Work hard, play hard: global gas benchmarks started the year with a massive bull ride, amidst cold winter temperatures and a tighter than expected gas supply.

In Asia, JKM MA prices jumped by almost threefold YoY, whilst half-month contracts peaked at over $30/mmbtu by mid-January, their highest level on record.

This unprecedented price rally has been largely driven by China and Japan ramping up their LNG imports by 38% and 15% respectively amidst colder than average temperatures and low nuclear availability in Japan. Outages at regional liquefaction plants, long shipping routes and lack of spot LNG carriers further supported the LNG bulls. Prices started to fall in the second half of the month, on improving nuclear availability and milder temperatures.

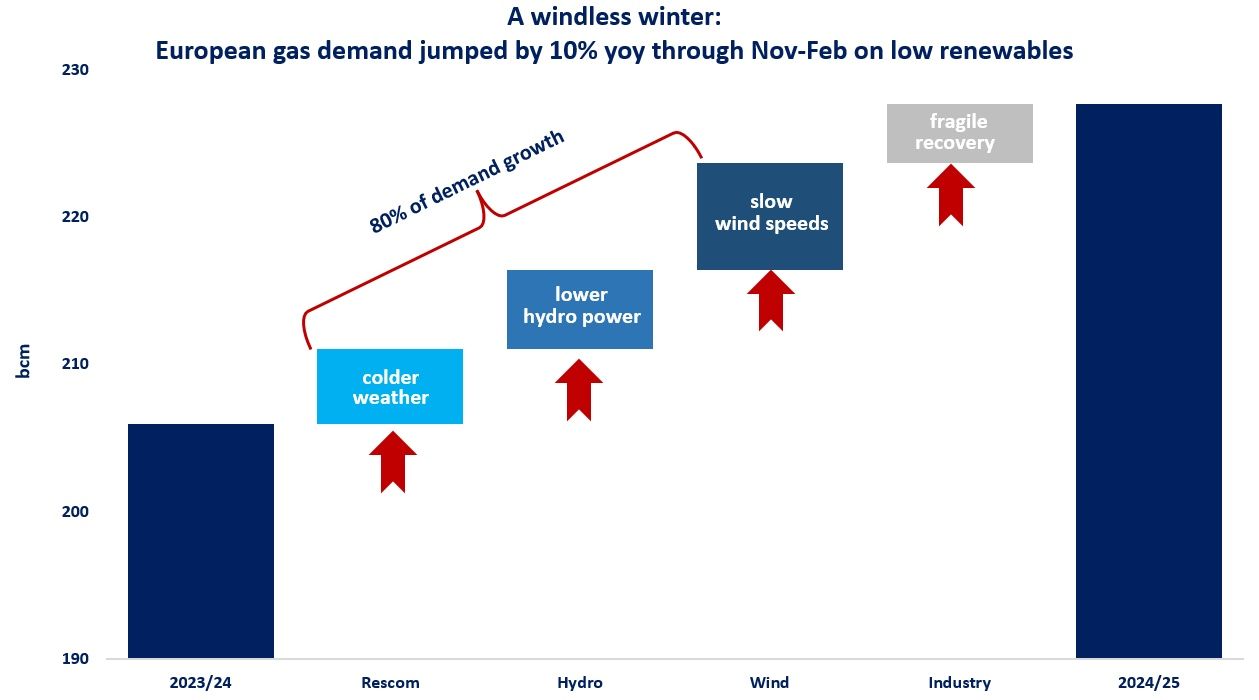

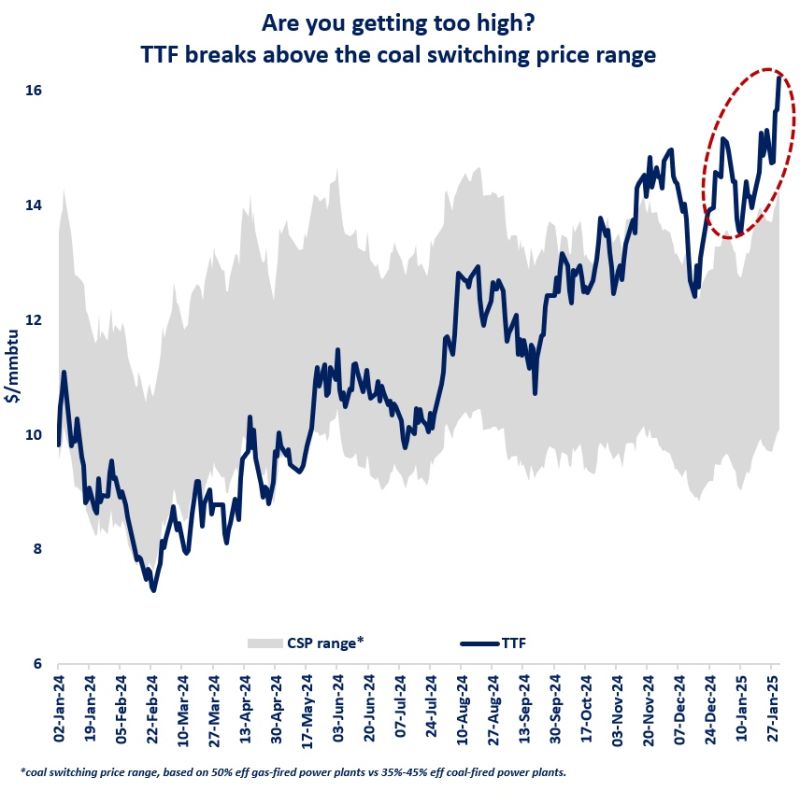

In Europe, TTF prices rose by twofold, amidst plummeting LNG influx (down by 50% YoY) as LNG cargoes were driven away to Asia and strong demand growth (up by over 7%) on cold temperatures in the first half of the month.

In the US, Henry was up by 20% YoY, largely supported by the ramping-up of LNG exports (up by ~50% YoY) and domestic production down by ~5% compared to last year.

What is your view? Is the bull ride over for this winter? How will prices evolve in 2021?

Source: Greg Molnar

See original post by Greg at LinkedIn.