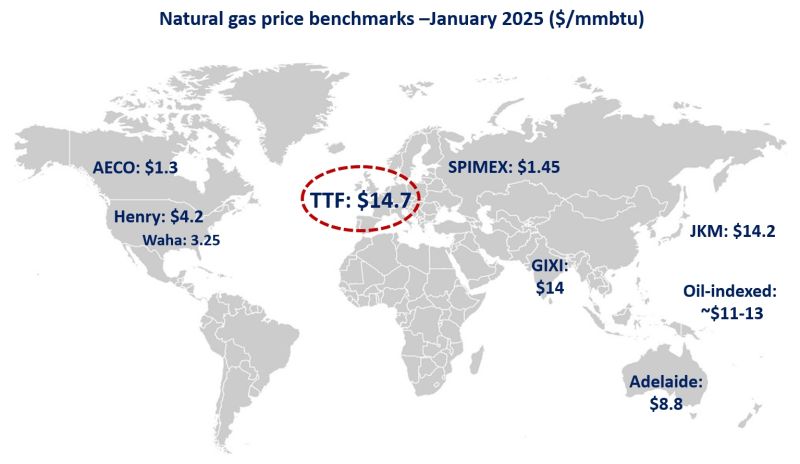

Natural gas prices recorded strong gains across all key markets in January, amid cold weather, looming supply uncertainties and rapidly depleting storage levels.

In Europe, TTF month-ahead prices averaged at near $15/mmbtu -their highest monthly since Feb23. Lower wind power output continued to drive stronger gas burn in the power sector (up by 7.5%), while sporadic cold spells supported higher gas use in residential / commercial.

Stronger gas demand coincided with lower Russian piped gas deliveries after the Ukrainian transit halt and unplanned outages limiting Norwegian gas deliveries. Storage draws remained excessively strong, brining down EU storage fill levels to just 54% of working capacity -and inventories standing 6 bcm below their 5y average.

In the US, Henry Hub prices surged by almost 40% month-on-month to average at just above $4/mmbtu. cold winter weather boosted rescom demand by 13% yoy while production levels remained close to their last year’s levels. In contrast, AECO in Canada did not move much, averaging at $1.3/mmbtu -as Canadian storage sites are still quite full and production remains pretty strong.

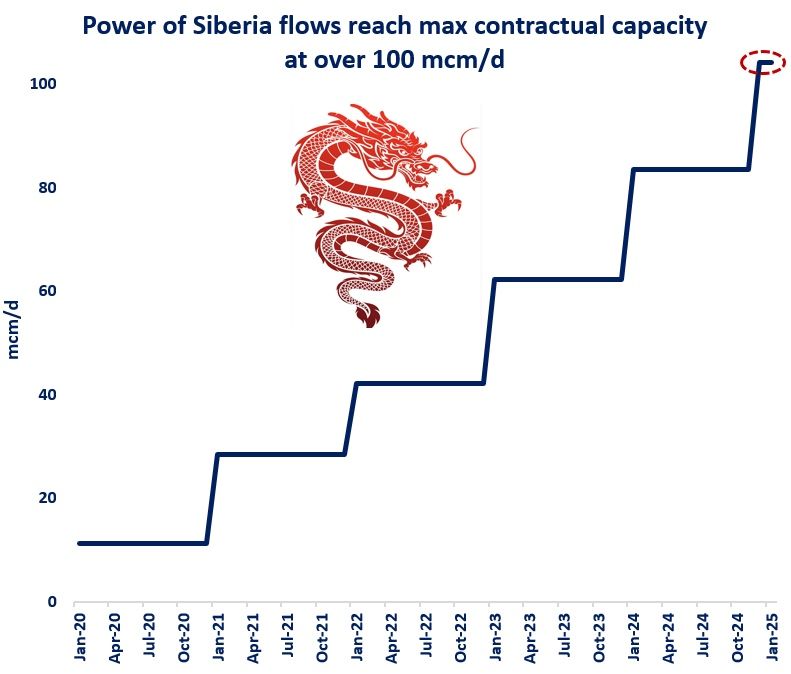

In Asia, JKM prices averaged $14.2/mmbtu -at a discount of $0.5/mmbtu compared to TTF. China’s gas demand remained depressed amid milder weather and weak macro-economic environment. The country’s PMI contracted to 49.1 -its lowest since Aug24. China’s LNG imports dropped by almost 25% yoy in Jan, squeezed between muted demand and higher Russian piped gas flows, with Power of Siberia now running at the full capacity.

What is your view? How will gas prices play out for the remainder of the heating season? The TTF premium seems to anchor itself for the coming months, amid rapidly depleting EU storage sites… but what is your view on Asian demand?

Source: Greg MOLNAR