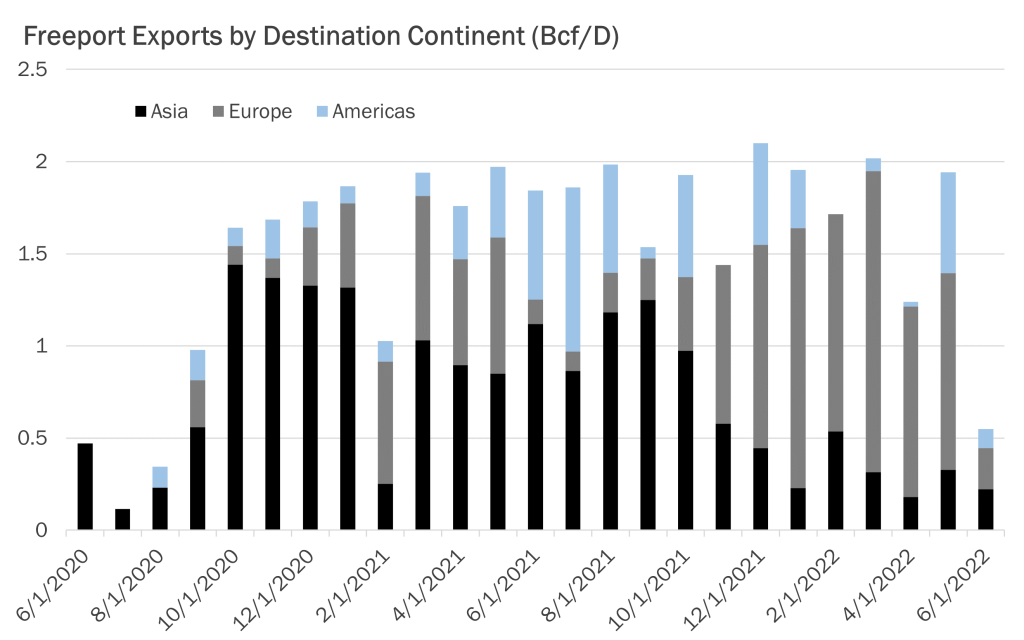

European storage, with the aid of LNG imports, has returned to five-year average levels. However, an expectation for tightness in the near term has returned to European markets after consecutive blows from the extended Freeport shutdown and reduced Russian pipeline flows to Germany emerged.

Freeport LNG over the winter provided more than 1 Bcf/D to Europe and was a critical component of European storage’s rally back to the five-year average. Russia, on the other hand, has also quietly played a role in Europe’s storage rally by virtue of not cutting off European pipeline flows completely.

However, today, the situation has changed dramatically and Russia announced that they would be cutting off flows to Germany by 60% over a stranded Nord Stream compressor undergoing maintenance in Canada.

European prices have soared from under $25 to over $45 in less than a week as markets priced in the impacts of lower Russian supplies. If Russia refuses to back down and provide supply, European prices could very well shoot up higher as Asian summer demand ramps back up and provides steady competition to European demand.

Source: Gelber & Associates