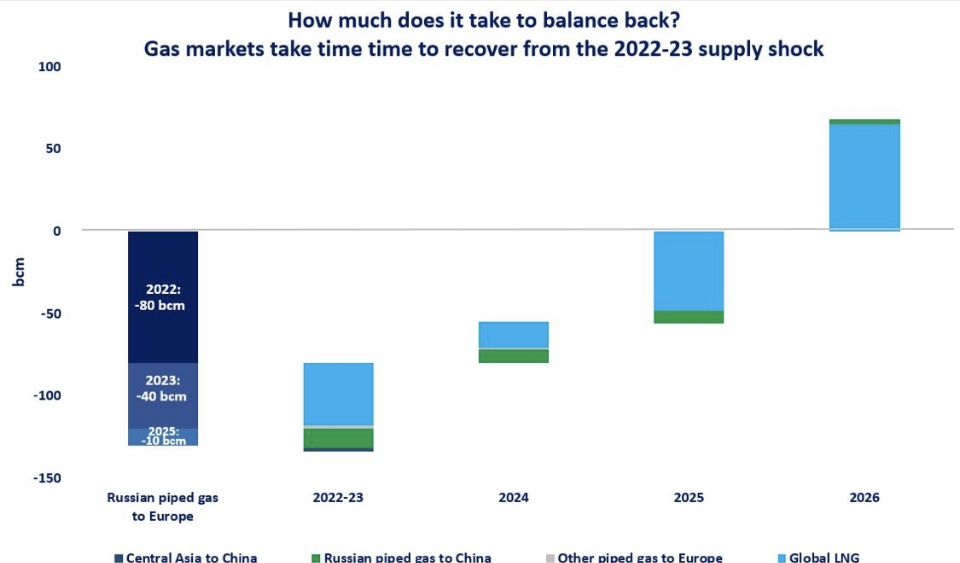

How much does it take to balance back: while natural gas market tensions have eased in 2023, the supply picture remains fundamentally tight and gas markets will need more time (and more volumes) to recover from the 2022-23 supply shocks.

Russian piped gas deliveries to Europe dropped by 120 bcm in 2022-23, equating to over 20% of global LNG trade.

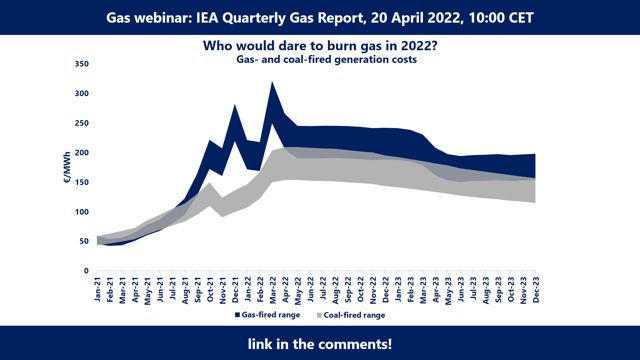

The consequences are well known to all of us: record high gas prices, reshuffling of global LNG flows and a painful readjustment in gas demand in the major European and Asian import markets.

And while prices have moderated down significantly in 2023, we should not forget that the supply picture remains fundamentally tight.

The dry LNG years are set to continue into 2024: less than 40 bcm/y of liquefaction capacity was added in 2022-23 and incremental LNG supply risks to be well-below 20 bcm in 2024, especially when considering the delay of Golden Pass Train 1 and the uncertainties related to Arctic 2 LNG.

Hence, the market will recover the volumes lost from Russian piped gas supplies only towards 2025-26 when the major US and Qatari LNG projects will be online.

Before that, the market looks tight from a supply perspective, with limited safety buffer and hence at risk of heightened volatility.

What is your view? By when will the market properly balance back? What are the key risks ahead? How will the new gas regime post-2025/26 look like?

Could there be shift from under – to oversupply? What is your outlook for 2024?

Source: Greg MOLNAR