TTF month-ahead rose by 50% since 5 October to €55/MWh ($17/mmbtu) -their highest level since early Feb23.

Australian strikes risks, production disruptions in Israel and damaged caused on Balticconector are all providing upward pressure on the market.

And while none of these events had so far a direct consequence on gas volumes available to the global gas market, they fuel market fear.

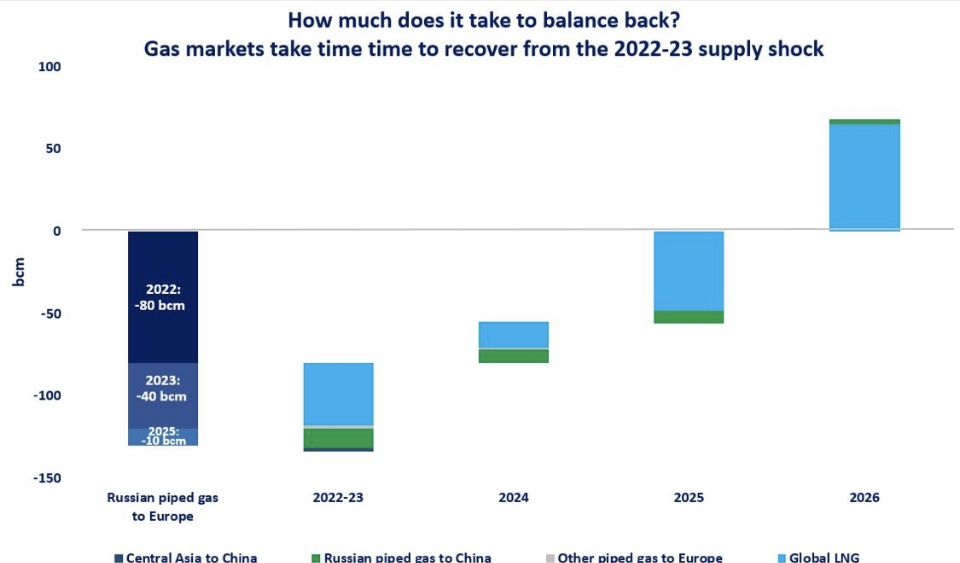

This heightened volatility also reflects that the European and global gas balance remains fragile. The supply side remains fundamentally tight, with no spare supply capacity left in the gas system.

What is your view? How will gas markets evolve in the coming winter months? Are we set for a wild volatility ride?

Source: Greg MOLNAR