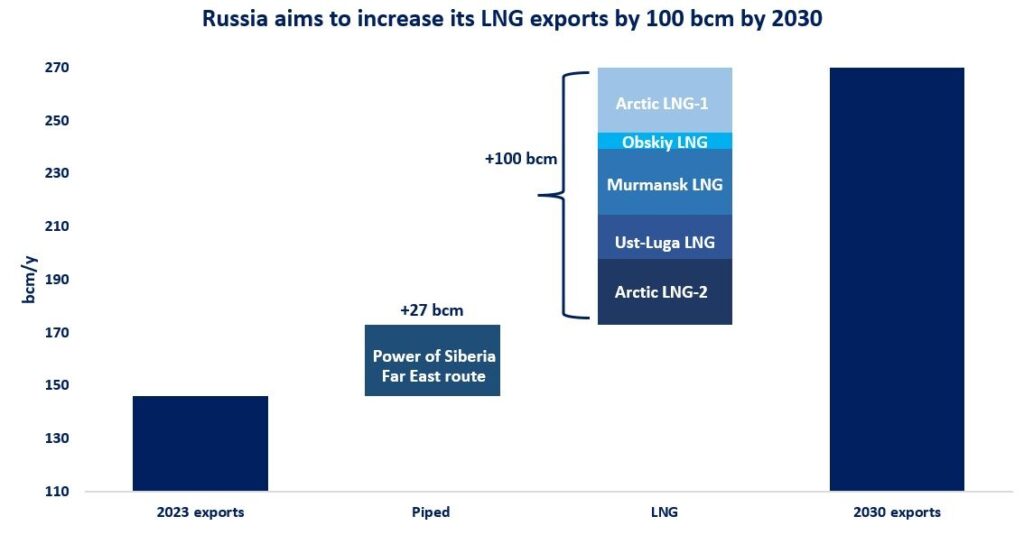

Sweet dreams are made of LNG: Russia is targeting to more than triple its LNG exports by 2030, from around 45 bcm in 2023 to over 140 bcm by the end of this decade.

Russia published its revised Energy Strategy earlier this month, with a clear bet on LNG, while piped gas exports are foreseen to increase by a marginal 27 bcm compared to its 2023 levels – this is exactly the incremental volumes contracted by China through Power of Siberia and the Far East pipeline systems.

So in short, not much upside is foreseen for Russian piped gas deliveries to Europe.

On the LNG side, Russia bets on 5 key LNG projects, with a combined capacity of almost 100 bcm/y.

This includes Arctic LNG-2 (almost completed but under sanctions) and the Ust-Luga project advanced by Gazprom.

In addition, there are three projects with a combined capacity of 60 bcm/y which are in early stages of development, including Murmansk LNG, Obskiy LNG and Arctic LNG-1.

Those projects have neither offtake contracts, nor secured financing and haven’t started any construction work…

All in all, Russia’s 100 bcm/y LNG bet by 2030 sounds like a long shot, considering the current sanction environment, technology access issues and the early status of most of the projects.

Still, the revised Energy Strategy confirms that Russia’s leadership sees LNG as a strategic sector, more than its traditional piped gas business. under the new Energy Strategy, the share of LNG in total Russian gas exports would rise from around 30% today to over 50% by 2030.

What is your view? Could Russia deliver its LNG ambition? What are the key challenges ahead? What would be the impact on the global LNG market?

Source: Greg MOLNAR