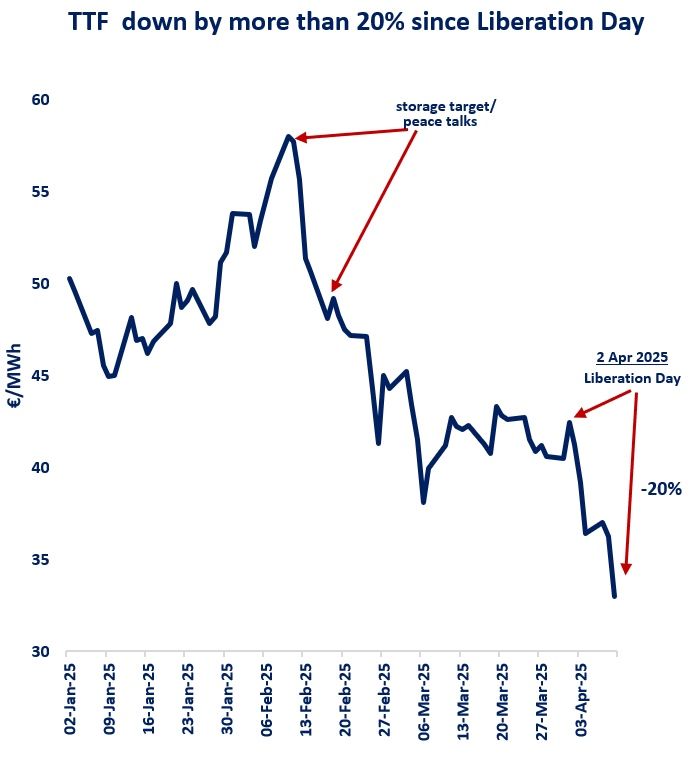

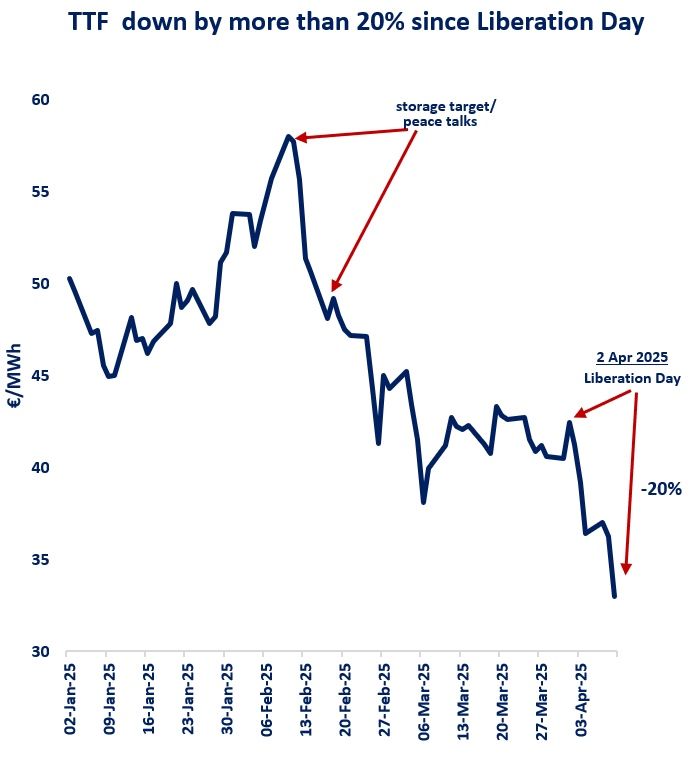

TTF month-ahead prices crashed by more than 20% since Liberation Day, today loosing another 7% and closing the trading day at just over €33/MWh -their lowest level since Sep24.

The growing macroeconomic uncertainty weighs on energy and gas demand outlook, while China’s retaliatory tariffs means that more LNG could flow towards Europe – instead of China and Asia.

There are also growing concerns around China’s gas demand: the country’s industrial gas use was on a downward trend since November last year, and the tariffs are likely to worsen its short-term prospects.

And in the EU, the Council agreed on more flexible gas storage rules: allowing up for 10% of flexibility to its 90% fill target, which could lower storage injection requirements by around 10 bcm… of course now we will have the negotiations with the Commission and the European Parliament before the new regulation is agreed.

Altogether, we are set for more uncertainty and greater volatility, and probably less gas demand growth than previously expected…

What is your view? How will the summer market play out? How will prices evolve? What will happen to the TTF-JKM spread?

Source: Greg MOLNAR