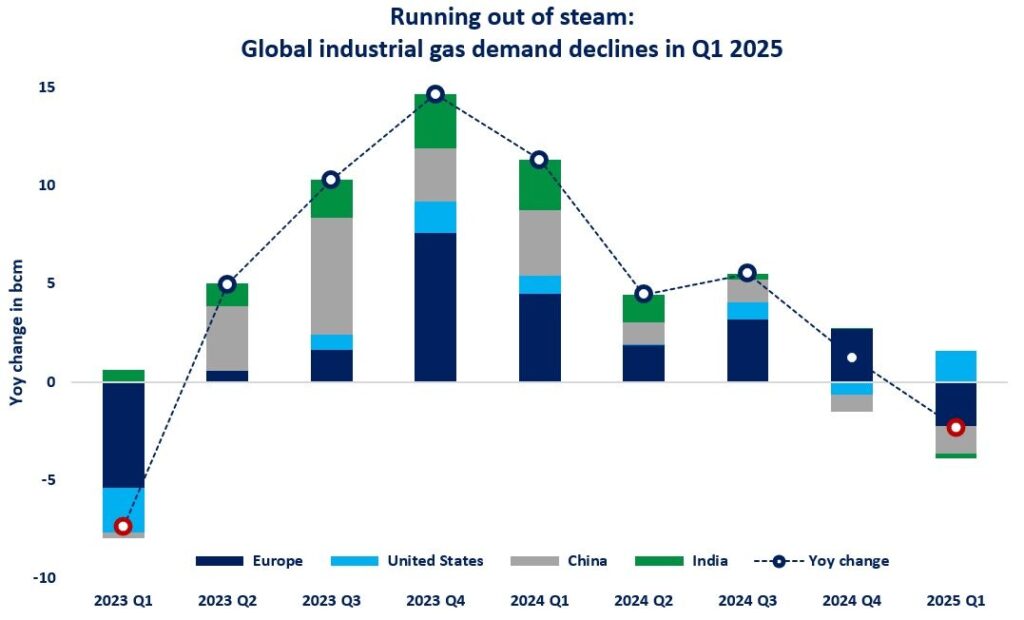

Running out of steam: global industrial gas demand declined in Q1 2025, for the first time since the 2022/23 gas crisis. Just a temporary hiccup, or something more profound is going on?

Industry was the single most important driver behind stronger gas use in 2024, alone accounting for almost 40% of incremental gas demand last year.

This was partly driven by the recovery in Europe and the by the continued economic expansion in fast-growing Asian markets, with China and India taking the lead.

