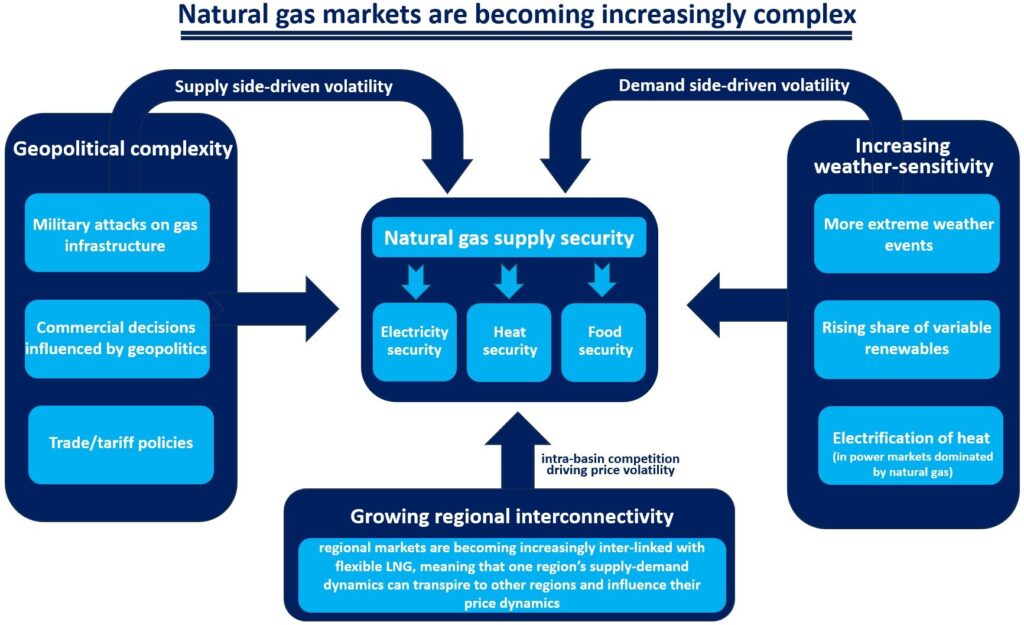

Why it is so complicated: natural gas markets are becoming increasingly complex and difficult to predict, necessitating to rethink the architecture of global gas supply security.

First of all, we have a rapidly changing geopolitical context, with profound implications on gas supply security.

And this includes military attacks on gas infrastructure, commercial decisions which are influenced by geopolitical considerations and increasingly complex trade policies.

Second, the weather-sensitivity of natural gas demand is increasing, partly because weather patterns are becoming more extreme, and partly because there is a growing share of weather-dependent renewables in the power mix, which needs gas as back-up to ensure electricity supply security.

And of course, regional markets are becoming increasingly inter-linked with flexible LNG, meaning that the supply-demand dynamics of one region can transpire and influence the evolution of gas prices in other, more distant markets.

Ultimately, the 2022/23 crisis transformed natural gas markets in a structural manner, and there is a clear need to rebuild the architecture of gas supply security through smarter policies, closer international cooperation and additional investments in assets underpinning gas supply flexibility.

Very much looking forward to discuss some of those issues in London this week.

Source: Greg MOLNAR