What drives gas price volatility: while market tensions moderated significantly since the 2022 crisis, gas price volatility remains well-above their historical levels, with TTF’s volatility standing 50% above its 10y average in 2024.

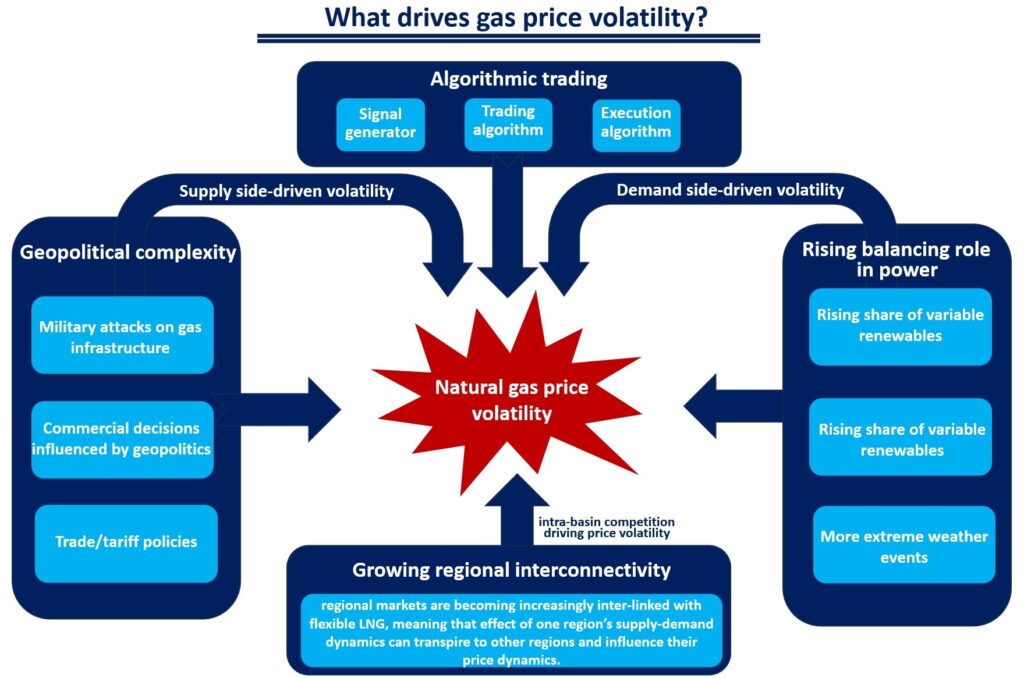

There are several structural drivers behind this stronger volatility, including:

