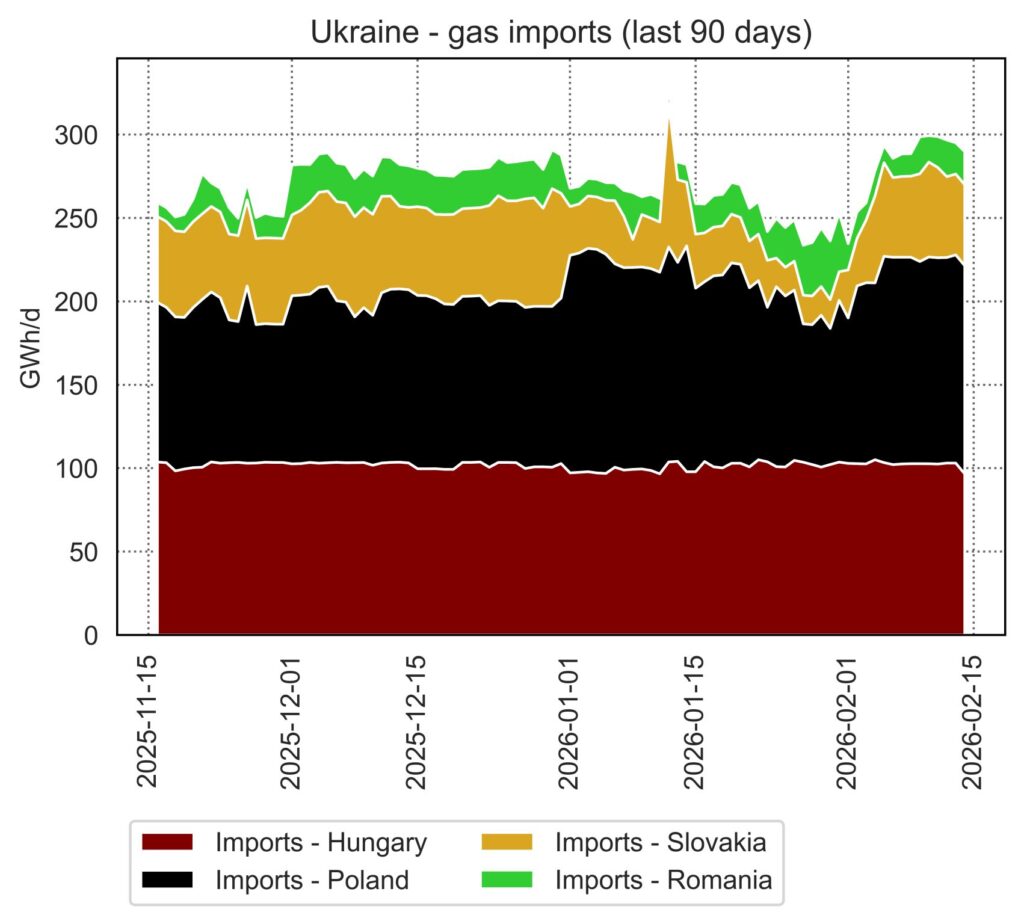

European gas exports to Ukraine have remained relatively constant throughout the winter, at a rate oscillating between 0.7 and 0.8 Bcm per month since the start of October.

Flows showed a small decline in the second half of January, driven primarily by a reduction in exports from Poland and Slovakia.

Total exported volumes have, however, recovered in the first two weeks of February, and last week saw the largest total volume of exports since the start of the winter.

These volumes are significant: total EU exports to Ukraine have crossed 3.3 Bcm since the start of the winter, over 2 Bcm higher than the previous year.

To put this in context, this is equivalent to just over 50% of the total storage withdrawals since the start of October in the four EU countries that are currently exporting to Ukraine.

This is also over twice as large as the total EU year-on-year increase in storage withdrawals since the start of the winter.

These exports have also had ripple effects throughout the rest of Europe. The most significant example is the ramp-up in German LNG imports and eastward exports in conjunction with the increase in deliveries at the Ukrainian border.

Ukraine’s energy crisis therefore continues to play a significant role in influencing European gas dynamics, and these trends are expected to continue for at least the next 12 months.

As Russian attacks on Ukrainian energy infrastructure continue, the possibility that imports of power and natural gas will grow further next winter also remains a concrete risk.

Source: Giovanni BETTINELLI