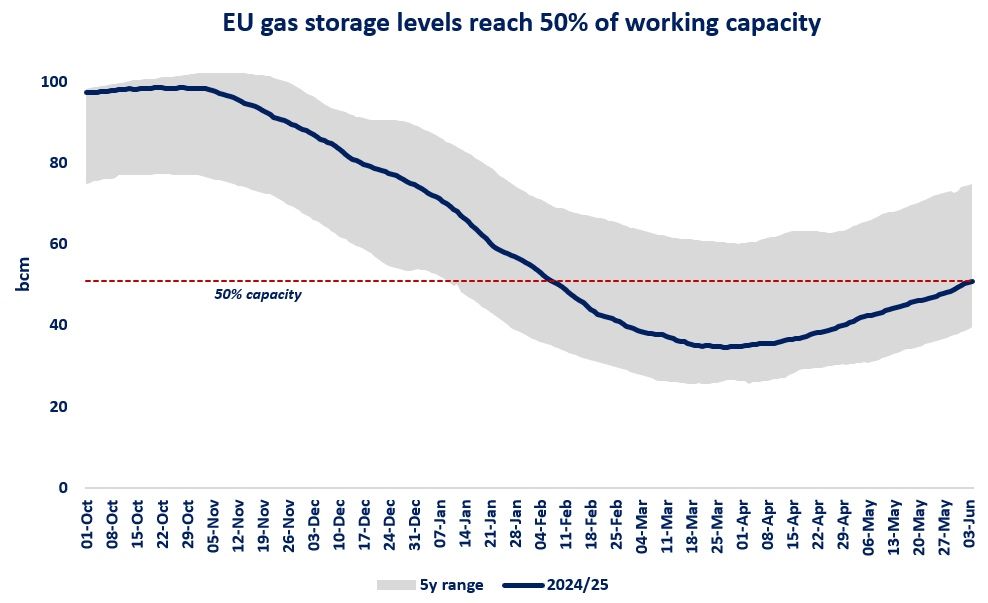

It’s Fifty in da house: EU storage levels reached 50% of capacity this week, and while injections ramped-up rapidly since the start of April, European stocks are still 17% below their 5y average, meaning that more LNG imports will be needed to build-up adequate stock levels ahead of the 2025/26 winter season.

EU storage injections surged by 34% yoy since April and totalled at just over 16 bcm. most of this additional injections were met through higher LNG imports, up by 20% yoy through Apr-May.

But are we on track to meet the EU’s storage target? if injections would continue at their 3y average, EU storage sites would be just 84% full by the start of November -13 bcm below their 3y average levels. lower gas stocks could support stronger price volatility over the winter season.

Considering the stronger filling requirements, together with the lower Russian piped gas imports and higher EU exports to Ukraine, Europe might need 20-25 bcm more LNG through Apr-Oct compared to last year.

And Europe is once again lucky, that China’s LNG appetite is rather weak this year (down by more than 20% yoy through Jan-May), which limits competition and hence the keeps prices at a relatively moderate level.

What is your view? how will gas markets evolve this summer? will Europe manage to fill up its storage sites to adequate levels? what are the key risks for a tighter summer outlook?

Source: Greg Molnar