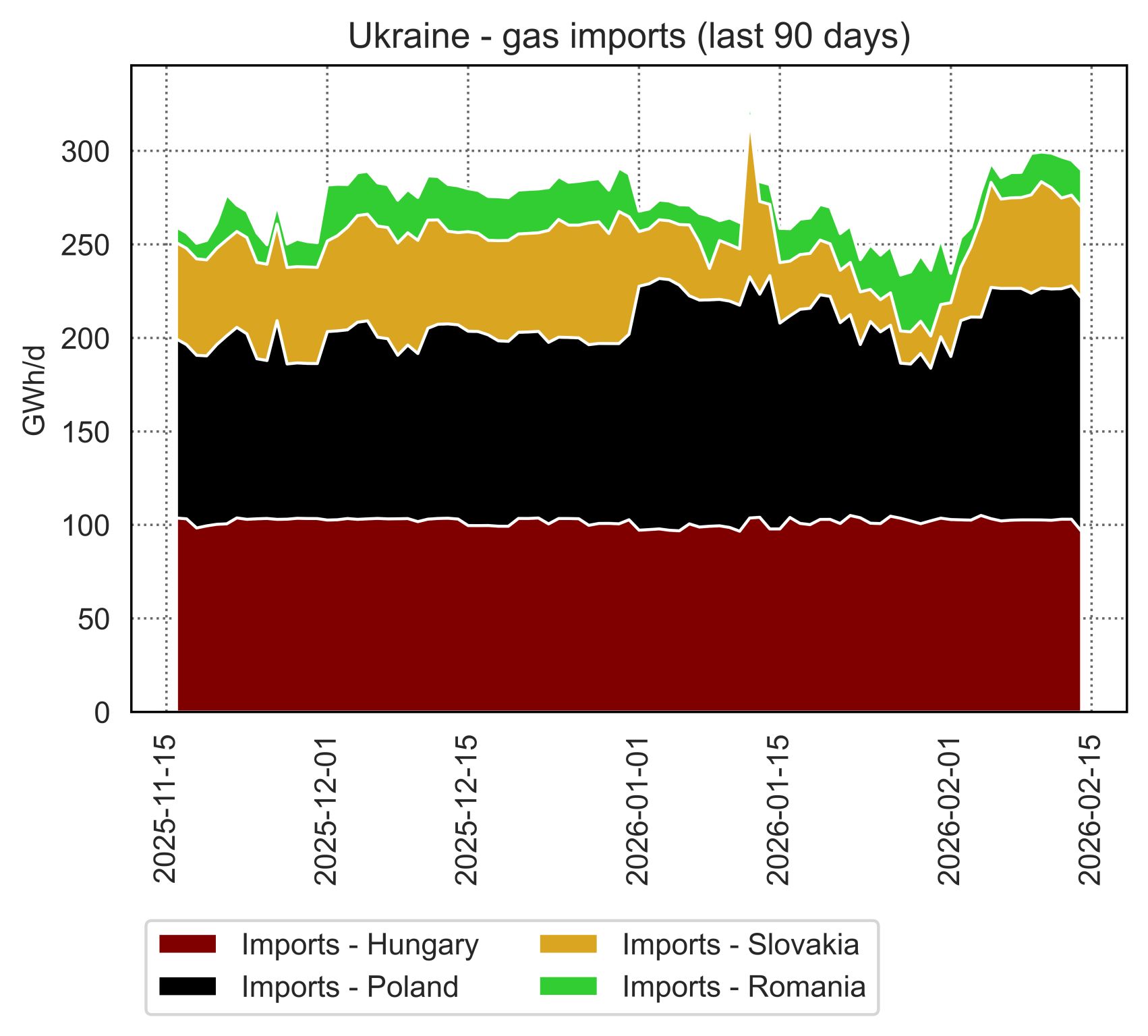

European gas prices increased again strongly yesterday, still supported by concerns on low Russian supply and weak stock levels. On the spot pipeline supply side, Norwegian flows came back to normal yesterday, averaging 349 mm cm/day, compared to 343 mm cm/day on Friday. Russian supply was almost stable, at 281 mm cm/day on average, compared to 280 mm cm/day on average on Friday.

On the 2 scenarios we mentioned yesterday, it is the most bullish that seems to prevail. Indeed, the strong rise in Asia JKM prices (+10.57% on the spot, to €117.030/MWh; +8.30% for the February 2022 contract, to €119.968/MWh) suggests Asian buyers are (currently) not ready to give up marginal LNG cargoes to their European counterparts and that they will compete to keep their LNG supply.

At the close, NBP ICE January 2022 prices increased by 25.740 p/th day-on-day (+9.58%), to 294.540 p/th. TTF ICE January 2022 prices were up by €10.31 (+9.75%) at the close, to €116.084/MWh. On the far curve, TTF Cal 2022 prices were up by €5.05 (+6.53%), closing at €82.353/MWh, with the spread against the coal parity price (€40.618/MWh, +0.94%) widening significantly.

TTF ICE January 2022 prices closed again yesterday above the 5-day High. They are up again this morning, to 119.250/MWh, around Asia JKM prices yesterday’s close. The question is whether Asian buyers will continue to outbid. In the past weeks, LNG imports among the top 3 world LNG importers (Japan, China, South Korea) weakened year-on-year, but they were (seasonally) up month-on-month.

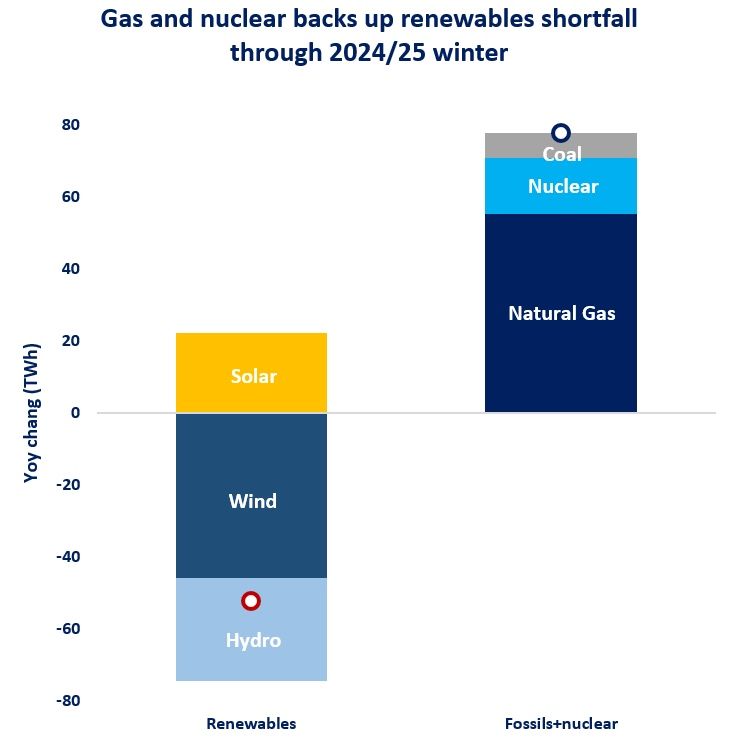

Unlike Europe, these countries have more flexibility to reduce their gas consumption, by using more coal for instance, or reducing energy consumption in the energy-intensive industries as China did. This is one of the main solutions that could lower gas prices.

Source: Energyscan