Last December, when I wished the year of 2021 to be as eventful as 2020, I meant a rather different thing 🙂 I doubt even the most desperate traders could have thought that the TTF front-month contract would first jump more than €30/MWh and then crash by almost €70/MWh in just one week. So this time I will keep in mind that one should articulate clearly his desires.

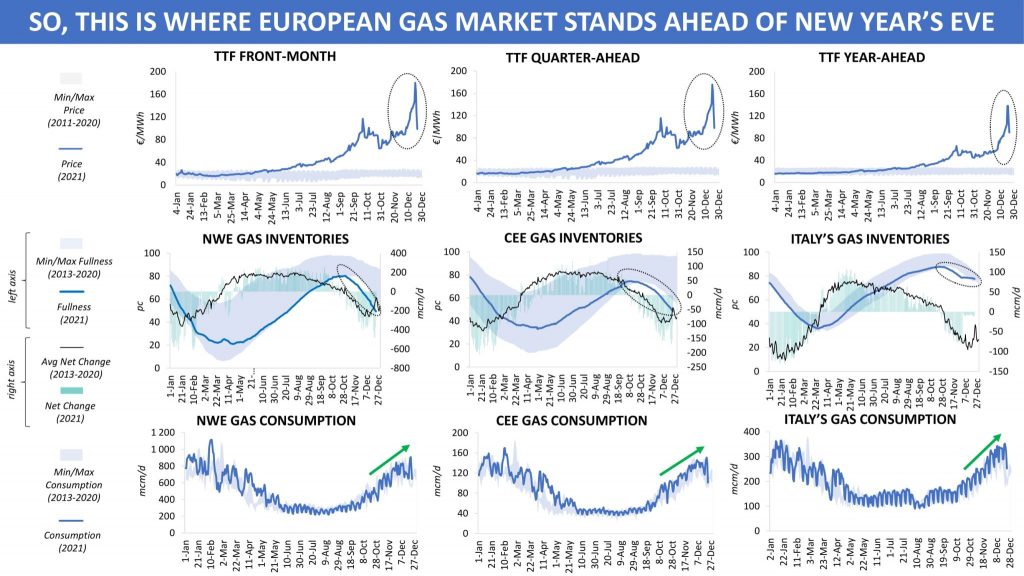

Gas price fluctuations have been present in the European market throughout the year, with last week being the quintessential expression of that increased volatility. It is no surprise that players found themselves in such an environment, considering two dimensions: on the one hand, high net withdrawals from the region’s storages and uncertainty surrounding Russian supplies in late Q4; on the other, expectations of warmer weather, together with high wind, at the very end of December/early January and LNG imports rising to the third-largest monthly level on record. All that happened amid lower trading activity in the run-up to Christmas.

Despite the drop in prices between 22 and 24 December, winter-delivery products, as well as further out on the curve contracts, were still assessed at historically high levels. When looking at fundamentals, the reason for that is quite explainable. Gas inventories in nearly all parts of the European region stood at multi-year lows in late December. As the coldest period of winter approaches, Europe’s gas consumption rose on average by 15pc in December as compared with that of November. The rapid increase in LNG deliveries to Europe was another indication of a tense supply/demand situation that prevails in the region.

Only time will tell whether the beginning of 2022 can bring some peace to the European gas market, but for now there is little evidence that the current turbulence should die away. Gas heating consumption has not peaked yet, and with colder weather in January and February demand for additional volumes will likely see renewed vigour. At the same time, the competition for LNG would probably be intensifying on the global market as even short-lived cold snaps in China, Japan or South Korea will make Asian importers actively join in the race for spot cargoes. That does not even include the spread of the Omicron variant across Europe and rising geopolitical tensions on the continent.

What I would like to wish the energy community for the coming year is that you always have a plan B. The year of 2021 has clearly demonstrated how important flexibility can be both for players and governments to prevent a slide into crisis. I hope you had a good Christmas and wish you a happy New Year. Stay safe and healthy!

Yakov Grabar (LinkedIn)