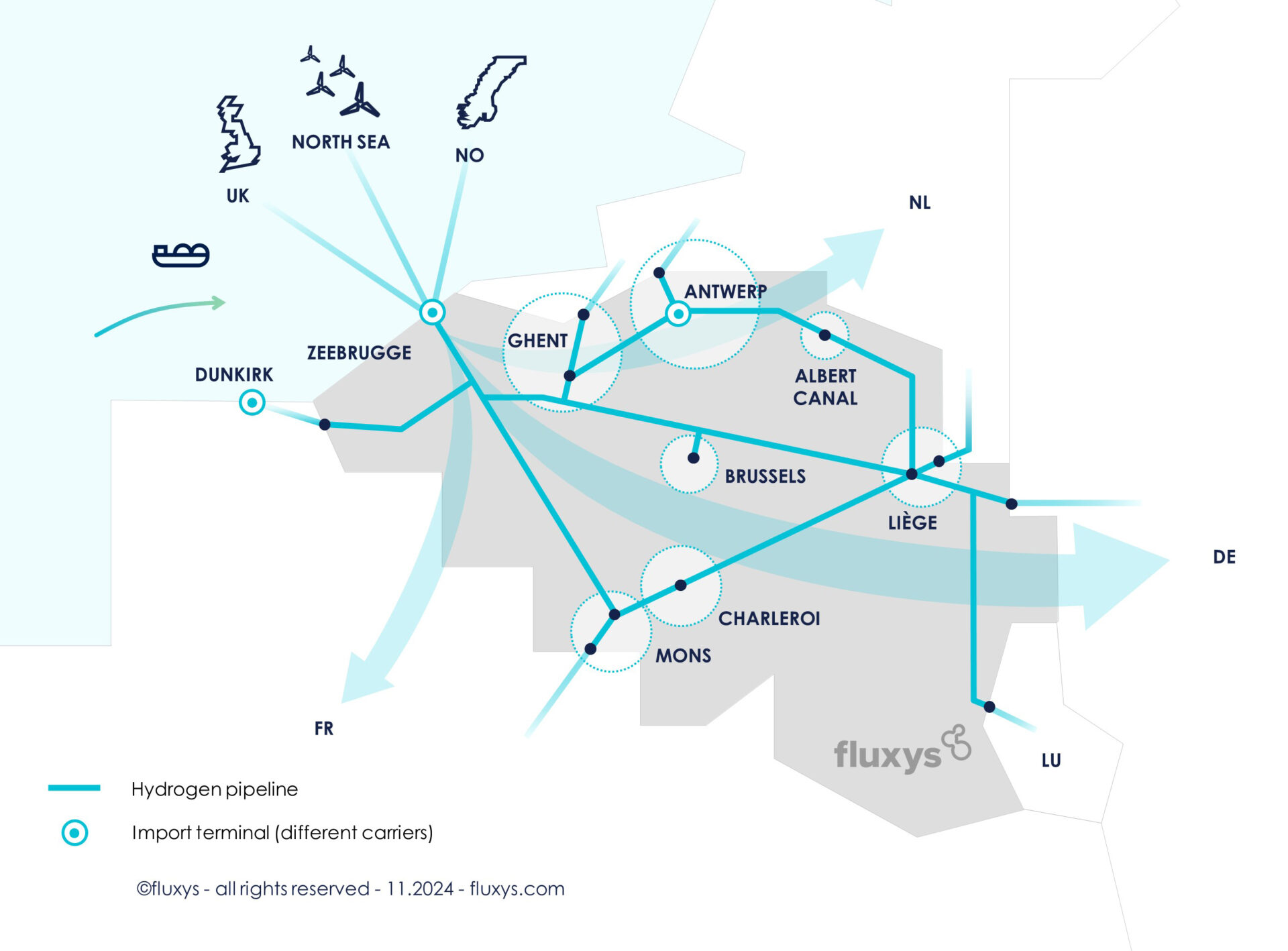

Belgium hydrogen terminal regulation is entering a critical phase as the federal regulator outlines how import infrastructure for hydrogen and ammonia should operate under the EU Hydrogen and Decarbonised Gas Package. The study clarifies the definition of hydrogen terminals, confirms a negotiated third-party access (nTPA) regime, and details how capacity allocation, transparency, and tariff principles should function in practice. The […]