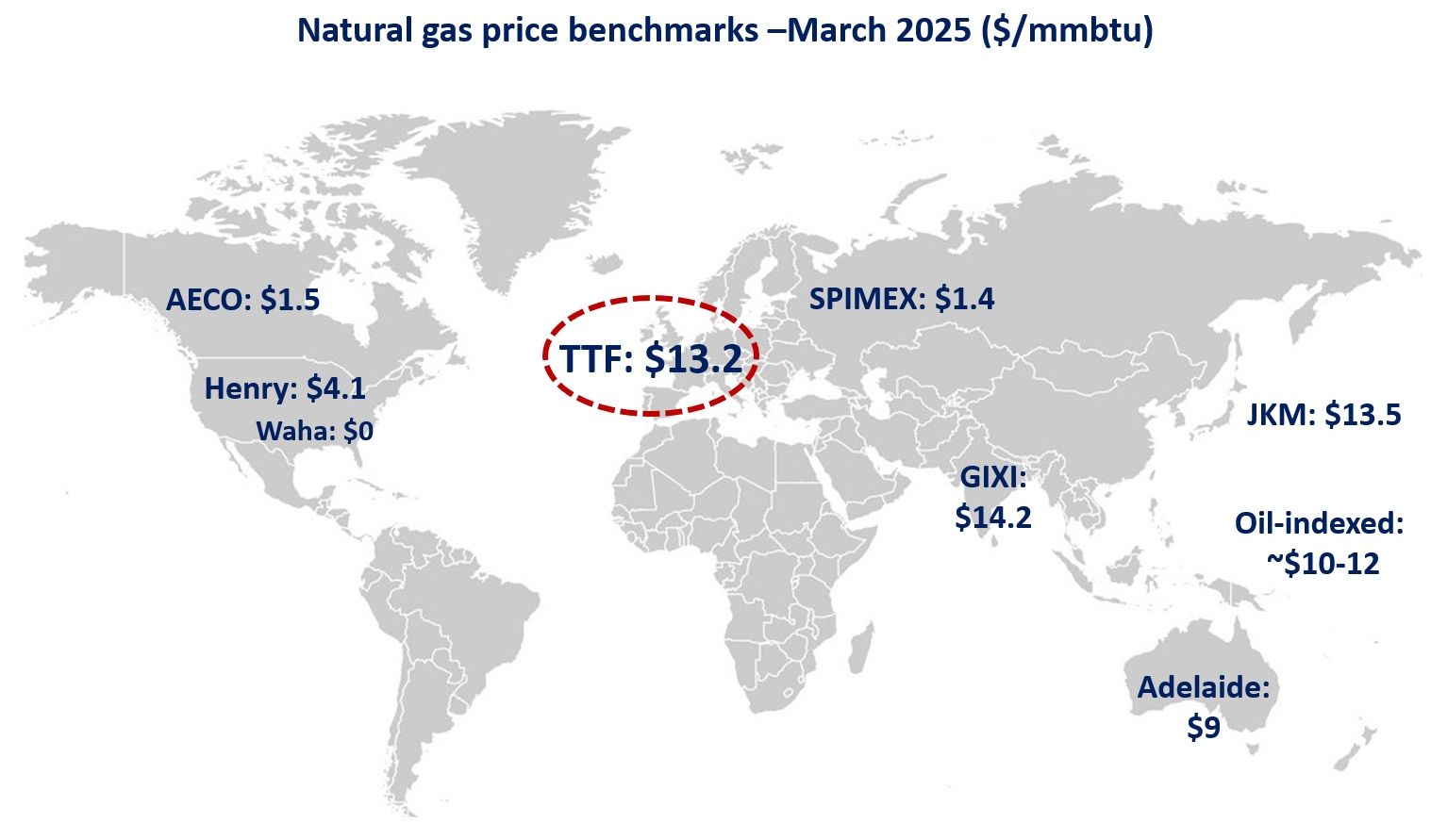

This is rapidly changing in 2025, with high gas prices and macroeconomic uncertainty weighing on industrial gas demand across all key markets.

In China, industrial gas demand growth turned into negative territory since November last year, and dropped by around 3% in Q1 2025 – a decline we have seen last time in 2022, during the darkest days of the gas crisis.

While China just posted a GDP growth of 5.4% for Q1 2025, there are signs that the country’s economic growth is slowing down, which has also repercussions on industrial gas demand, as well as electricity use (which dropped by 0.3%).

In addition, some of the energy intensive industries might opt for gas-to-coal switching to mitigate the impact of high spot LNG prices on their overall energy costs.

In India, industrial gas demand dropped by just over 2% yoy over the Oct-Feb period, with the fertiliser sector taking most of the hit, with its gas use declining by near 6% yoy.

In Europe, industrial gas demand dropped by around 5% yoy in Q1 2025, mainly driven by gas and energy intensive industries, including refineries and fertilisers.

In Europe, we might see another year of decline in industrial gas, and not because we are becoming more efficient, but rather because Europe is loosing its competitiveness against other economies…

In contrast with other markets, US industrial gas use increased by almost 1% during the heating season, potentially benefitting from the comparative advantage provided by lower Henry Hub prices (which were less than half of TTF and JKM).

What is your view? What outlook for Europe’s gas and energy intensive industries? How structural is China’s slowdown? What could be the impact on the US?

Source: Greg MOLNAR