The race for the space: EU storage sites are rapidly filling up, currently standing at 72% of capacity and 18 bcm above their 5y average.

Storage injections since April were about 20% below their average levels, but the high inventory levels inherited from the previous heating season ensure us that the EU will comfortably meet its 90% fill target.

In fact, if assuming that injections continue at the their average rate observed since mid-April, storage sites could be 90% full by early August and close to 100% by mid-September.

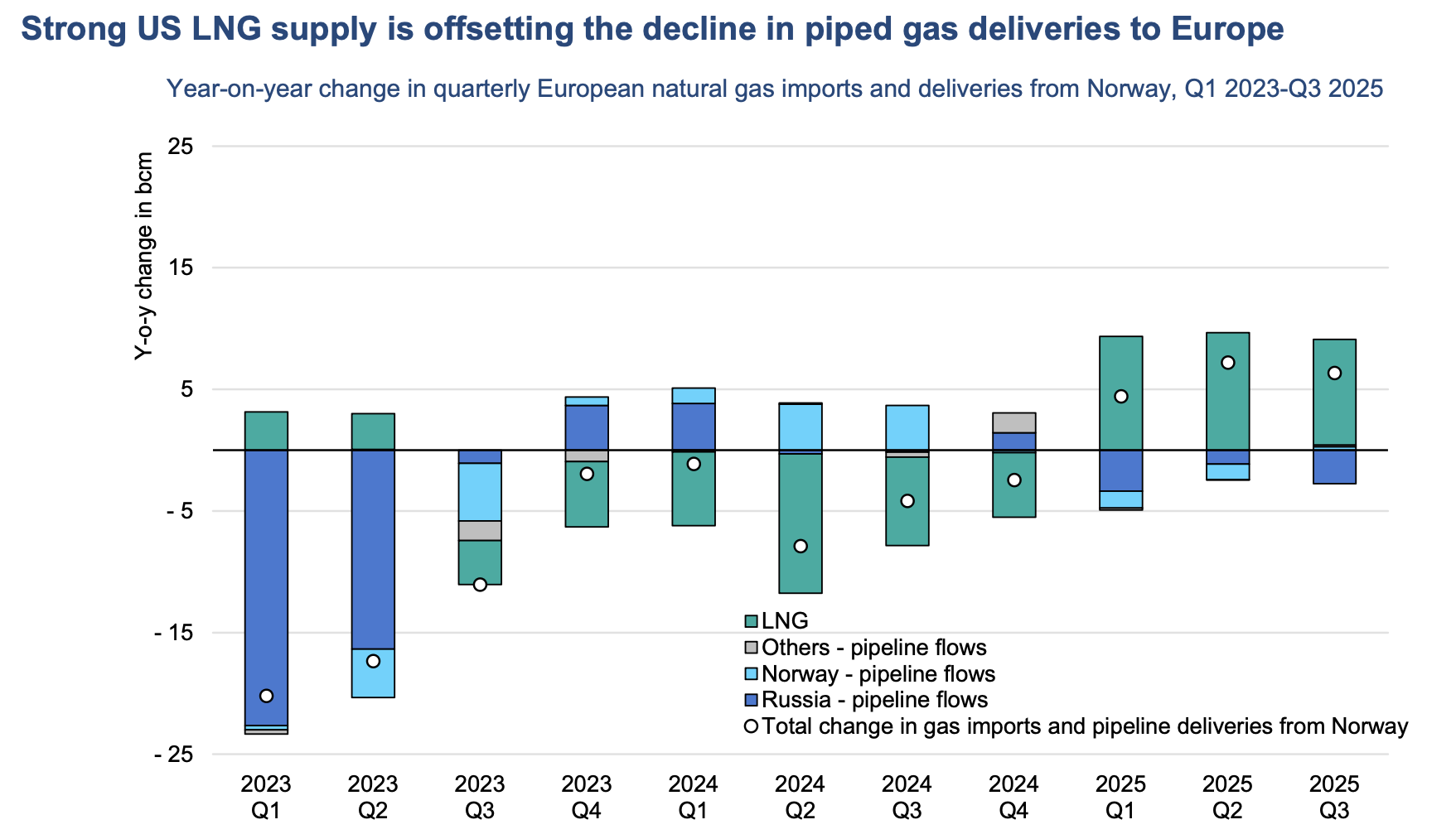

If Russian piped gas supplies are fully cut, the EU would be still able to fill-up its storage sites to over 90% by the start of the 2023/24 winter.

