Gas prices remained elevated across all key markets in March, amid tight supply-demand fundamentals and low storage levels.

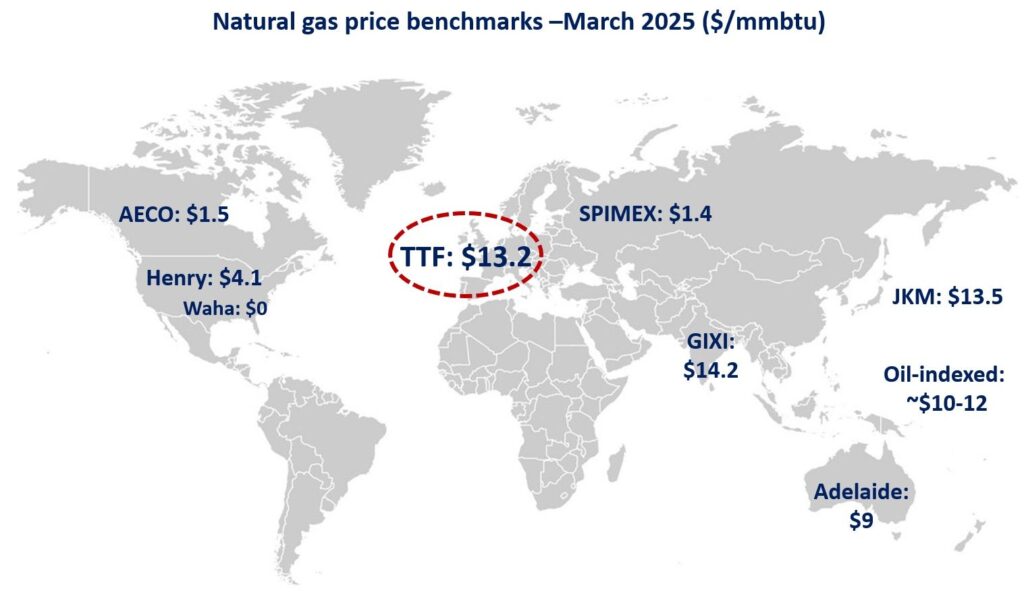

In Europe, TTF month-ahead prices stood 55% above their last year’s levels, averaging at just over $13/mmbtu.

Demand remained strong, increasing by around 4%. Lower renewables power output continued to support higher gas-burn in the power sector, including in southern Europe amid low hydro availability.

Meanwhile, piped gas flows continued to decline both from Russia and Norway, supporting stronger storage draws and higher LNG imports (up by almost 50% yoy).

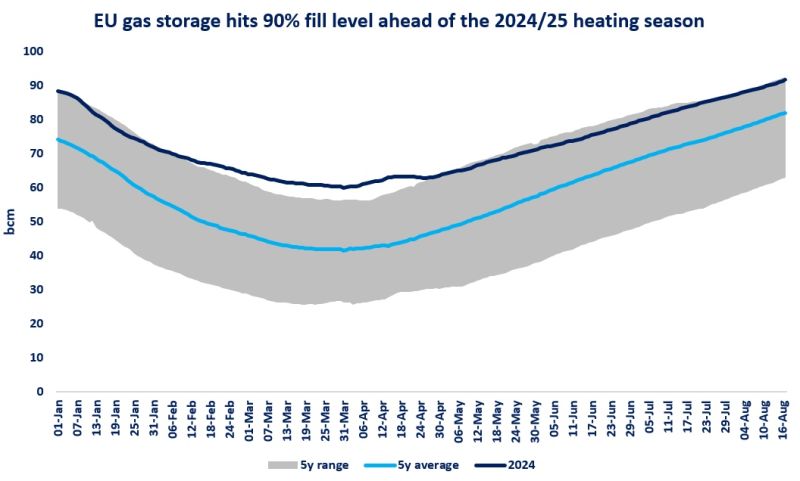

EU storage sites closed the heating season standing 25 bcm below their last year’s levels, indicating a heated filling season ahead of us…

In Asia, JKM prices followed TTF, up by 50% yoy to an average of $13.5/mmbtu. High gas prices are now clearly weighing on demand prospects in the region, including in China where gas demand dropped by 3.5% through Jan-Feb, according to NDRC.

And preliminary data indicates that the downturn continued also in March, amid weaker macroeconomics, mild weather and less gas burn for power. Chinese buyers are now limiting spot LNG procurements, and relying on their long-term, oil-indexed LNG contracts, trading at a $2-3/mmbtu discount compared to JKM.

In the US, Henry Hub prices almost tripled compared to last March, and averaged at just above $4/mmbtu.

Strong demand through Dec-Feb tightened market fundamentals with lingering effects into March.

Higher prices prompted an increase in domestic gas output (up by 3.5%), while in the power sector we started to see gas-to-coal switching, reducing gas-fired powgen by around 10% yoy. And gas prices turned once again negative at the Waha hub in the Permian, amid pipeline maintenance and capacity restrictions.

What is your view? How will gas prices evolve through the filling season? What will be the impact of Europe’s storage demand? Will we continue to see a strong competition for LNG between Europe and Asia?

Source: Greg MOLNAR