FREE TRIAL

Already a subscriber ? Log in

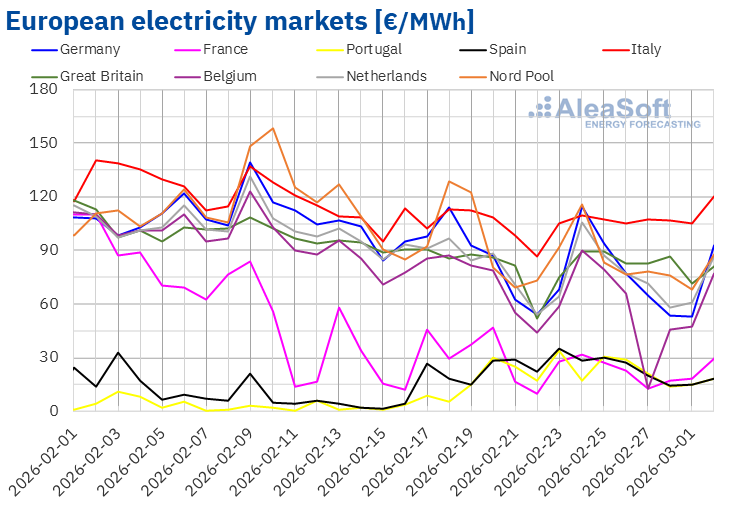

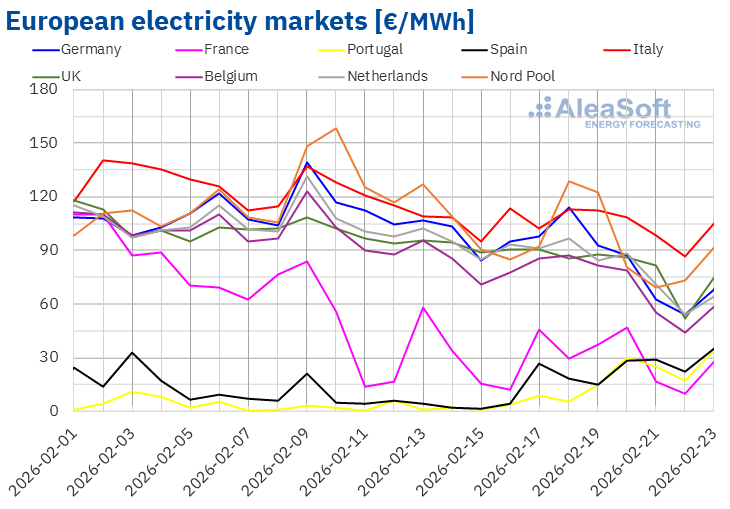

European power prices fell across most major markets in the final week of February, with weekly averages remaining largely below €75/MWh. The decline was driven by a sharp increase in solar photovoltaic generation, including record February output in Germany, France and Italy, combined with lower electricity demand amid milder temperatures. However, wind energy production dropped significantly in several markets, particularly […]

