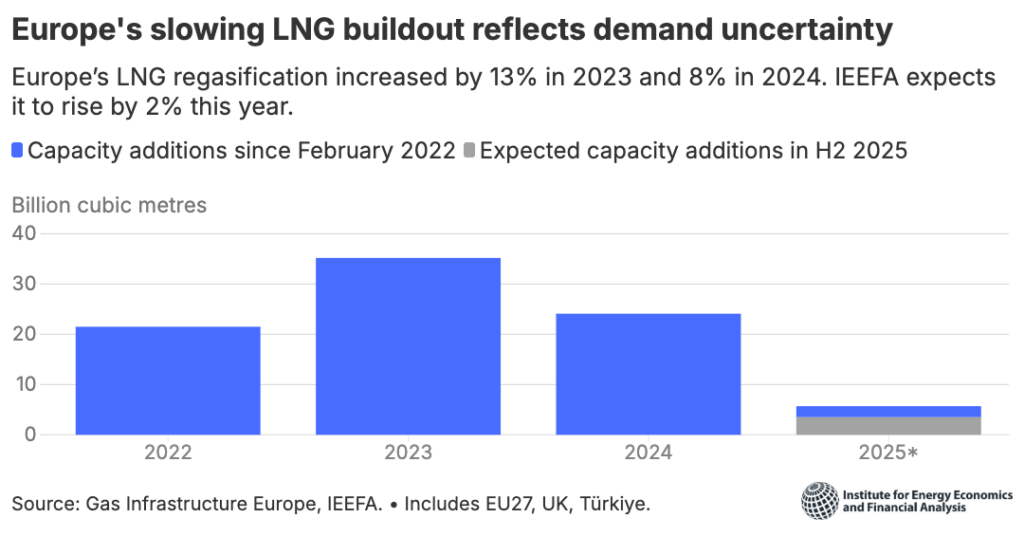

Europe’s liquefied natural gas (LNG) infrastructure expansion is losing momentum as the continent anticipates a drop in gas consumption — a development that could put pressure on European gas prices and reshape market dynamics for the remainder of the decade.

Europe’s liquefied natural gas (LNG) infrastructure expansion is losing momentum as the continent anticipates a drop in gas consumption — a development that could put pressure on European gas prices and reshape market dynamics for the remainder of the decade.

The IEEFA highlights that total LNG-terminal build-out in Europe is decelerating: while regasification rose by 13% in 2023 and by 8% in 2024, its growth is projected at only ~2% in 2025.

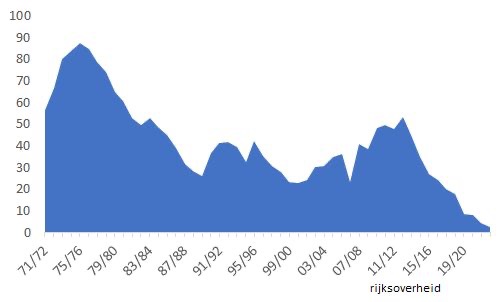

Importantly, Europe’s overall gas consumption is forecast to fall by ~15% between 2025 and 2030, with LNG imports potentially down ~20% in the same timeframe.

Several planned or recently commissioned LNG terminals have been cancelled or placed on hold. Germany shelved a floating storage and regasification unit (FSRU) at Mukran; France’s Le Havre FSRU has sat largely idle and a court ordered its removal.

Though Europe’s LNG imports surged by ~24% YoY in the first half of 2025, largely substituting for pipeline flows from Russia, the disconnect between high terminal capacity and expected future demand raises stranded-asset risk.

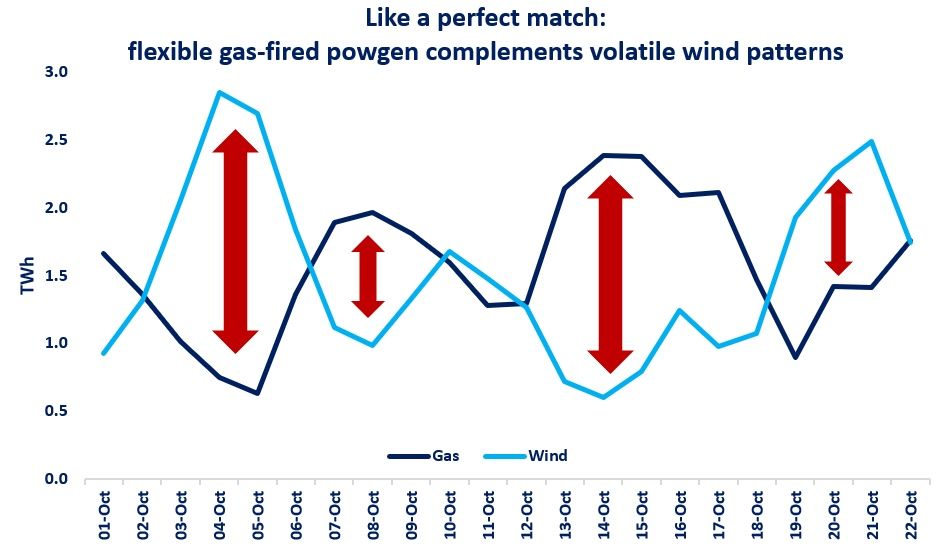

The implication for European gas prices is two-fold: on one hand, reduced demand could ease price levels; on the other, slower infrastructure build-out may limit flexibility during supply shocks — keeping the market exposed to volatility.

With Europe’s LNG build-out stalling and demand headed downward, the market is entering a new phase. For gas traders, utilities and regulators, the question is whether European gas prices will settle at a lower baseline — or if under-investment in infrastructure will reduce resilience to shocks and sustain price upside. Either way, the landscape for European gas is poised for structural change.

Source: IEEFA