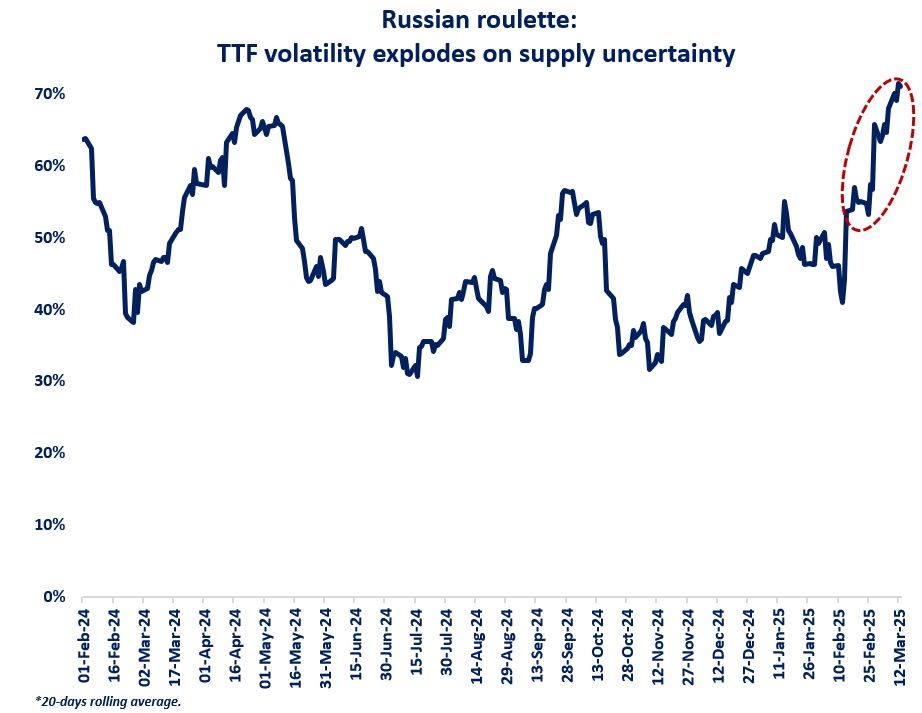

Both crude and European gas markets corrected heavily following their runups to $130/bbl (WTI) and $81/MMBtu, respectively.

Currently, the WTI is floundering near $100/bbl, falling nearly 8% today while the TTF is trading near $37 – less than half of its value from a week ago.

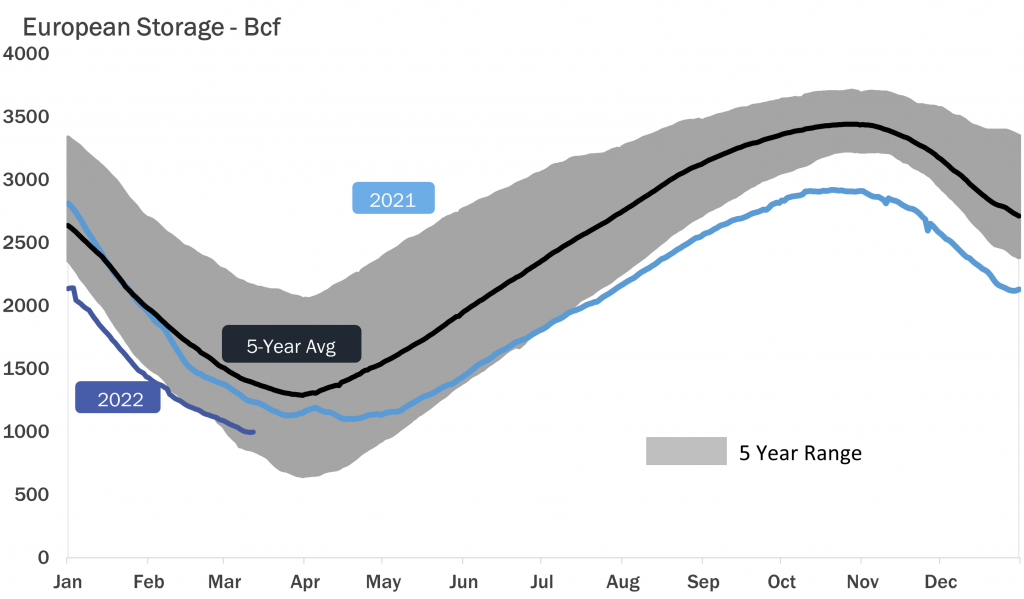

Commodity markets remain uncertain in their attempt to price in the potential for a global supply shock into the financial markets, a strong reason behind the volatility of the last two weeks. Focusing specifically on international gas, the TTF has fallen spectacularly as we round the corner of winter. Storage, depicted below, is now well into the five-year range and the first injection of the year was actually observed on 3/12/2022 for European markets.

Mild weather and LNG imports have largely diminished the decline of storage experienced through the height of winter. Lower Russian pipeline imports into Europe through Ukraine have been a factor that Europe has successfully dealt with through much of the latter half of 2021.

Pipelines like the Nord Stream I, whose path lies far from the land zones impacted by the Russian invasion, remain online. Though the EU has made plans to shift away from reliance on Russian gas in the long-term, Russia has continued to keep gas through its non-Ukrainian pipelines flowing.

As a result, European prices have begun to sink as gas’ peak demand season looks to come to a close with a major supply shock from Russia yet to appear. Despite the TTF’s current decline, the upside risk remains extremely high, and the geopolitical consequences of further escalation by Russia would have massive ramifications in the energy world.

Source: Gelber and Associates