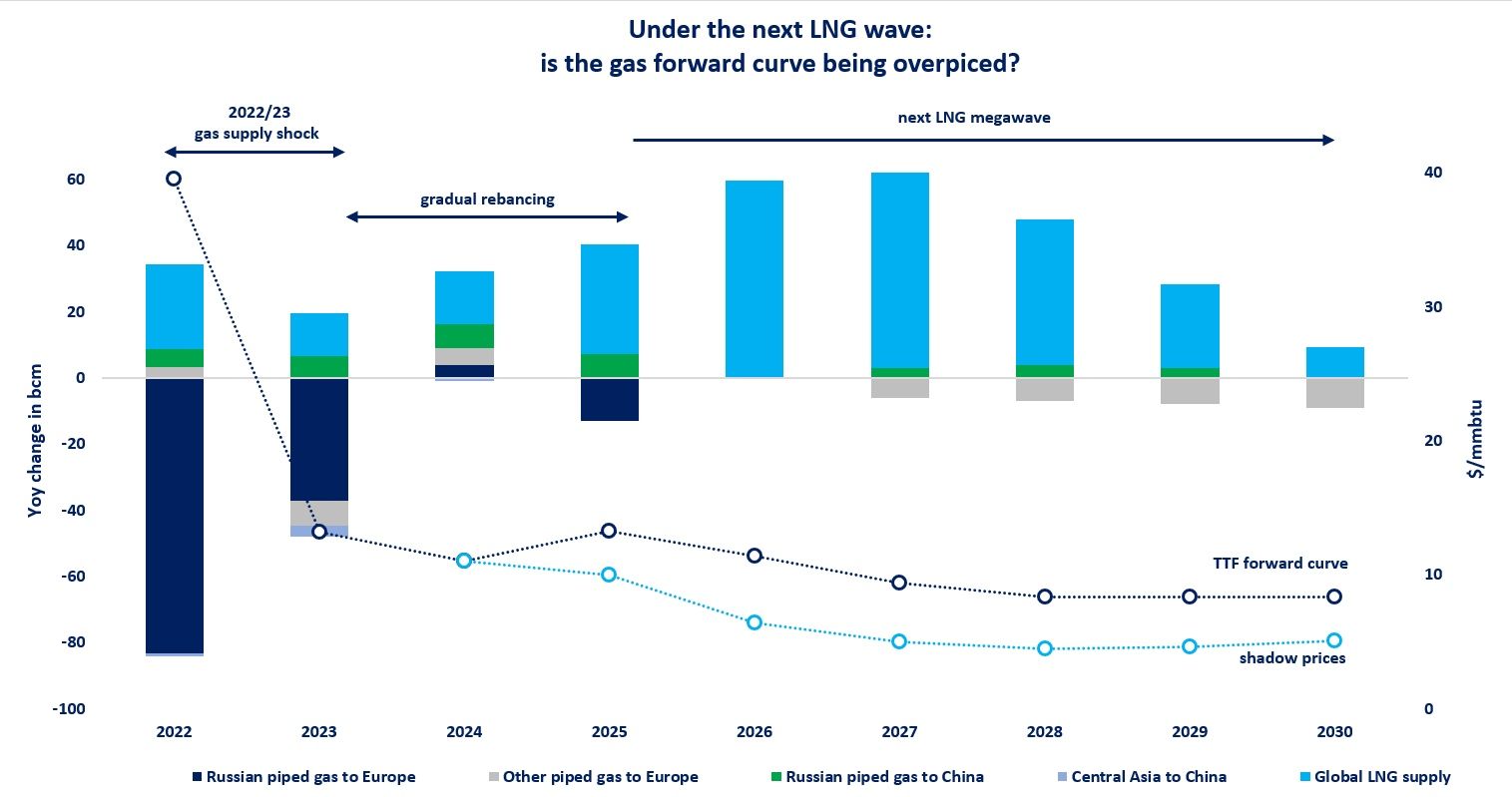

Who let the bears out? European gas prices fell by more than sixfold compared to their August highs, to their lowest levels since Sep21, nearing now the €50/MWh breaking point.

There are a few bears out there, a combination of weather, economy and geopolitics:

(1) Unseasonably mild weather: EU gas demand fell by more than 20% since the start of the heating season, with almost 60% of this due to mild temperatures;

(2) Storage levels: are standing 30% or 20 bcm above their 5y average, indicating that injection needs will be potentially lower in summer 2023, which could help to balance the market;

(3) China’s covid worries weigh on the country’s economic and energy demand outlook. the country’s LNG imports fell by 20% yoy so far in Jan;

(4) Muted Russian reaction on the EU price cap: no signs of backlash or further supply cuts so far. Russia was even indicating that the Yamal pipeline is still technically available;

(5) Strong winds: a short-term factor, but certainly bearish, with wind generation up by 30% yoy since the start of 2023.

This being said, the current prices are still almost 4 times higher than their historic average… and bears can quickly turn into bulls it weather gods decides so, or further technical issues arise, spiced up by geopolitical craze…

The next big price mover will be certainly Freeport and its return date, which seems now been delayed into the second half of Jan/Feb…

Source: Greg Molnar