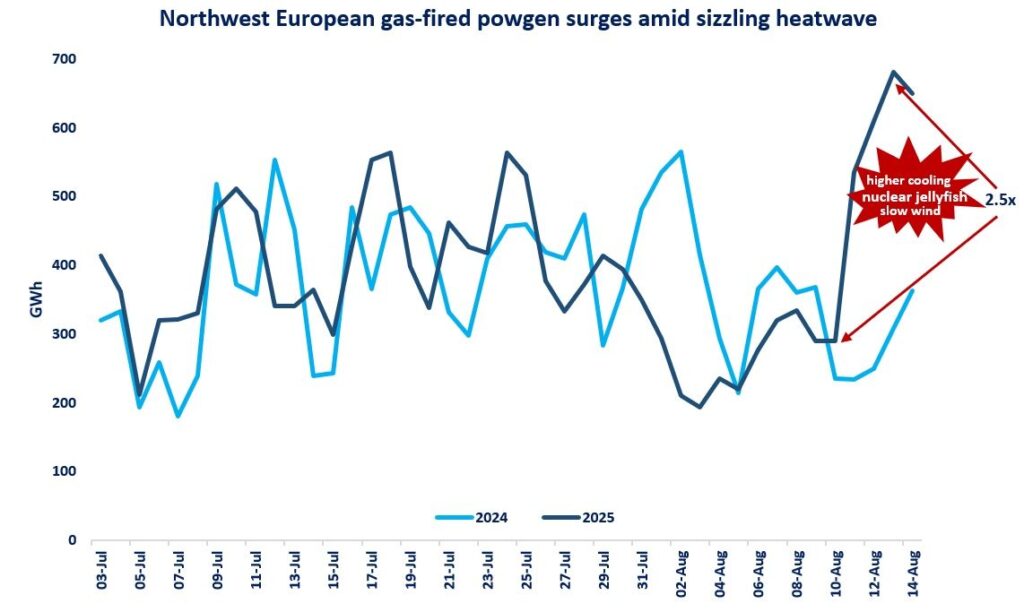

Gas-fired powgen surged by near 2.5 times in the key Northwest European markets as the sizzling heatwave puts pressure on the European power system and increased the call on flexible gas-fired powgen assets.

Several factors contributed to this steep increase in gas-fired output:

(1) higher cooling demand: the extreme heatwave is increasing cooling needs, and hence electricity demand, including in the early evening hours, when the sun is not shining anymore;

(2) nuclear worries: rising river temperatures on the Rhone limits nuclear power output at several French reactors. in addition, jellyfish led to to shut down of four reactors at Gravelines (almost 10% of French capacity);

(3) slow wind speeds: high temperatures might have contributed to lower wind power generation, further adding to the pressure to the European power system;

(4) renewables curtailments: it would be interesting to see some data/insights on whether curtailments on solar are contributing to higher gas-based generation in certain hours.

Day-ahead peak power prices rose to above €200/MWh in recent days, while peak intra-day prices surged to near €1000/MWh, reflecting the very tight market conditions.

These episodes demonstrates the crucial role of flexible powgen assets, such as CCGTs or gas peakers, in power systems increasingly dominated by weather-dependent, renewable power sources.

What is your view? how can the flexibility of the European power system further enhanced? what role for gas-based generation? and what are the implications on the gas market?

Source: Greg MOLNAR