2023 was another wild ride for the global gas markets. And the 5 key developments for me are:

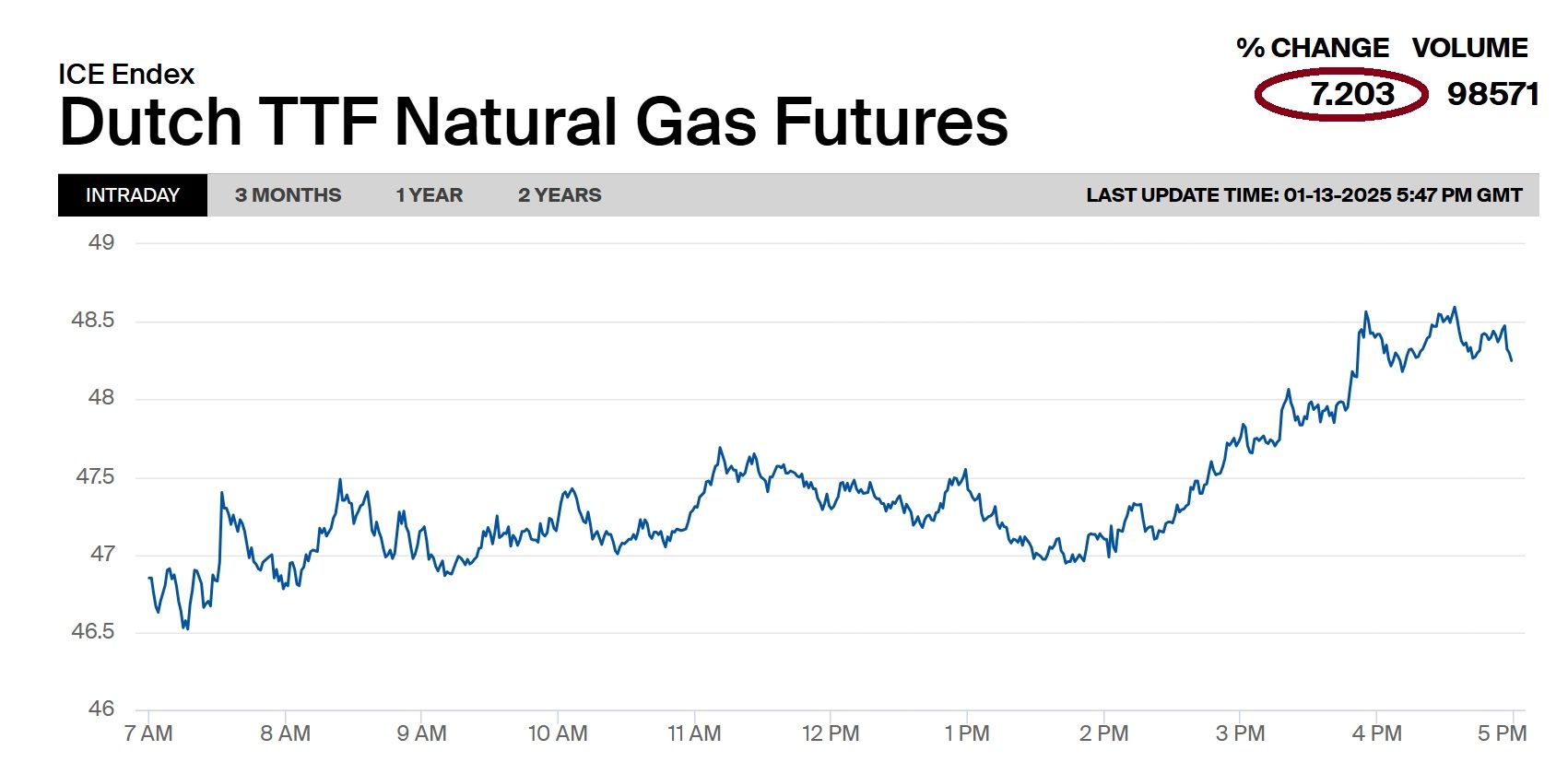

(1) Gas markets moved towards a gradual rebalancing, with TTF and JKM prices declining by 60% and 50% compared to 2022 – albeit remaining well-above their historic averages;

(2) A dry year for LNG: global LNG supply increased by a mere 13 bcm, less than half of the additions through 2016-2022, and not sufficient to offset the steep declines in Russian piped gas deliveries to Europe;

(3) A new king in town: the US became the world’s largest LNG producer, ahead of Australia and Qatar. The come back of Freeport LNG and the ramp-up of Calcasieu Pass LNG propelled the US to the first place;

(4) The Dragon is back: China regained its position as the world’s largest LNG importer ahead of Japan. The country’s gas demand increased by an estimated 7%, supporting higher LNG imports, which rose by almost 15% -although remaining below their 2021 record levels;

(5) Europe’s gas demand dropped by 7% to its lowest level since 1995 – primarily due to lower gas burn in the power sector and lower gas use in residential / commercial. Industry is showing the first signs of recovery – albeit fragile and highly dependent on prices.

LNG shipping risks are back in full swing, with Panama Canal congestions and geopolitical tensions rising across the Red Sea.

What is your view? What were the key development in 2023? And what are your expectations ahead of 2024?

Source: Greg Molnar