FREE TRIAL

Already a subscriber ? Log in

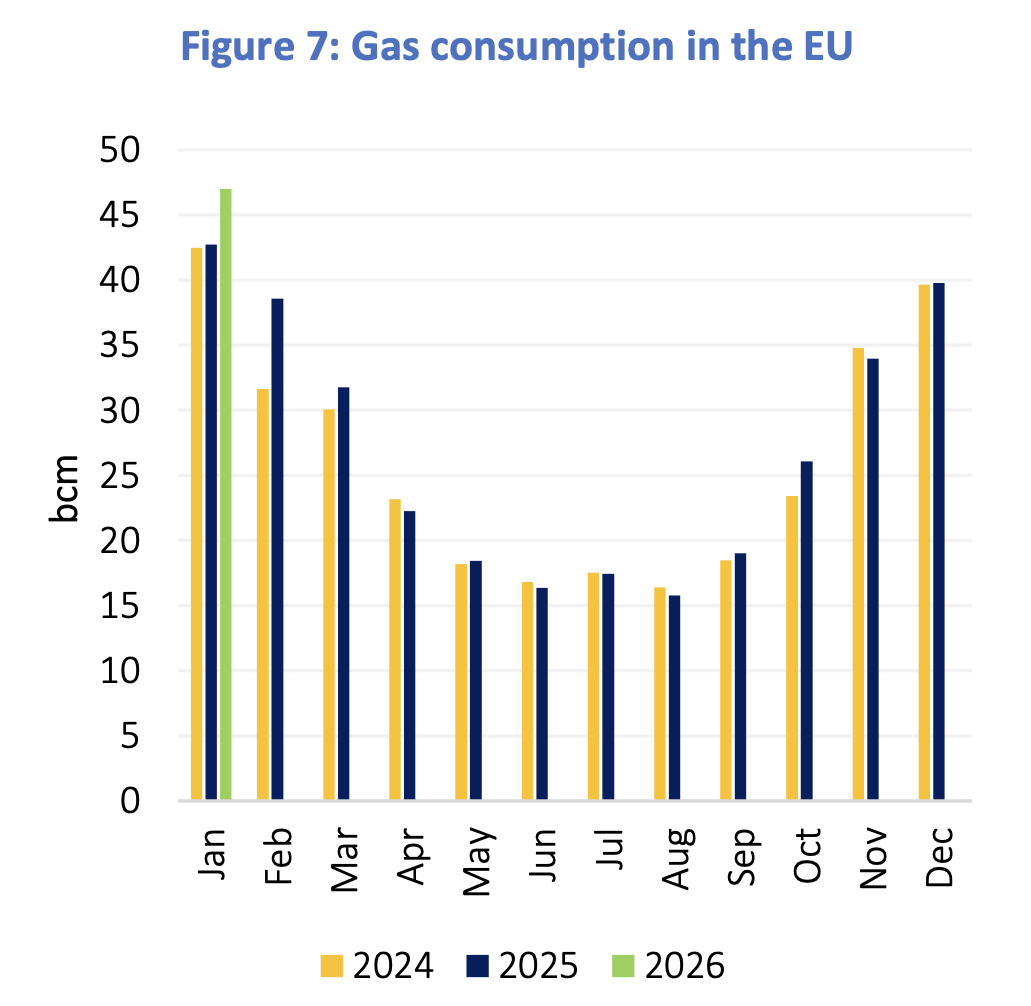

The European gas market tightened sharply in January as colder weather lifted demand, accelerated storage drawdowns and pushed LNG imports to new highs. Rising gas-fired power generation and lower domestic output further increased Europe’s reliance on external supply, reinforcing the region’s exposure to global LNG competition and price volatility. The European gas market strengthened markedly in January, driven by a […]

FREE TRIAL

Already a subscriber ? Log in

Azerbaijan gas exports are becoming an increasingly important pillar of Europe’s diversification strategy, with Italy positioned as a key entry and transit hub through the Southern Gas Corridor. Azerbaijan gas exports have gained strategic importance in the context of Europe’s efforts to diversify supply following the structural reduction of Russian pipeline volumes. Through the Southern Gas Corridor and the Trans-Adriatic […]

FREE TRIAL

Already a subscriber ? Log in

European electricity prices declined across most major markets in the third week of February as lower gas and CO2 futures, higher renewable output and weaker demand weighed on power prices. Spain and Portugal moved in the opposite direction, with the Iberian market registering sharp weekly increases. European electricity prices fell in most major markets during the third week of February, […]

