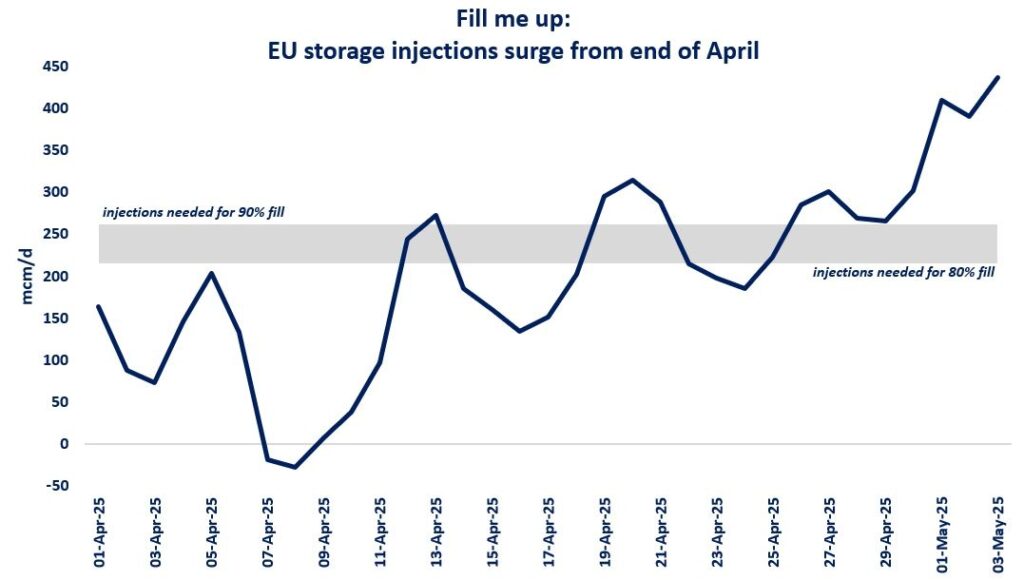

EU storage injections surged since the end of April, putting the EU on track to reach its 80-90% fill target by the beginning of the next heating season.

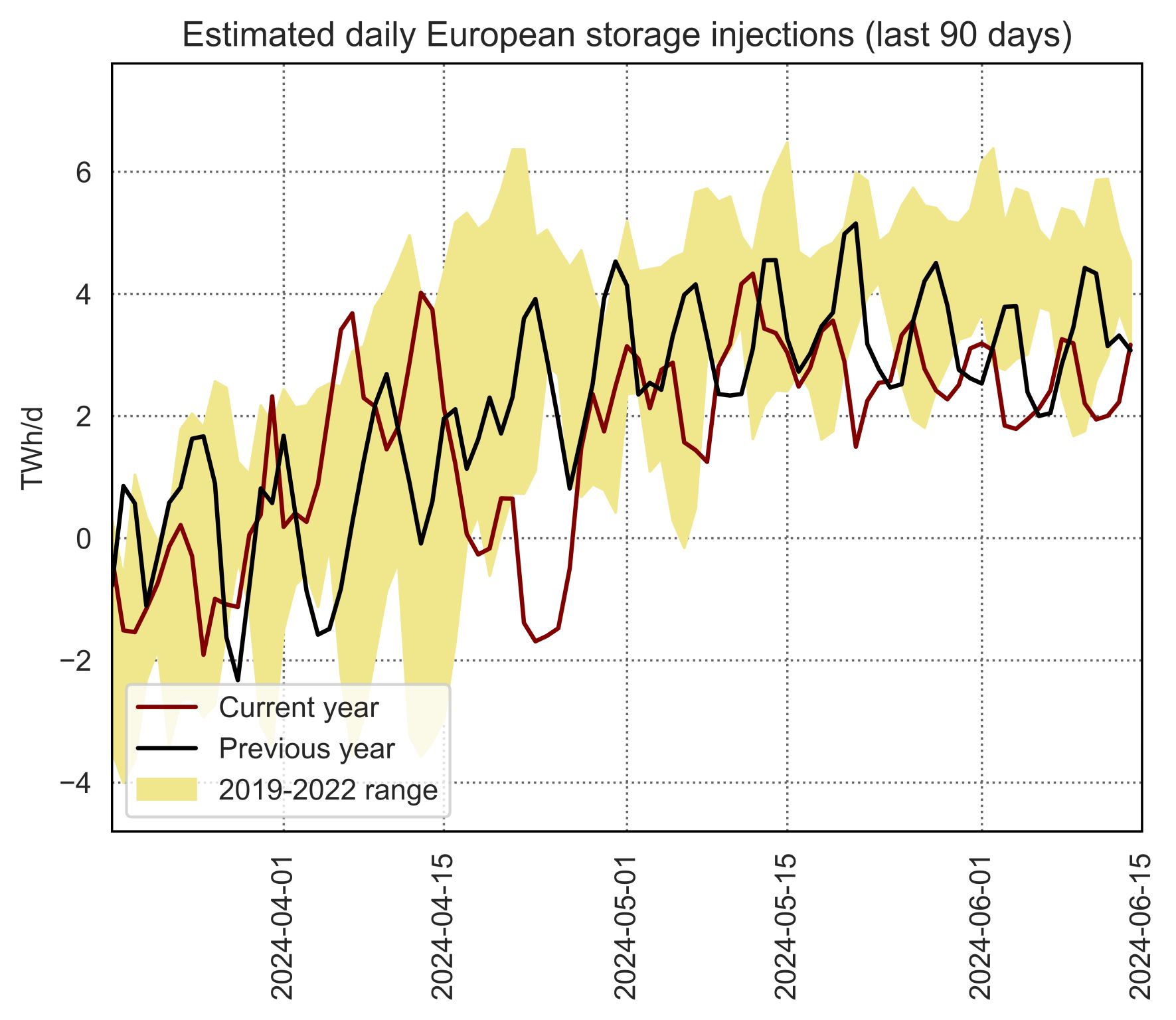

EU storage injections stood 70% above last year’s levels since the start, totalling at near 7 bcm, and boosting EU storage levels to above 40% of working capacity by early May.

The surge in LNG imports (up by 20% yoy), together with weaker demand in the second half of April (partly on strong solar output) helped to speed up storage injections.

The gradual recovery in the seasonal spread (now at around €1.2/MWh) have provided some additional incentives for injections. this being said, the current spread is not sufficient to cover the cash costs of most storage operators, which could once again lead to storage closures (see Breitbrunn facing closure risk).

And while current injection rates suggests that the EU could reach its 80-90% fill target, there is no place for complacency. there will be several factors at play:

(1) LNG availability: the EU will need to compete for LNG cargos through the summer to fill up its storage sites. the ramp-up of US LNG supplies, including from Plaquemines will be key in determining global LNG supply;

(2) China’s LNG appetite: China’s LNG imports are down by 25% year-to-date, which freed up some volumes, including to Europe. a recovery in China’s gas demand growth could intensify the competition with Europe (although this seems unlikely at the moment);

(3) Domestic demand: gas-fired powgen surged on lower renewable output in Q1 2025, and lower hydro availability together with sizzling summer heatwaves could further increase the call on gas-fired power plants.

Source: Greg MOLNAR