European spot and near curve gas prices dropped yesterday, pressured by warmer weather and comfortable LNG and pipeline supply.

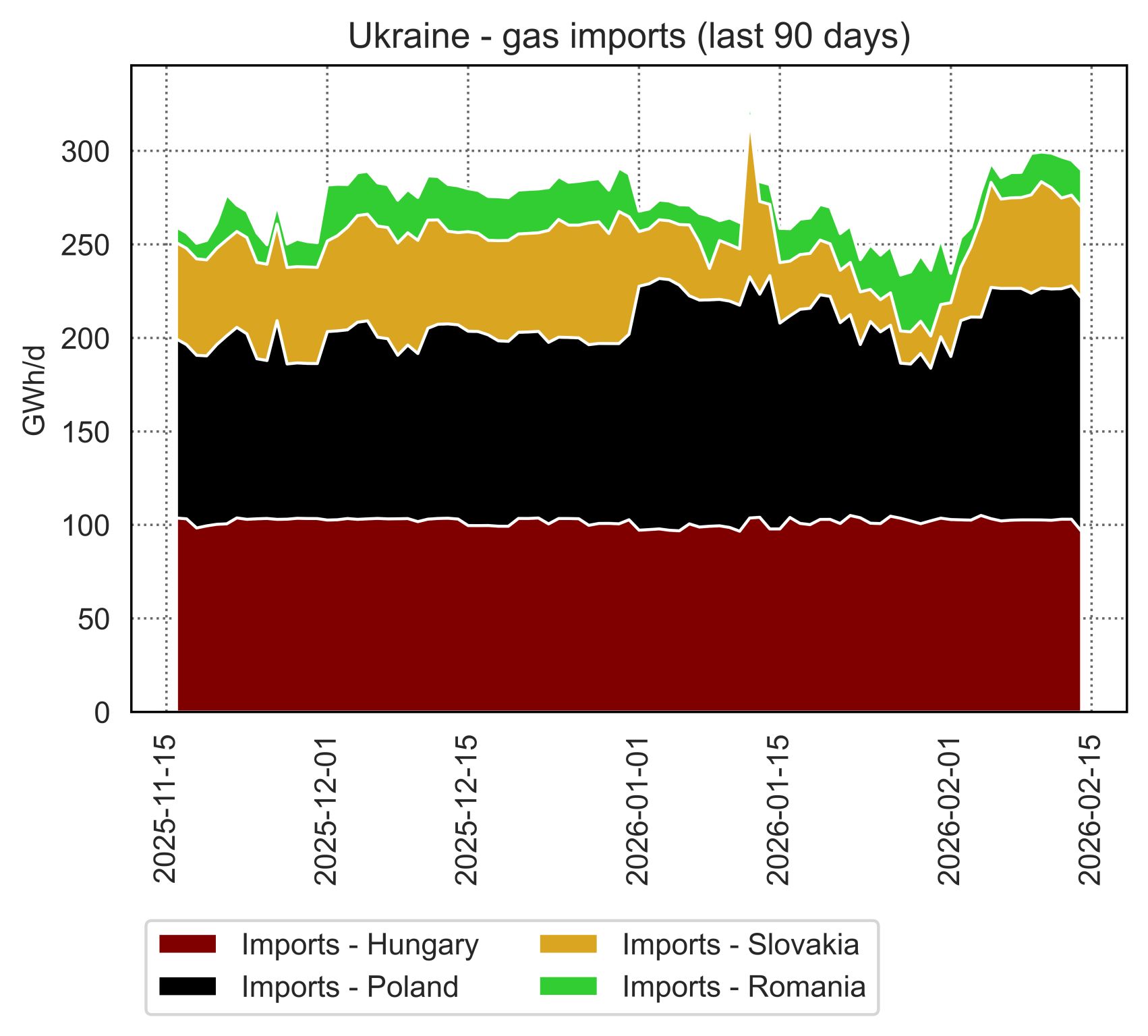

Russian flows rebounded slightly yesterday, averaging 245 mm cm/day, compared to 241 mm cm/day on Friday. Norwegian flows were stable at 324 mm cm/day on average.

By contrast, far curve prices were up again, supported by resilient coal prices and the feeling that the crisis will be long-lasting, which justifies the reduction of the backwardation.

At the close, NBP ICE May 2022 prices dropped by 15.530 p/th day-on-day (-6.80%), to 213.010 p/th.

TTF ICE May 2022 prices were down by €3.75 (-3.61%), closing at €100.137/MWh. On the far curve, TTF ICE Cal 2023 prices were up by €1.46 (+1.91%), closing at €77.814/MWh.

In Asia, JKM spot prices dropped by 4.50%, to €94.760/MWh; May 2022 prices dropped by 1.80%, to €103.528/MWh.

The maximum coal switching level was stable yesterday around €93/MWh. Therefore, TTF ICE May 2022 prices because were able to continue their decline quietly, below the 20-day average.

But, as said yesterday, the downside potential seems limited (the 5-day Low target seems out of reach) as long as coal prices and Asia JKM prices remain resilient, with an upside risk in case fundamentals tighten.

Source: EnergyScan