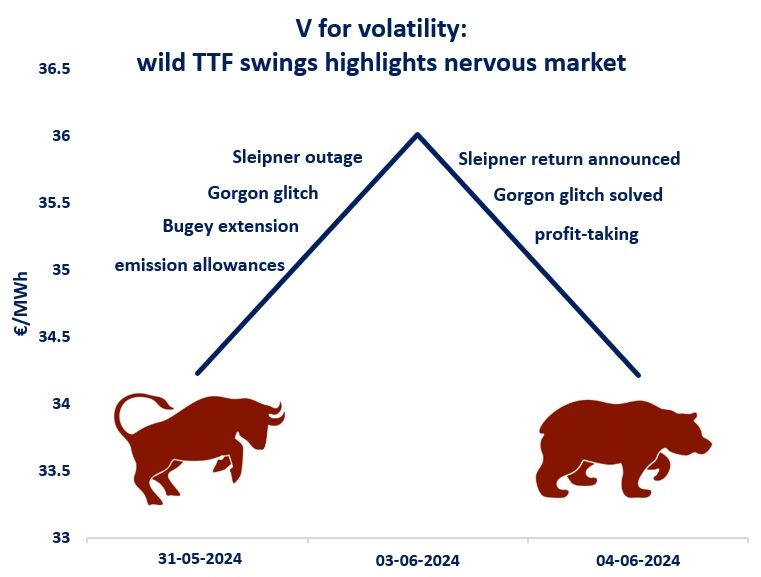

TTF was caught by a perfect storm yesterday, with intraday prices surging by near 13%, following a major outage at the Sleipner riser in Norway, taking out by almost 80 mcm/d of supply (equating to roughly 10% of Europe’s summer gas demand).

Add to this the European Commission’s announcement to withdraw 267 million emissions allowances, a glitch at the Gorgon LNG plant in Australia and the extension of the Bugey nuclear outage by another month.

Following yesterday’s wild ride, TTF moderated down close to last Friday’s levels, almost entirely offsetting the gains of Monday. Gassco announced that Sleipner could return by Friday, the Gorgon glitch was quickly resolved and some traders rushed to cash-in profits.

TTF’s wild volatility highlights that the market remains nervous, mainly due to the prevailing geopolitical uncertainty, including the fate of Russian piped gas flows to Europe.

Source: Greg Molnar (LinkedIn)