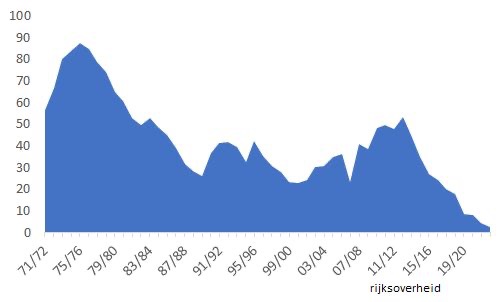

On October 1, 2023, the Groningen gas field stopped production, exactly 60 years after it started producing. It was the largest gas field in Continental Europe.

For many people who have been following European gas markets for decades, this is the end of an era, the loss of what used to be a significant part of EU’s domestic gas production but also a very significant source of flexibility, akin a virtual gas storage.

Those less familiar with the intricacies of European markets may wonder why it stopped. Not because of lack of gas, but because of earthquakes. First reported in the 1980s, a “significant” one (3.6-magnitude) in 2012 changed public opinion (houses were damaged) and forced the Dutch government to decide to first cap & reduce Groningen production, but as seismic activity continued, decision was made to stop the production.

This was initially expected to take place in October 22, but due to the crisis in Europe, production was extended and another 2.4 bcm was production during GY 22/23. Now Groningen was only produce in exceptional circumstances.

Given the circumstances – should we have kept Groningen for longer, or even tried to increase gas production?

Should the additional revenues have been kept in a fund reserved exclusively to repair/build new houses for people living in Groningen area – very few having benefited directly from the field. That ship seems to have sailed now. Domestic gas is replaced by lower demand and more LNG.

Source: Anne Sophie Corbeau