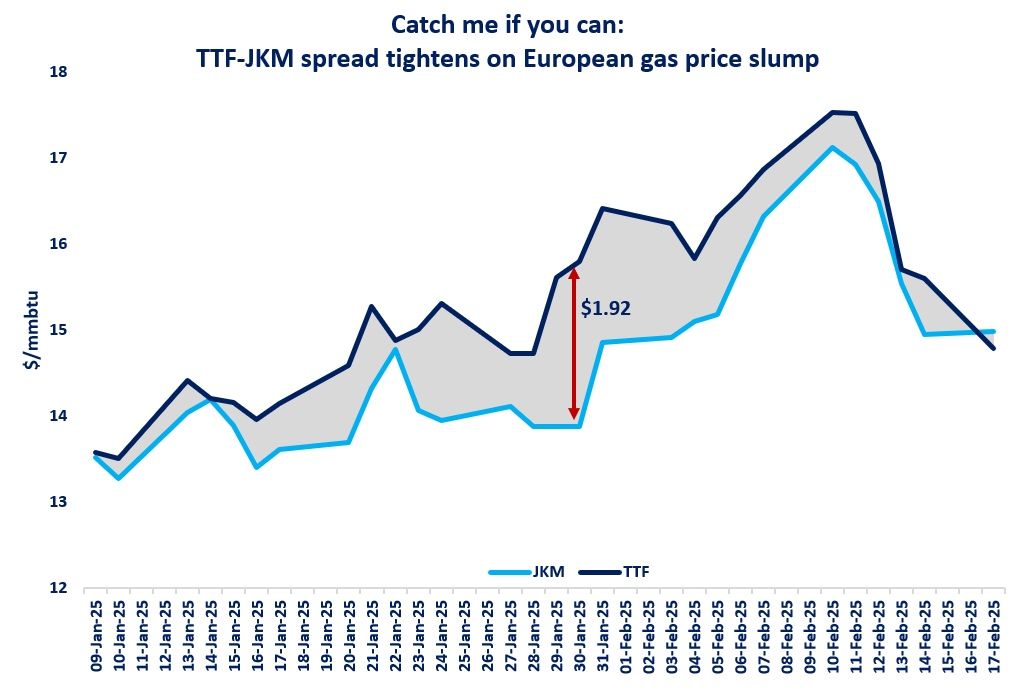

The European gas price slump tightened the spread with JKM, as TTF settled yesterday slightly below the Asian benchmark, for the first time since the start of the year.

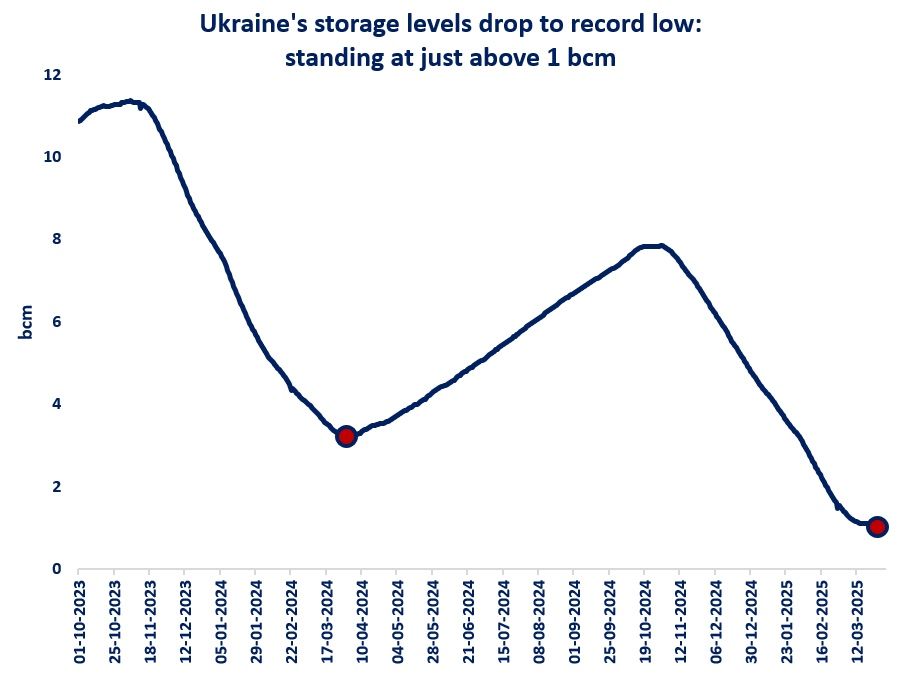

Low storage levels, together with higher European gas demand pushed TTF well-above JKM prices through January, as Europe was desperately looking for flexible LNG cargos.

The European premium soared to $1.92/mmbtu at the end of January -its highest level since May 23 and enough to attract an LNG cargo even from Australia -something we haven’t seen since 2022.

After reaching an almost two-year high last Monday, TTF prices plummeted by more than 15%, driven by the potential softening of EU storage targets, peace talks with Russia and milder weather forecasts for northwest Europe.

In addition, weak demand in Asia, especially in China, is also adding to the bearish picture.

And while JKM followed the freefall of TTF, it declined less steeply in recent years, meaning that yesterday JKM settled at a slight premium to TTF -for the first time since early Jan25.

This does not seem to be a structural change, as Europe will need plenty of LNG this summer to refill its storage sites (including in Ukraine). But it also highlights the volatility of the market, and how quickly things can move…

What is your view? How will the TTF-JKM spread move this summer? What do you expect from the peace talks for gas markets? Are we entering softer market conditions?

Source: Greg MOLNAR