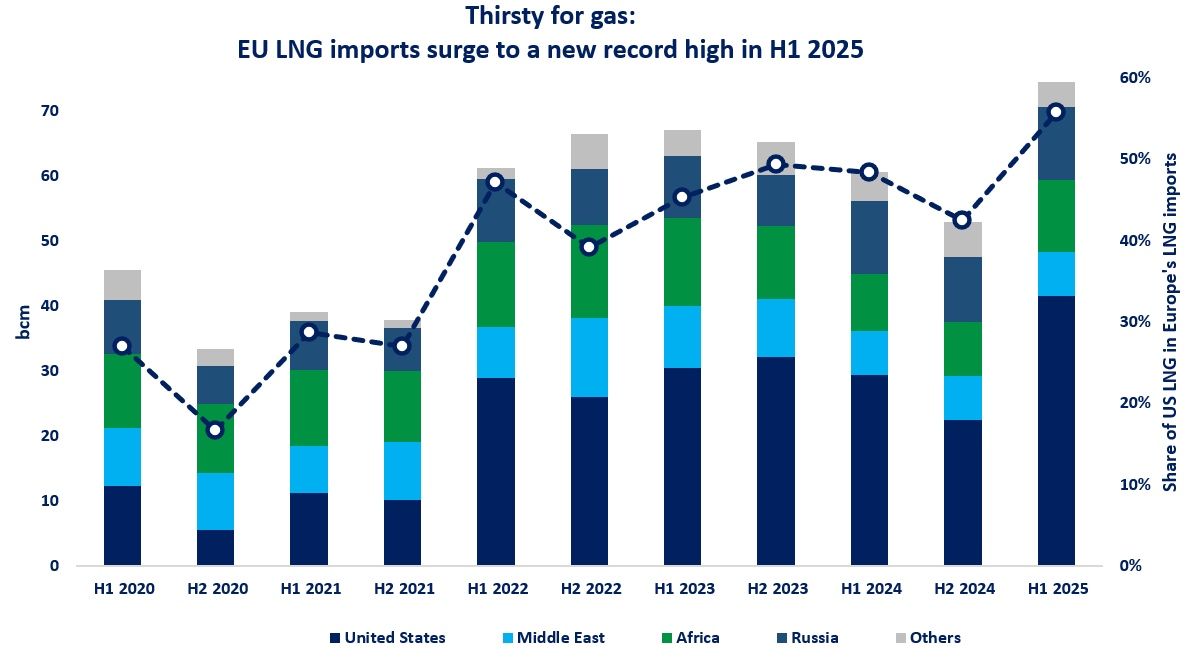

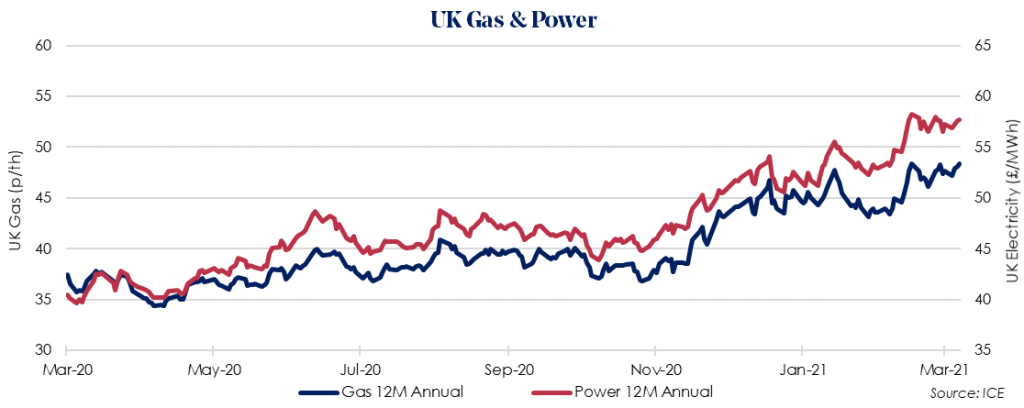

The May 2021 Gas rose 5.1% to 47.21 p/therm last week as colder temperatures drove up demand and on lower LNG send-out. The backlog of ships travelling though the Suez Canal was cleared over the weekend, around 12 days after the massive Ever Given ship grounded.

But with European gas storage already running lower than normal for this time of year, delays of LNG deliveries to Europe may take longer to correct.

The May 2021 Power rose 3.5% to £56.22/MWh tracking gas gains, and as wind generation remained below average last week increasing reliance on gas-fired power generation.

The Oct 2021 12 Month Gas price rose by 2.0% last week to 48.33p/therm as the LNG delays resulting from the Suez Canal backlog could be felt as far ahead as next winter. European Gas storage remains close to its lowest level for the past 3 years, around 31% of total capacity.

UK Gas storage increased to 49%. Research firm Energy Aspects said it expects the Nord Stream 2 gas pipeline to contribute to European supply from the start of Q4-21, following an apparent softening of U.S. opposition to the project and the start of work by a second Russian pipelaying vessel.

The Oct 2021 12 Month Power price rose by 2.1% to £57.72/MWh last week tracking gas contracts higher even though European energy demand concerns remain as COVID infection rates rise across the Continent. However, the UK’s own vaccine continues to rollout at the scheduled pace, with more than 30 million people having received at last their first dose.

Brent crude oil saw a rise of 4.7% last week to $64.86/bbl. This was largely caused by delays to cargoes travelling through the Suez Canal. That said, production has seen a significant rise over the last few days, with OPEC+ and the US declaring increased drilling rates.

With all parties now focussed on a drilling recovery throughout the Summer, it is not clear whether demand will match the increasing supply. The forecast for the coming week is for oil prices to see some drops, reacting to the news of increased production.

Pound Sterling rose 0.7% last week as the UK reached the next step of the roadmap that marks the start of the easing of lockdown restrictions. The highly successful vaccination program and the gradual reopening of the UK economy continues to support the Pound.

Meanwhile, US government bond yields have fallen providing bearish pressure for the US Dollar. Some optimism for the Dollar was provided by the lowest post-pandemic job loss claim this week amid strong manufacturing indicators.

European coal prices rose 0.3% last week as gas and LNG prices remain high while the backlog from the blockage in the Suez Canal is cleared. Despite warm temperatures in Europe last week, colder temperatures were forecast to sweep the Continent over the weekend boosting demand for coal.

European carbon rose by 5.2% to €42.37/tCO2 this week following the publication of EU emission data. The data has shown a 14.4% reduction in EU ETS CO2e emissions for 2020, due to economic slowdown related to the COVID-19 pandemic.

The reductions in EU ETS emissions have provided a boon to the scheme as the price has remained high despite low emissions. As emissions are expected to increase again in 2021 the price of Carbon is likely to increase significantly as the year continues.

Source: BEOND GROUP

Follow on Twitter:

[tfws username=”Beondgroup” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]