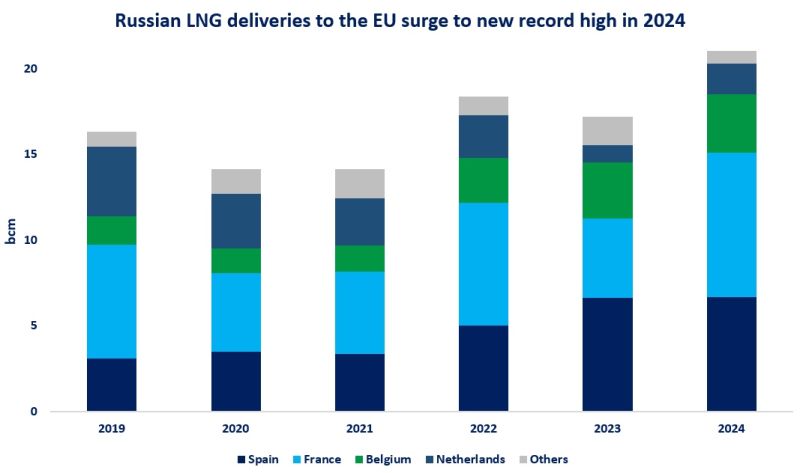

Gimme me more: Russian LNG deliveries to the EU surged by more than 23% in 2024 to reach a record high of 21 bcm, solidifying Russia’s position as the bloc’s second largest LNG supplier.

Yamal LNG flows continued to soar in 2024, primarily supported by stronger deliveries to France, Spain, Belgium and the Netherlands – altogether accounting for over 90% of the EU’s total LNG imports in 2024.

France alone increased its Russian LNG imports by 80% (or 4 bcm) compared to 2023, making it the largest Russian LNG importer in the EU.

Consequently, Russia was able to further solidify its position as the EU’s second largest LNG supplier, with a market share of around 18%. in turn, the EU now accounts for around 78% of the total Yamal LNG exports.

Notably, west Europe’s Russian LNG imports are just below the Russian piped gas delivered to the landlocked Central and Eastern European markets (who has naturally less options to diversify their gas import portfolio).

It will be interesting to see how the EU’s ban on transshipments will play out.

While Yamal LNG might face some challenges in reaching the northeast Asian markets due to more complex shipping logistics, this could result in higher Russian LNG deliveries to the European Union in 2025… and I’m not entirely sure if it was the initial intention of European policy makers…

What is your view? How will Russian LNG dynamics play out in 2025?

Will tighter JKM-TTF spreads and the transhipment ban lead to another year of gimme more?

Source: Greg MOLNAR