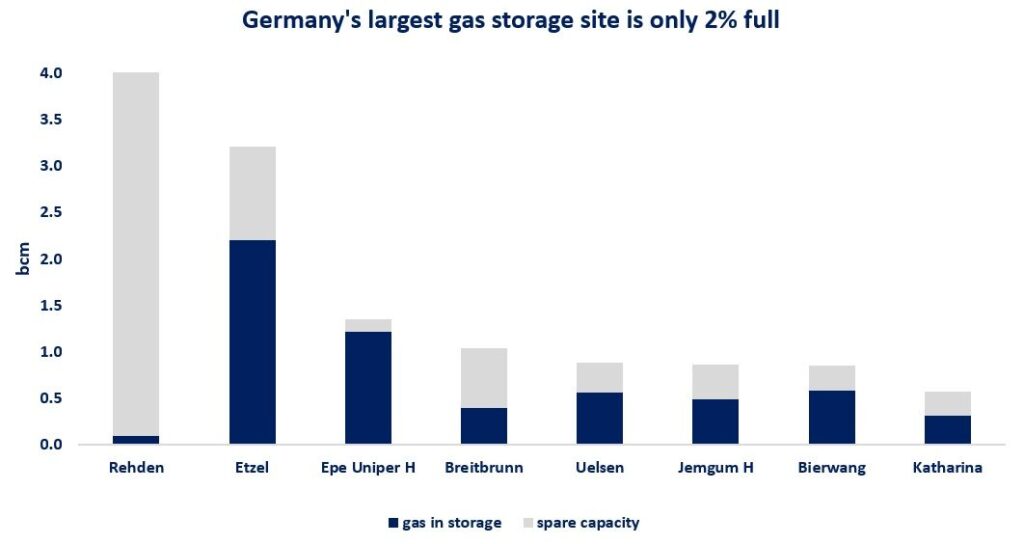

Germany’s largest gas storage site is still only 2% full, highlighting the challenge to fill up storages when seasonal spreads are tight and regulatory incentives are not sufficient.

Rehden is Europe’s second largest facility with a capacity of near 4 bcm. It plays a key role in ensuring the gas supply security of northwest Europe. Rehden was filled up to 98% at the start of the previous heating season, and alone met 7% of Germany’s winter demand.

For this year, Rehden should be filled up to around 45%, according to the latest revision of Germany’s storage regulation. However, as things stand now, there is a clear risk that Rehden will miss this target.

So why is Rehden not being filled up? there could be couple of reasons:

(1) lack of long-term storage capacity contracts: these were historically tied with Gazprom’s long-term supply contracts. these are now gone;

(2) tight seasonal spreads: €1-2/MWh spread is a weak incentive for storage injections;

(3) insufficient regulatory incentives and lack of financial support (which would help with the tight seasonal spreads).

Low storage levels in Rehden could lead to a more fragile northwest European gas balance through the heating season, especially if the winter is colder than usual.

The non-filling of Rehden raises also questions around the longer-term financial viability of gas storage. unfortunately, storage closures are back on the agenda, especially in Germany.

And Rehden is not the only storage not being properly filled: Wolfersberg is at 6%, while Frankenthal remains completely unbooked.

What is your view? How will the storage dynamics play out this year? What is the longer-term future for European storage sites? what is the solution for tight storage spreads?

Source: Greg MOLNAR