The European Union has committed to phasing out all imports of fossil fuels from Russia by 2027. While sanctions have not been imposed on natural gas as they have been on oil and coal, the EU’s dependence on Russia has already been significantly reduced.

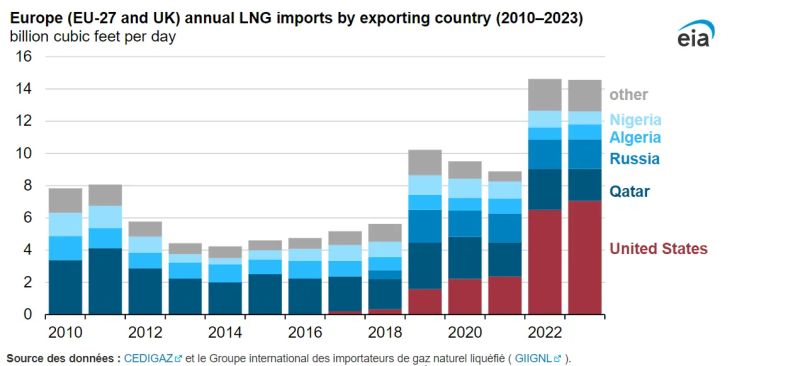

In 2023, deliveries of Russian pipeline gas to the EU had decreased by 80% since 2021, although partially offset by a temporary increase in LNG imports from Yamal.

Consequently, the share of European imports from Russian gas dropped from over 40% in the years preceding the invasion to 14% in 2023.

Pipeline exports to the European Union collapsed, dropping from a peak of 180 billion cubic meters in 2019 to 63 billion cubic meters (bcm) in 2022 and to around 27 bcm in 2023.

Currently, Russian gas is routed to European markets through two main channels: Ukraine and a branch of the offshore TurkStream pipeline.

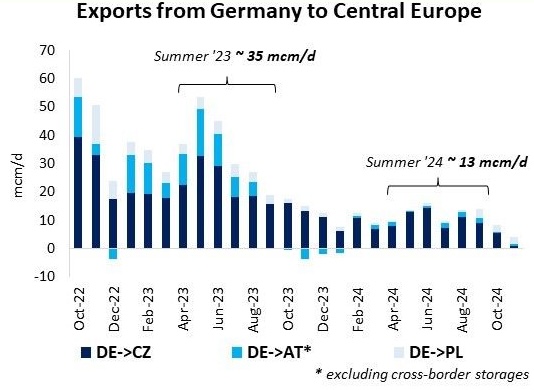

It seems unlikely that a Ukrainian transit agreement allowing Russian gas to flow through Ukraine will be extended beyond the end of 2024, although some occasional supplies based on short-term bookings cannot be ruled out.

This leaves the 13 bcm per year segment of the TurkStream pipeline as the primary route for Russian gas to reach European countries.

The disconnection of Europe from these pipelines puts Gazprom in a precarious position from a technical, political, and financial standpoint, as there are few markets to which it can redirect its natural gas.

China has positioned itself as the primary alternative for Gazprom. The Russian company began sending natural gas to China when the Power of Siberia pipeline came into operation in 2019.

The Power of Siberia currently has a capacity of 22 bcm of gas and is expected to reach a capacity close to 38 bcm by 2030.

The Power of Siberia 2, with a capacity of 50 bcm, was also announced in 2019, but the project has experienced significant delays due to US sanctions and a lack of commitment from China.

For Gazprom, the Chinese market would be significantly less profitable than the European market.

According to Energy Intelligence, the marginal cost of fields intended for the Chinese market is 40% higher than those connected to the European market.

Thus, Russia is also seeking to concurrently develop its LNG industry; the LNG exports from four existing LNG plants represent approximately 41 bcm/y of LNG export capacity.

However, the country faces several challenges: restricted access to Western liquefaction technology, US sanctions against Russian entities, logistical issues related to maritime transport, and the need to find buyers for the additional production.

Given the increasing liquidity and flexibility of the global LNG market, gas importers in the EU should have no trouble finding alternative suppliers to Russia and will now be able to benefit from the new common gas purchasing platform to negotiate these additional volumes on an aggregated basis.

Source: Vincent BARRET