The recent gas price rally pushed TTF through all over the coal switching price range, meaning that gas-fired power plants are increasingly loosing their competitiveness against coal-fired power generation.

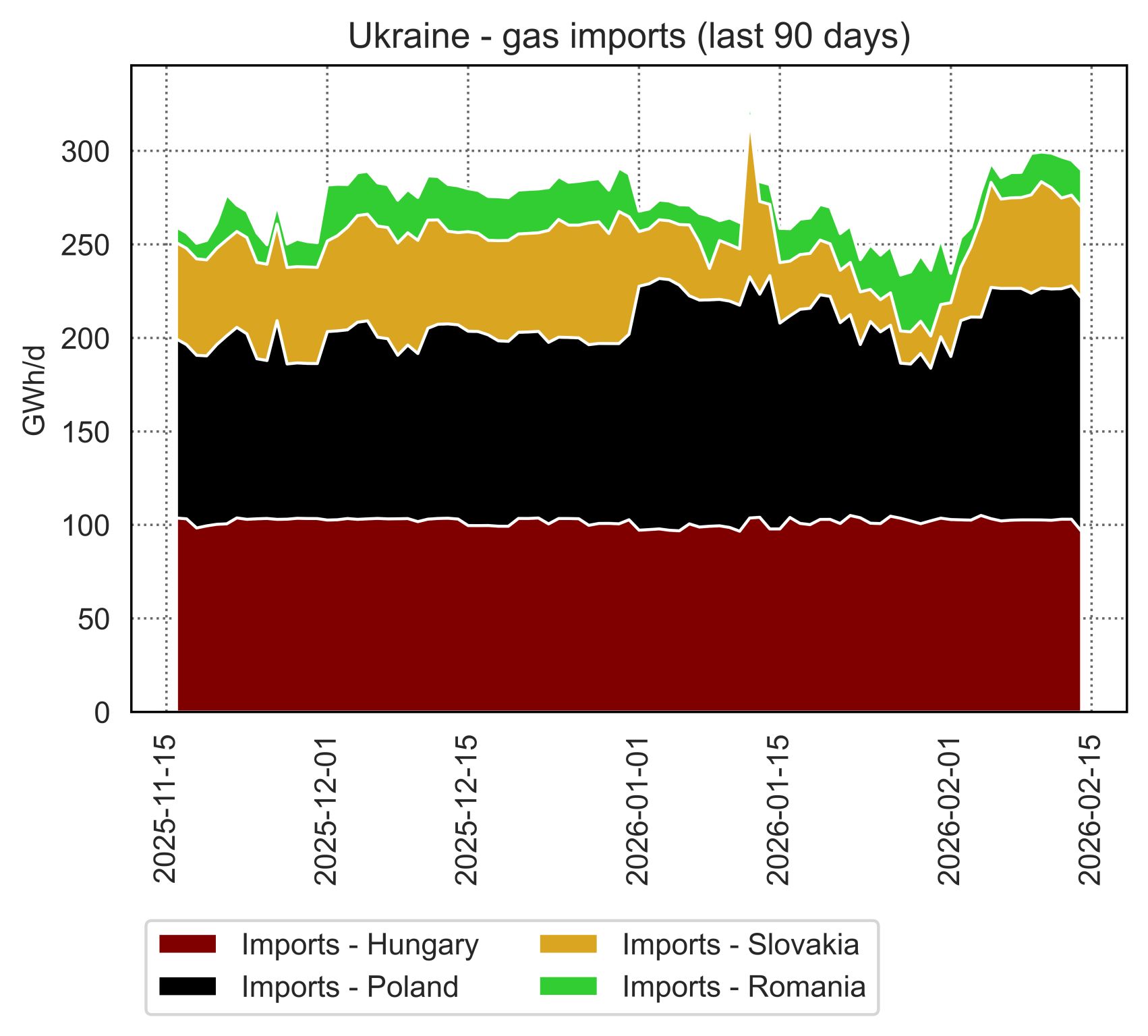

TTF prices rose by almost 20% since mid-Sep, partly due to tighter fundamentals (limited LNG supply growth, Norway maintenance) and rising geopolitical tensions (Russia-Ukraine, Middle East).

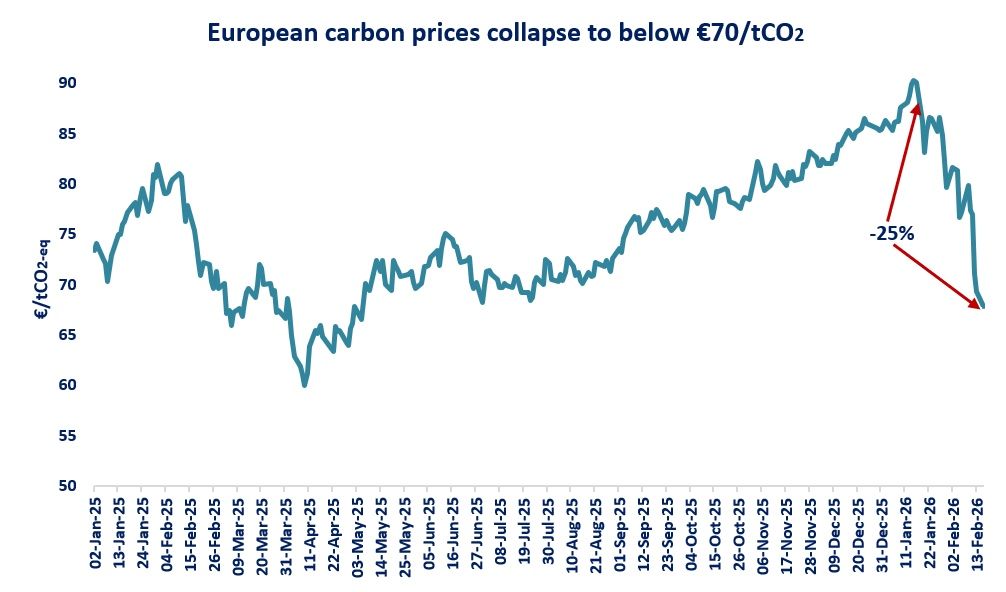

In contrast, carbon prices continued to weaken and dropped to their lowest since Apr24. gloomy macroeconomic outlooks, together with profit-taking selling is weighing on carbon prices.

This also marks a (probably temporary) decoupling of TTF and carbon prices, which moved together for most of the 2024.

Last but not least, Rotterdam coal prices increased by just above 10% since mid-Sep, being less sensitive to geopolitical risks than natural gas/LNG.

Altogether, these prices movements have eroded the competitiveness of gas-fired power plants vs coal, meaning that we could return to gas-to-coal switching dynamics through the winter, if gas prices don’t soften.

This does not mean necessarily more coal burn, as European thermal generation is rapidly shrinking amidst stronger renewables and improving nuclear availability.

It means rather than gas-fired powgen could decline even faster compared to coal-based generation.

This is also a strong indication to gas bulls that the price rally might be loosing steam: the top end of the coal switching range is a key resistance level for TTF.

This being said, further LNG project delays together with a cold winter and rising geopolitical tensions could push TTF above the coal switching range through the upcoming winter season.

What is your view? How will TTF prices evolve in the coming months? Do you see more of an upside or downside risk? What is your take on carbon prices?

Source: Greg MOLNAR