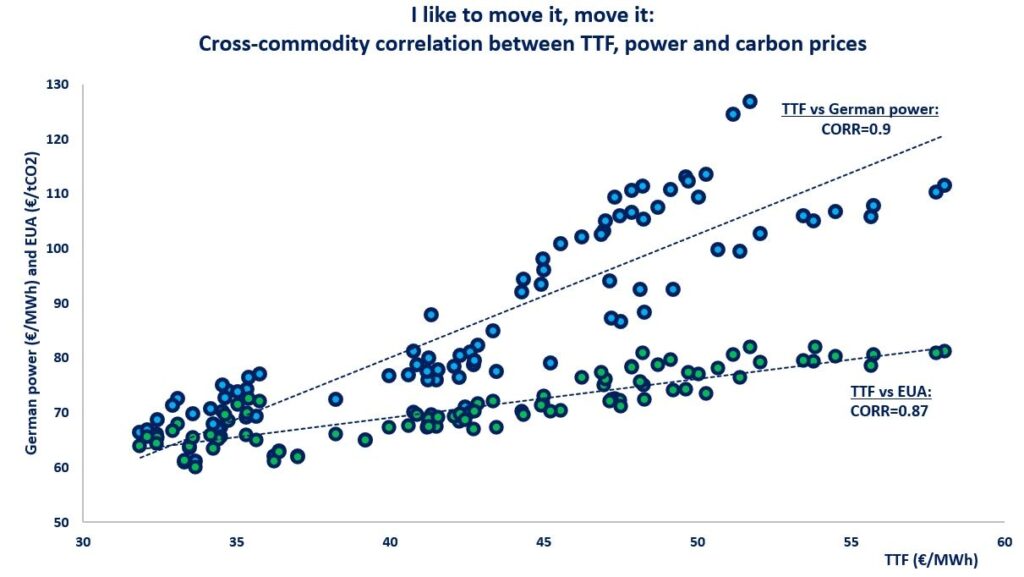

Despite strong volatility, the cross-commodity correlation between TTF, power and carbon prices continued to strengthen since the start of the year, highlighting the increasing integrated nature of trading strategies.

The correlation between TTF and carbon prices grew from an average of 0.45 in 2024 to near 0.9 since the start of the year.

Similarly, the interplay between German power and carbon prices (not shown on the graph) strengthened from 0.45 in 2024 to above 0.9 since the beginning of 2025.

In contrast, the correlation factor between TTF and German power prices weakened from 0.95 last year to just around 0.9. the correlation weakened particularly in Feb, when relatively high gas prices supported gas-to-coal switching and diminished the price setting role of gas in power.

Of course correlation is not necessarily causation, but this strong interplay might indicate the growing cross-commodity influence of natural gas prices. with the growing back-up role of gas in the power sector, these correlation dynamics are likely here to stay and drive trading strategies.

What is your view? how will the interplay between European gas, carbon and power prices evolve? what are the impacts on trading/hedging strategies? how could this change in the future?

Source: Greg MOLNAR