FREE TRIAL

Already a subscriber ? Log in

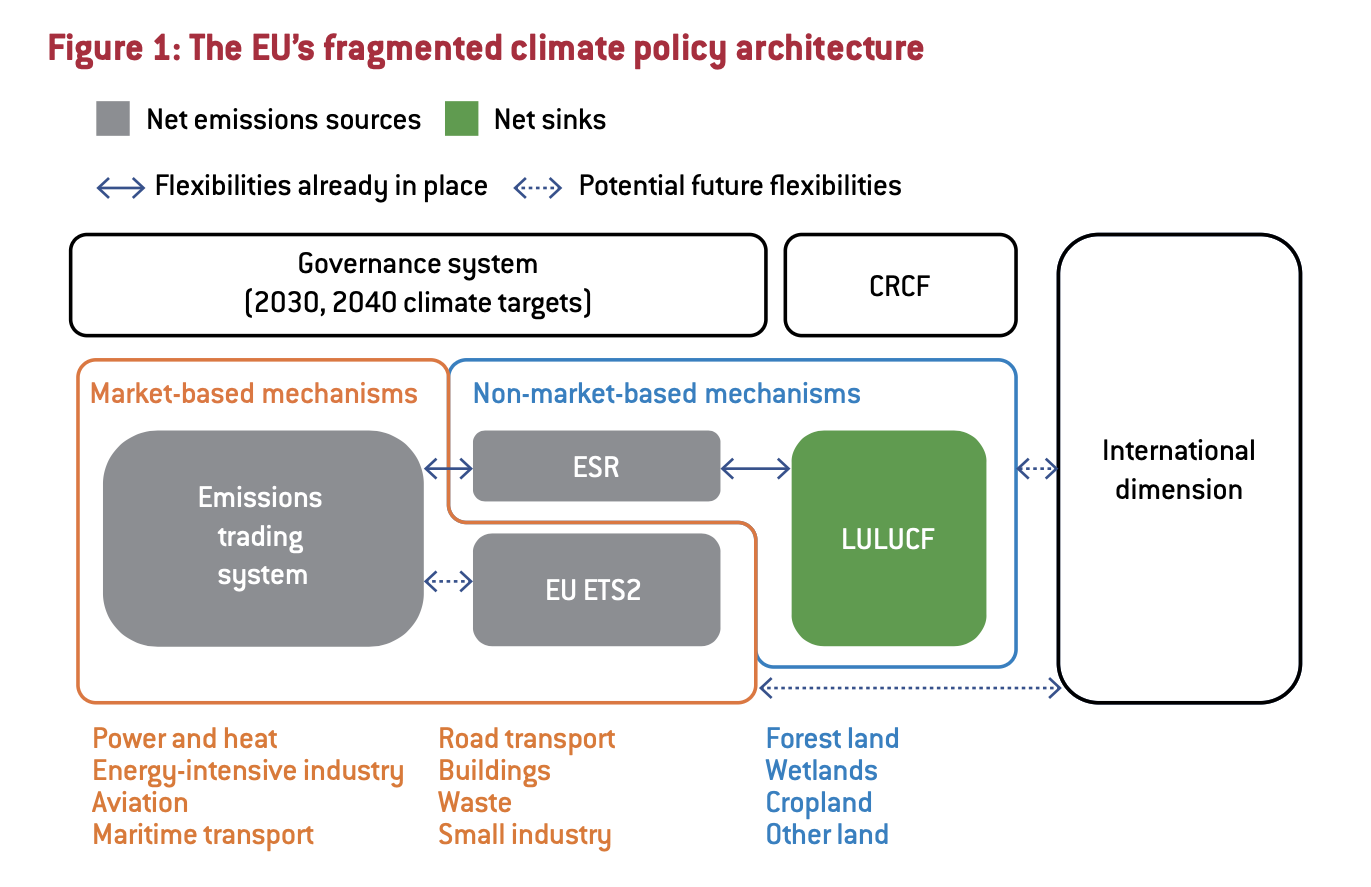

EU carbon market reform is moving up the policy agenda as Brussels debates how to simplify and integrate its fragmented climate architecture. Proposals to converge carbon pricing systems around the EU ETS could reshape long-term energy price signals, including those influencing European gas demand. EU carbon market reform is emerging as a central issue in the debate over the European […]

