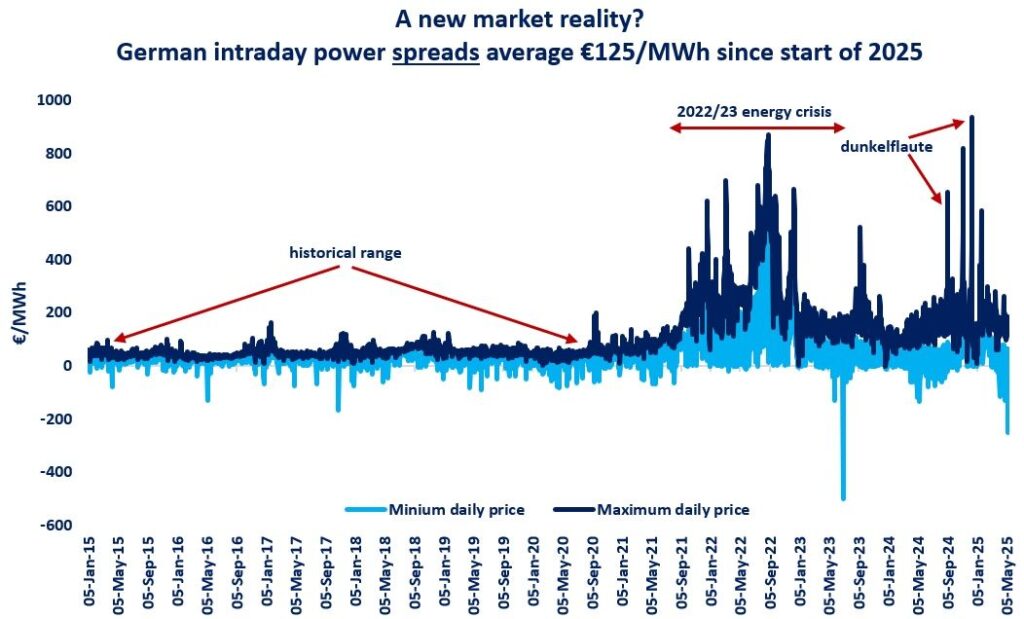

German intraday power spreads averaged at €125/MWh since the start of the year, reflecting renewable power supply volatility, and inadequate investment in flexibility assets, such as batteries and smarter grid.

Intraday electricity price spreads averaged at $30/MWh through 2015-20 in Germany, at a time when the share of renewables stood at around 35% of the power mix (vs 50% in 4M 2025).

Intraday price spreads exploded through the energy crisis and averaged at a staggering €200/MWh through 2022. it can be argued, that extreme gas price volatility coupled with a very tight European power market was driving these extraordinary price spreads.

And while gas markets gradually balanced back, intraday power price volatility remained well-above its pre-crisis levels.

In Germany, intraday power price spreads averaged at €125/MWh since the start of the year, compared with an average electricity price of €100/MWh. so effectively, we have lager average intraday price spreads than the actual average electricity price.

Weather dependent renewables are a key driver behind these extraordinary price spreads.

During the dunkelflaute days in December, intraday spreads surged to a staggering €800/MWh. more recently, strong solar power output pushed power prices down to -€200/MWh on Sunday, resulting in an intraday spread of near €400/MWh.

And while intraday price spreads are a good trading opportunity, it is ultimately the reflection of a power system where there is a structural lack of flexibility assets and mechanisms… and this in turn could indicate a more vulnerable power system.

What is your view? how will European power markets will evolve? could we see more intraday volatility with summer heatwaves on the horizon? what is your outlook for batteries?

Source: Greg MOLNAR