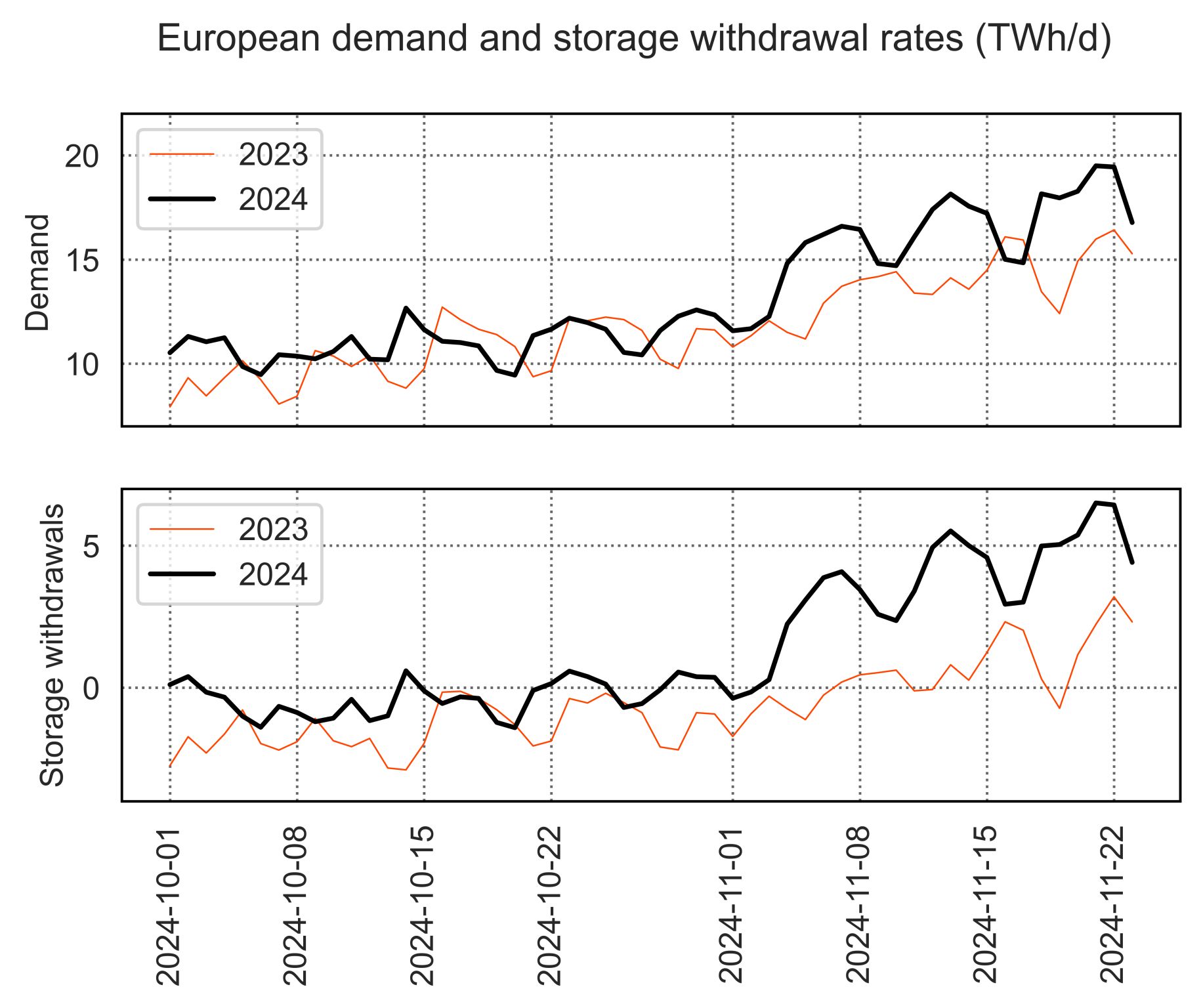

This being said, full storage sites are no guarantee against winter volatility and supply risks.

A cold winter, together with lower Russian piped gas and/or a tighter availability of LNG could easily renew market tensions. Hence, we will need to keep demand in check.

What is your view? How will EU storage fill levels evolve in the coming months? What will be the impact on prices?

Source: Greg Molnar (LinkedIn)