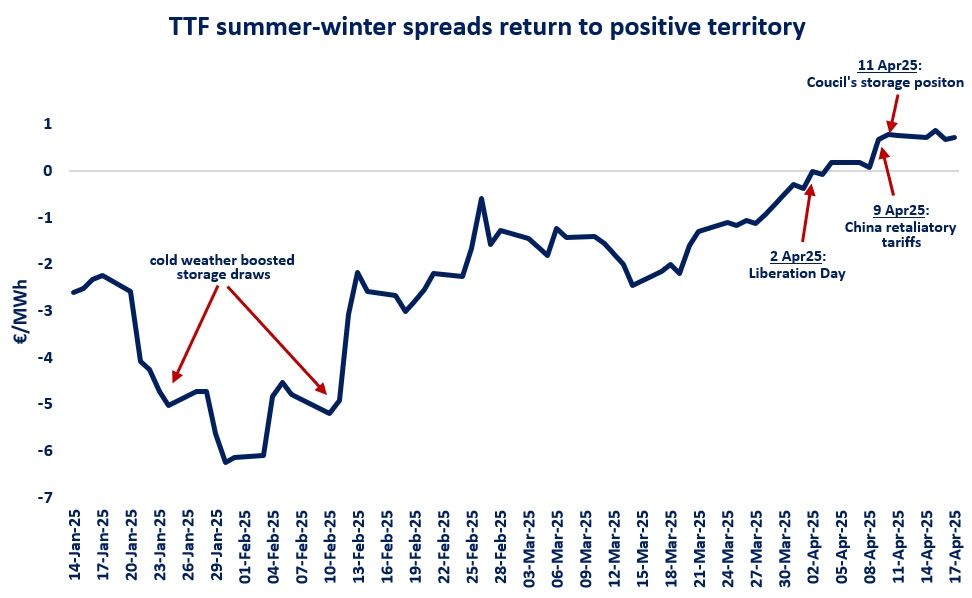

Be positive: after spending most of their time in negative waters, TTF seasonal spreads finally returned into positive territory, just in time for the filling season.

TTF front seasonal spreads averaged at minus €2.75/MWh through the Nov-March period, meaning that the summer 2025 contracts were trading at a premium compared to the winter 2025/26 contracts.

This effectively discouraged European midstreamers to book storage capacity, with many auctions failing to sell storage space for the upcoming summer.

Since 1 April, summer contract prices fell more steeply compared to winter contracts, which led to the recovery of seasonal spreads.

Four key factors contributed to the recovery of storage spreads in recent weeks:

(1) Growing macroeconomic uncertainty and recession fears led to downward revisions for summer gas demand both in Europe and Asia, leaving more gas for storage;

(2) China’s retaliatory tariffs would encourage more US LNG flowing to the European market and as such would support storage filling;

(3) Regulatory changes: the Council adopted its negotiation position for more flexible storage fill target (extending the fill season until 1Dec and allowing for a 10% flex range around the 90% fill target);

(4) Recent unsuccessful storage auctions naturally limit the foreseen injection demand, which in turn puts further downward pressure on summer contracts.

The current seasonal spreads are still below €1/MWh, which is still a weak signal for storage refill and is usually not sufficient to recover the cash costs of many storage operators.

The next step to watch is the storage agreement between the Council and the Parliament.

If the new flexibility rules apply to the current year, we could see a stronger recovery in storage spreads.

What is your view? How will the European summer market evolve? Can we refill storage sites up to 90%? What role for LNG?

Source: Greg MOLNAR