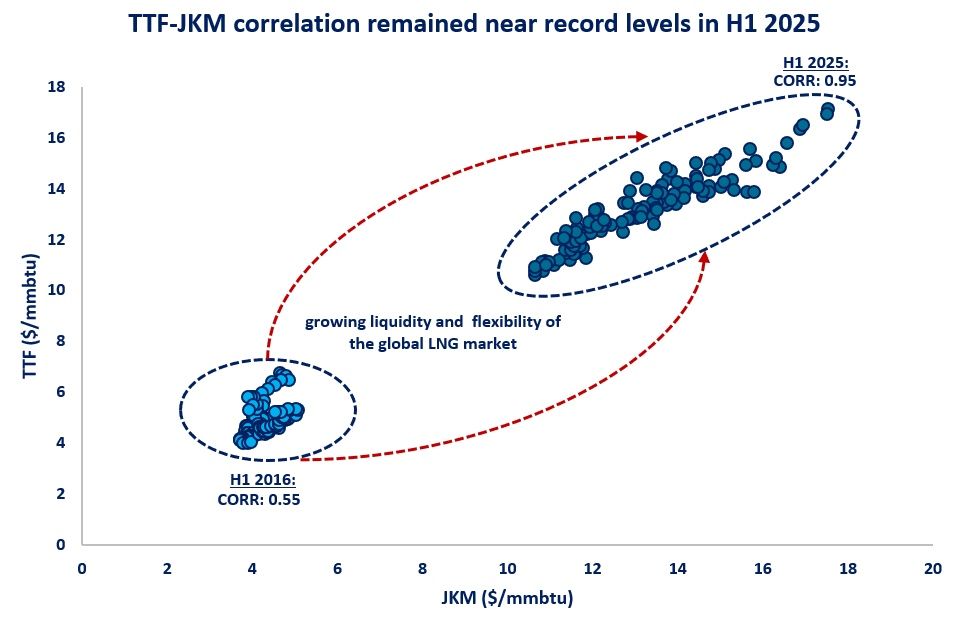

A global gas market: Despite all the volatility, the correlation between TTF and JKM remained at near record levels in the first half of 2025, indicating that regional markets are increasingly interconnected and interdependent.

The TTF-JKM correlation strengthened from an average of around 0.5 between 2012-2016 to just over 0.9 since 2020, reflecting the profound structural changes in the global gas market since 2016:

(1) LNG trading rose by a staggering 70% since 2016, largely driven by fast-growing Asian markets, and since 2021//22 by Europe’s diversification needs from Russian gas;

(2) The US became the world’s largest LNG exporter, accounting today for 25% of global LNG supply, underpinned by destination-flexible, Henry Hub-indexed contracts;

(3) The share of spot LNG grew from 18% to near 30%, driven by sellers’ short-term optimisation strategies and buyers’ growing flexibility needs;

(4) The rise of portfolio players: the big 3 (Shell, TotalEnergies and BP) today account for around 30% of global LNG trade, further enhancing the flexibility and liquidity of the market;

(5) Price benchmarks: TTF evolved into a fully fledged hedging venue for both European and global market players, while JKM’s recognition is well-reflected by its growing use in long-term LNG contracts.

The next LNG mega-wave (near 300 bcm/y by 2030) is expected to reinforce these structural changes and transform more profoundly the global gas market.

The US is set to reinforce its dominant position, increasing further the share of destination-flexible LNG contracts. spot trading is expected to further increase, with now both traditional suppliers (eg QatarEnergy) and traditional buyers (eg China’s major) actively entering the trading space. and the role of TTF/JKM/HH will further increase, both for risk management purposes and and as price indices used in long-term LNG contracts.

What is your view? How will the global gas market transform in the coming years? are we moving towards more flexibility and liquidity?

Source: Greg MOLNAR