FREE TRIAL

Already a subscriber ? Log in

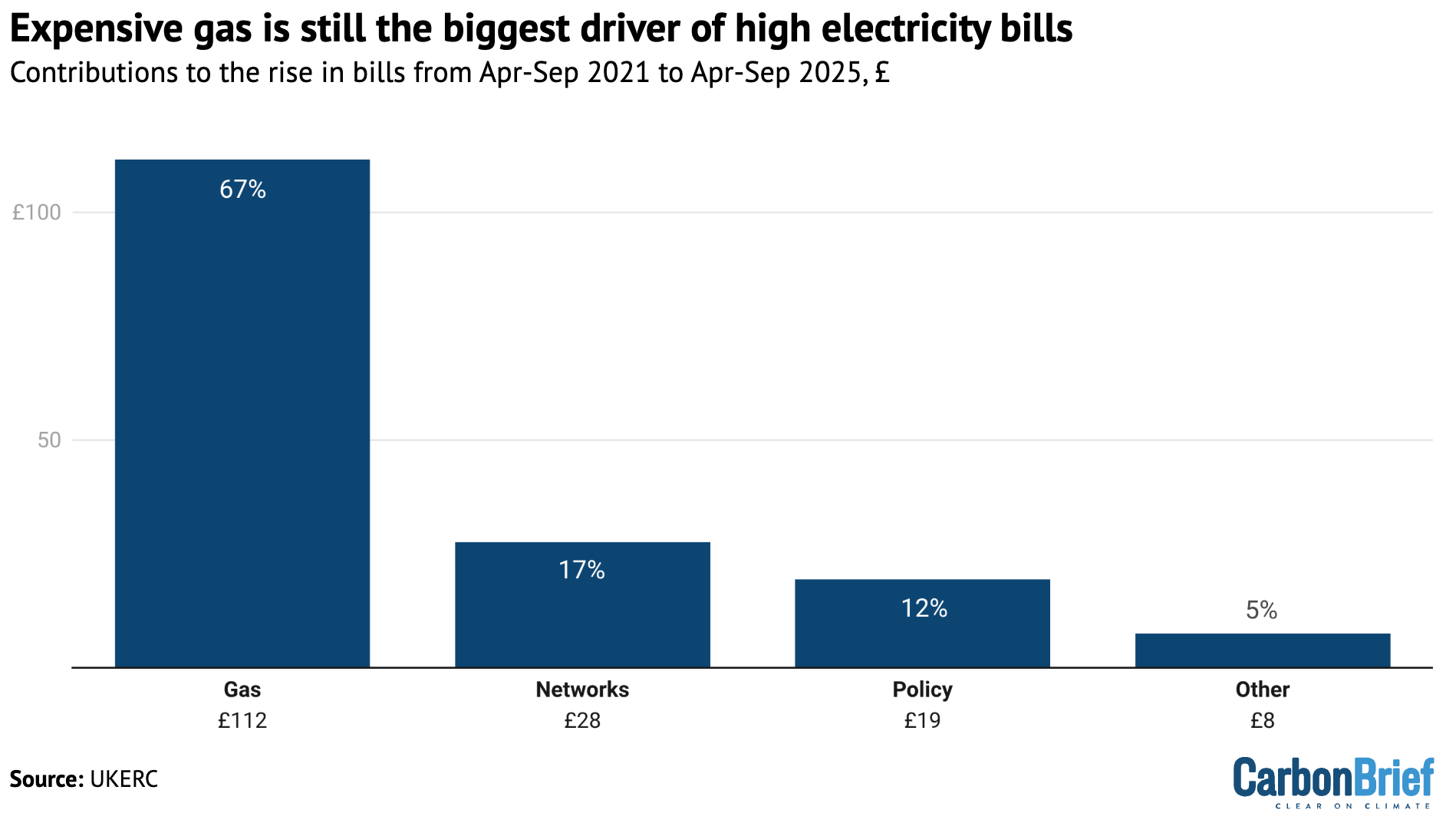

UK electricity prices continue to be strongly influenced by gas because gas-fired power plants still set the marginal price during most hours of the day. Although renewable generation has expanded rapidly, the structure of the UK power market means wholesale gas prices continue to determine electricity costs across much of the system. As a result, fluctuations in gas markets remain […]

