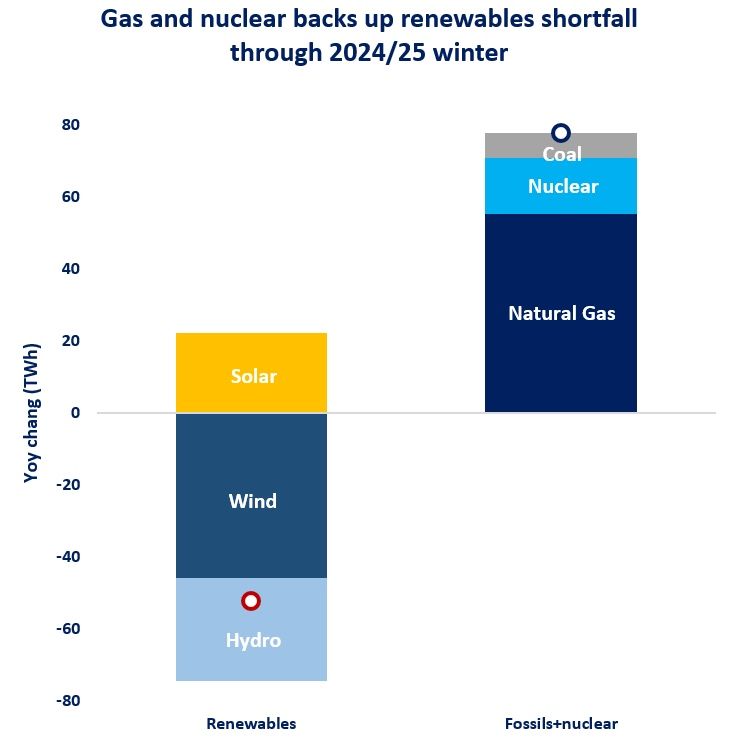

Natural gas and nuclear backed up the European power system amid the renewables shortfall this heating season, highlighting their key role in maintaining secure and stable electricity supply.

Combined wind and hydro generation dropped by 11% (or almost 75 TWh) yoy through the 2024/25 heating season. Slow wind speeds depressed wind power generation this winter, especially in the markets of Northwest Europe.

In addition, hydro power generation plummeted in Southern Europe, with Spain, Italy and Türkiye combined recording a drop of 18% yoy.

The only bright spot among renewables was solar, which continued to expand, although not enough to offset the steep decline in wind and hydro power output.

In this context, gas-fired power plants played a key role in backing up the electricity system, expanding their output by more than 20% (or 55 TWh) over the heating season. In addition, nuclear power generation rose by almost 5%, mainly supported by improving nuclear availability.

Coal-based generation increased marginally, mainly driven by Germany.

Higher gas-fired powgen, together with colder temperatures drove up European gas consumption by almost 10% yoy. Stronger gas demand was met through various flexibility mechanisms, including storage operations and higher LNG imports – which soared to a record high of 50 bcm in Q1 2025.

This winter highlighted once again the intimate link between gas supply flexibility and electricity security… and the balance would have been significantly tighter without all those good old nuclear reactors.

What is your view? How will the European electricity market evolve? What role for dispatchable, flexible power plants in a power system increasingly dominated by renewables? And how should we remunerate these flexibility services?

Source: Greg MOLNAR