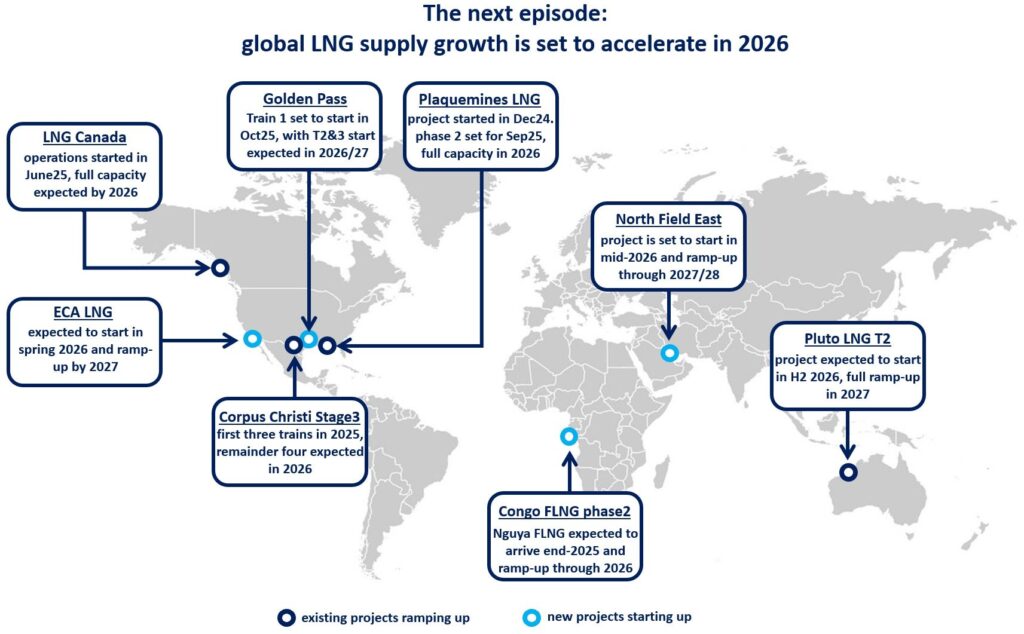

Global LNG supply growth is set to accelerate in 2026 to its fastest pace since 2019, as new major LNG liquefaction ramp-up their production.

This strong growth will be primarily supported by North America and Qatar’s North Field East expansion and mark a new phase for the global LNG market.

In the US, Plaquemines LNG loaded its first LNG cargo back in Dec24 and the project’s phase 2 is expected to start operations in Sep25, meaning that the project could ramp-up to its full nameplate capacity (around 27 bcm/y) in 2026.

Corpus Christi Stage 3 (14 bcm/y) started operations in Feb25. it is expected to commission the first three midscale trains this year, and the remainder four in 2026.

And Golden Pass is set to start-up its first train in Oct25 with a capacity of 8 bcm/y, ramping up through 2026. Train2&3 are expected to be commissioned in 2026/27, bringing the project’s total capacity to near 25 bcm/y.

LNG Canada (19 bcm/y) loaded its first cargo end of June 2025 and is expected to ramp-up supplies to full capacity through 2026. supplies will primarily benefit the major Asian markets.

In Mexico, the Costa Azul LNG project (4.4 bcm/y) is expected to start operations in spring 2026, and rely primarily on US sourced feedgas supplies.

Outside of North America, the single most important project is Qatar’s North Field East expansion. the mega-project will have a capacity of 44 bcm/y. the first train is expected to be commissioned by mid-2026, with the project gradually ramping-up to full capacity through 2027/28.

In Africa, ENI’s Congo FLNG phase 2 (3.2 bcm/y) could start operations at the end of 2025, with the arrival of Nguya FLNG. production would ramp-up through 2026, primarily supplying the European market.

And in Australia, Pluto LNG Train2 (7 bcm/y) is expected to start operations in the second half of 2026 and reach full capacity through 2027, with supplies primarily destined to the major Asian markets.

Altogether, 2026 will be a step change for the global gas market, marking the first year of the mega-LNG wave. it will be also a test on how demand responds to stronger supply growth, especially in Asia.

What is your view? how will this strong supply growth impact the market? how will prices react? will we see a strong demand response? do you expect any project delays?

Source: Greg MOLNAR