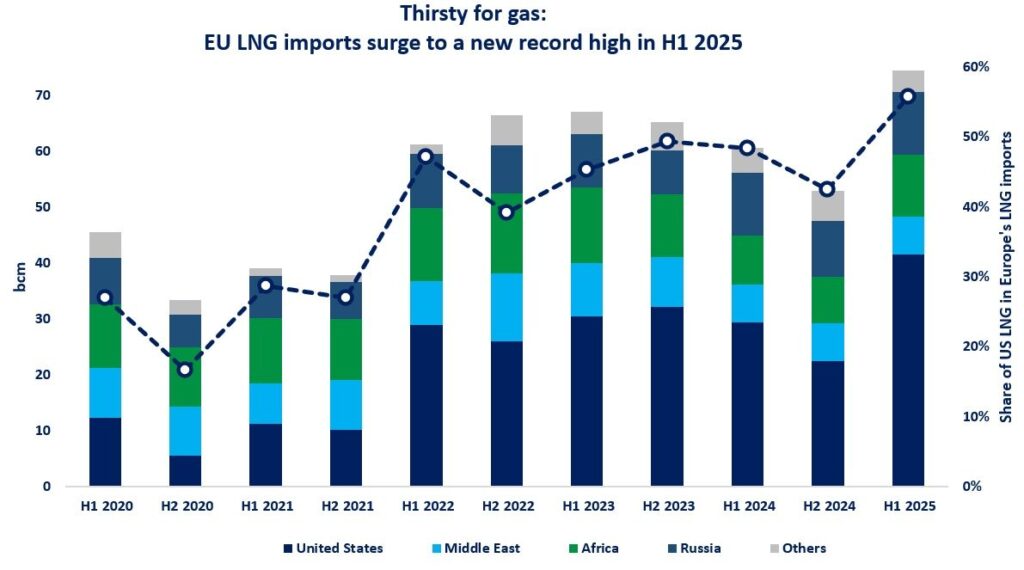

European LNG imports surged by a staggering 40% (or 22 bcm) yoy in H1 2025 to a new record high of 75 bcm.

Four key factors contributed to this very strong growth:

(1) Higher EU gas demand: gas consumption increased by near 5% (or 8 bcm) in H1 2025, primarily driven by lower renewables power output and colder winter temperatures in Q1;

(2) Lower piped gas imports: Russian piped deliveries to the EU almost halved compared to last year, translating into a loss of 6.5 bcm, due to the halt of the transit via Ukraine.

In addition, Norwegian piped deliveries are also somewhat lower, down by 3.5% (or almost 2 bcm) amid higher maintenance;

(3) Stronger storage refill: EU storage injections were up by 35% yoy since April, translating to almost 7 bcm in absolute terms. and we are still almost 20 bcm below last year’s storage levels;

(4) Higher piped gas exports to Ukraine: EU exit flows to Ukraine surged by near twelvefold (or almost 2 bcm) as the country needs to refill its historically low storage levels.

The US accounted for almost 90% of the EU’s incremental LNG imports, increasing its share in total EU LNG supplies to just over 55%.

The majority of this additional LNG is supplied from Plaquemines LNG, which alone met almost 30% of the EU’s incremental LNG demand.

Without this new plant, we would be in a much tighter market environment.

What is your view? How will the EU’s LNG imports evolve in the second half of the year? Gas storage levels are still well-below their five-year average, Russian piped gas deliveries are set to remain low, while summer heat could boost gas demand in the power sector.

There are also signs that China’s gas demand started to recover, which could mean more competition for LNG cargoes in H2 2025…

Source: Greg MOLNAR