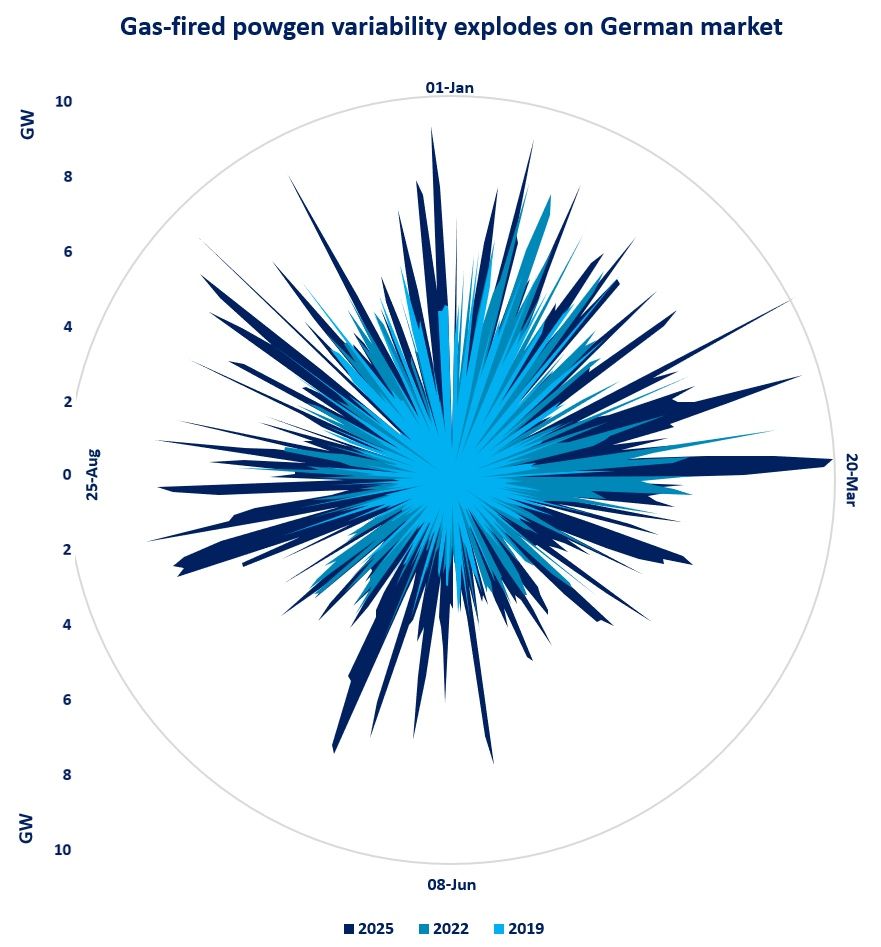

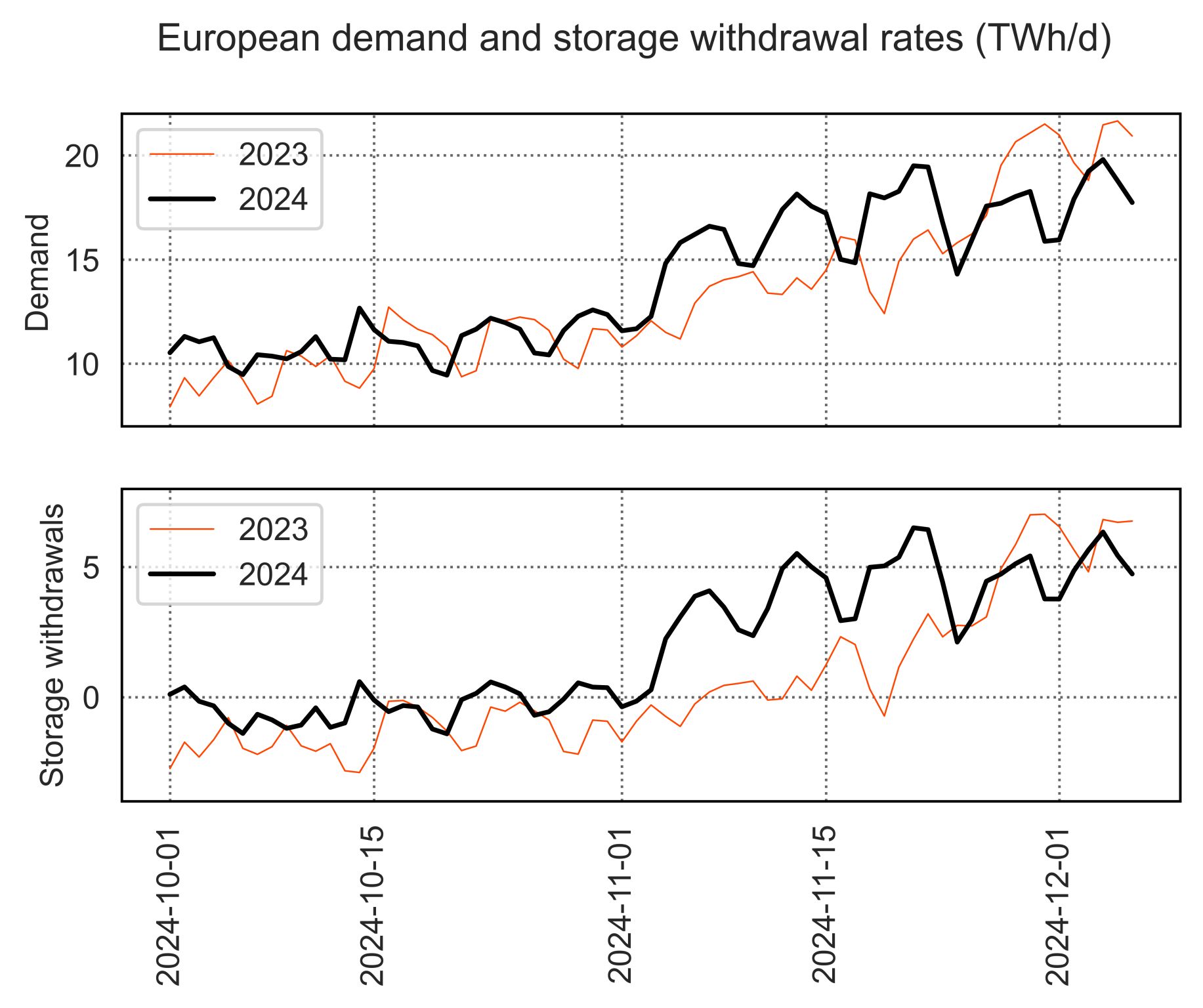

(1) A more intimate link between gas and electricity markets: the gradual coal phase-out and the rapidly growing share of weather-dependent, variable renewables increased the back-up role of gas-fired power plants in the power system, driving stronger gas-fired powgen volatility. for instance, in the UK the volatility of gas-fired powgen almost doubled from 400% to 800% between 2017-24. this stronger gas-to-power demand variability naturally translates into higher short-term gas price volatility. and of course, weather patterns are becoming also more extreme…

(2) Geopolitical complexity: heightened geopolitical tensions contribute to additional short-term price variability, especially in the import-reliant European and Asian gas markets.

(3) The globalisation of gas markets: regional gas markets are becoming increasingly inter-linked with flexible LNG, meaning that the supply-demand dynamics (and the resulting price volatility) of one region can transpire and influence the evolution of gas prices in other, more distant markets. price volatility is inherent to a more complex global gas market.

(4) Algorithmic trading and AI: the automation of certain trading processes through algorithms is potentially contributing to stronger volatility patterns and can amplify already existing market movements both in natural gas and electricity markets. AI could potentially further amplify this trend in the coming years.

So it seems, that gas price volatility is here to stay and make gas trading more exciting than ever. stronger gas price volatility is also naturally attracting financial players, who wish to benefit from short-term price swings and are crucial for providing greater liquidity to the market.

Heightened price volatility will ultimately require more sophisticated risk management strategies, especially in the context of Europe’s growing reliance on the global LNG market. long-term contracts can also mitigate exposure to spot price volatility, at least to a certain extent…

What is your view? how will gas trading evolve in the coming years? is volatility here to stay? how to best navigate price risk?

Source: Greg Molnar