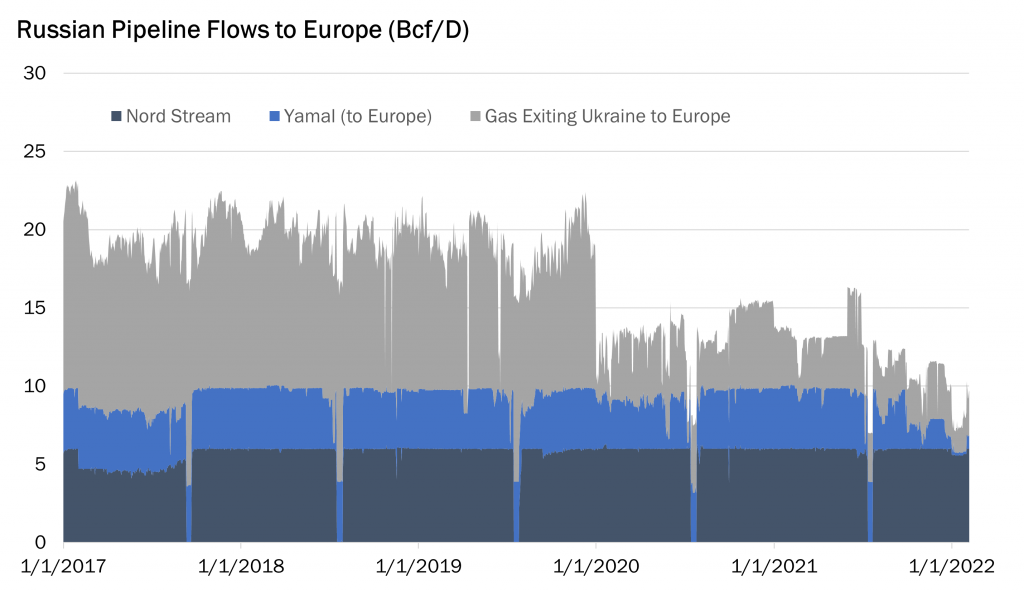

Since the start of 2020, Russian flows to Europe have decreased by ~50%, with the majority of volumes through the Yamal Pipeline and through transit points in Ukraine facing significant declines.

Through 2021, Russia has repeatedly claimed that only after refilling its own storage would it begin to transfer flows to Europe; however, as shown in the graph below, pipeline flows past the summer of 2021 never increased at any point in time on the macro level.

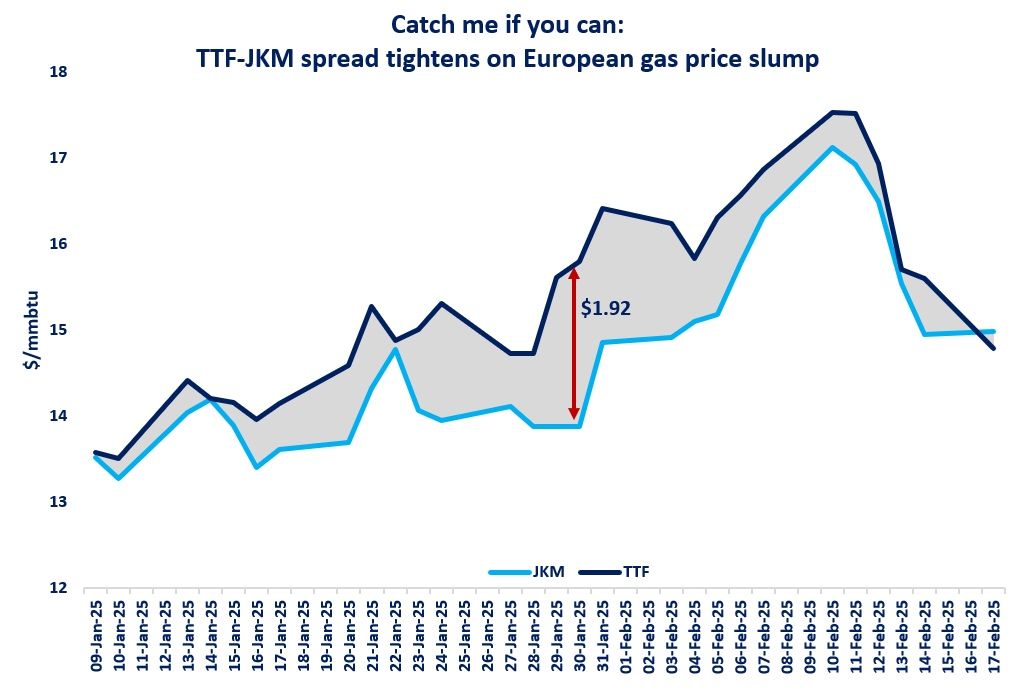

Increasing tensions between Ukraine and Europe have the markets on edge, and reports of a partial pullback of Russian troops in the early morning caused the Dutch TTF to fall ~10% and the WTI to fall by ~5%. It remains unclear whether the current troop pullback will materialize into one of a larger magnitude; despite the rapid decrease in TTF prices, significant upside risk still remains in European markets.

Volatility will increase in these markets, where wild speculation over the geopolitical consequences of Russia’s actions reigns.

Source: Gelber and Associates