FREE TRIAL

Already a subscriber ? Log in

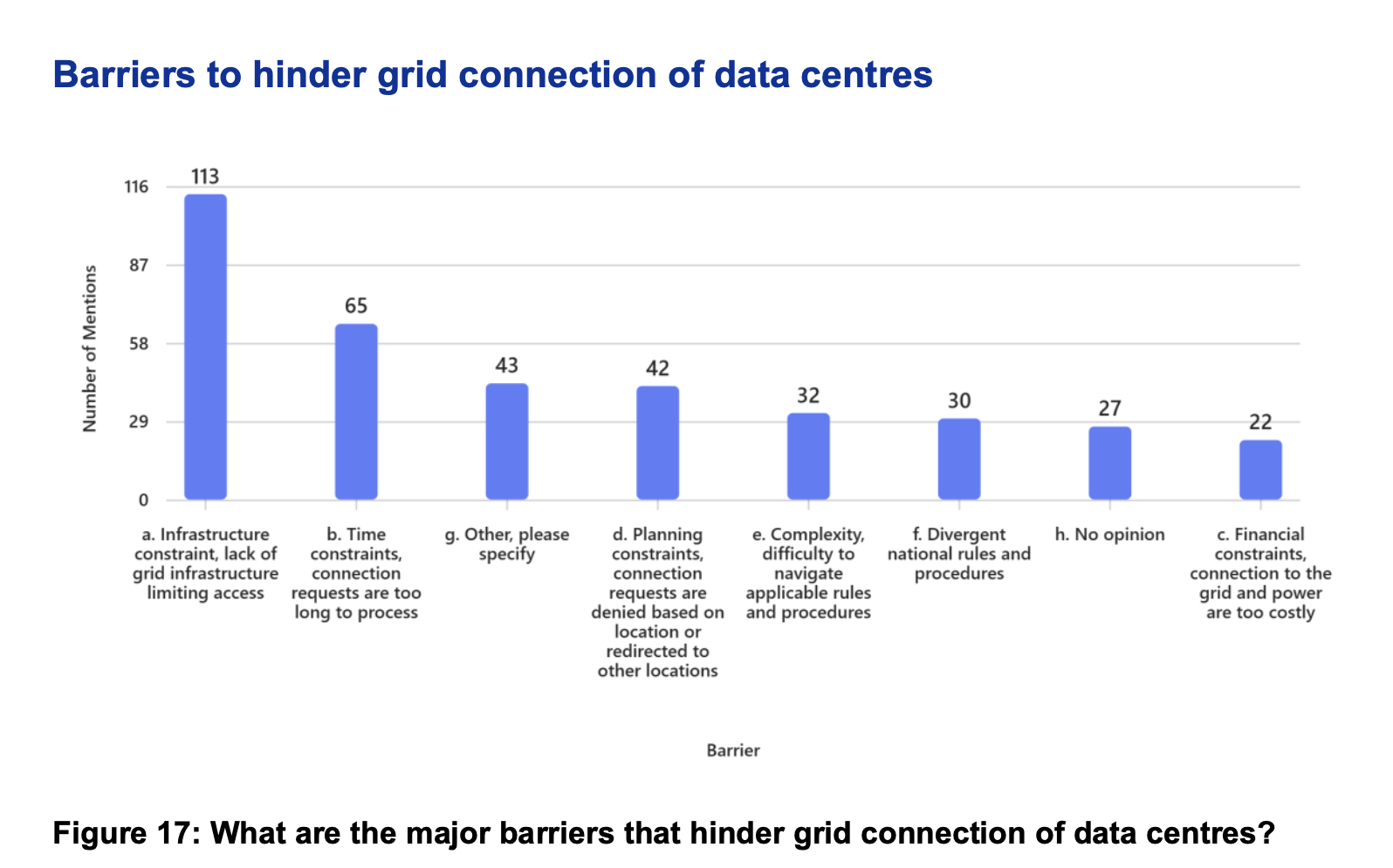

AI energy demand is emerging as a major new driver of Europe’s electricity consumption as the rapid expansion of data centres accelerates power needs across the region. The report highlights that integrating the growing electricity requirements of AI infrastructure will require significant grid investment, forward planning and system flexibility to avoid congestion and reliability risks. Concentrated demand from large data […]

FREE TRIAL

Already a subscriber ? Log in