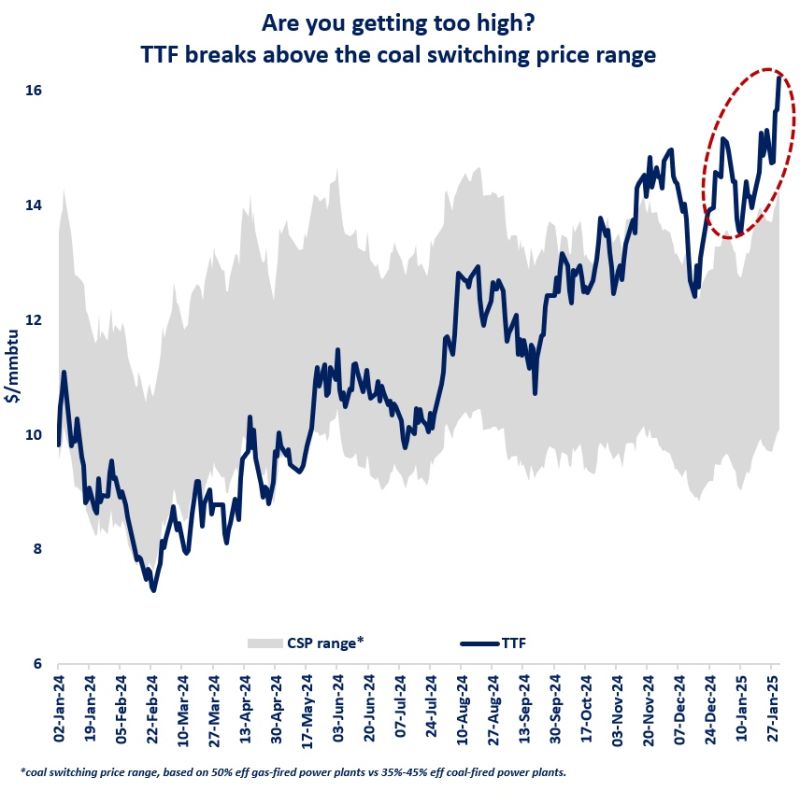

Do you remember the last time when Europe saw average prompt prices in early summer climbing above Jan levels? There has not been such a thing since ‘18, when the average TTF DA was assessed in Apr some EUR1/MWh higher than the same product in Jan. Three years later in ‘21, a similar scenario is repeating itself.

As the causes of this month’s rise in gas contracts were being analysed multiple times, it may be interesting to look at the current developments from a different angle, by comparing with those a year ago.

Apr ’21 is the very opposite of Apr ’20 for the market, except perhaps in the area of LNG imports. This is largely due to the easing of Covid restrictions across Europe, but another thing is important in that context.

The significant difference in market environment, now and then, again unsettles many of our assumptions about the speed at which a once static commodity has been recently evolved. Not so long ago, the conditions could not have changed so drastically over the period of 12 months, but in today’s reality even months can make a difference. With decarbonization plans taking shape and pipeline vs. LNG competition intensifying, high volatility will likely be more common in the market.

Source: Yakov Grabar

See original post by Yakov at LinkedIn.