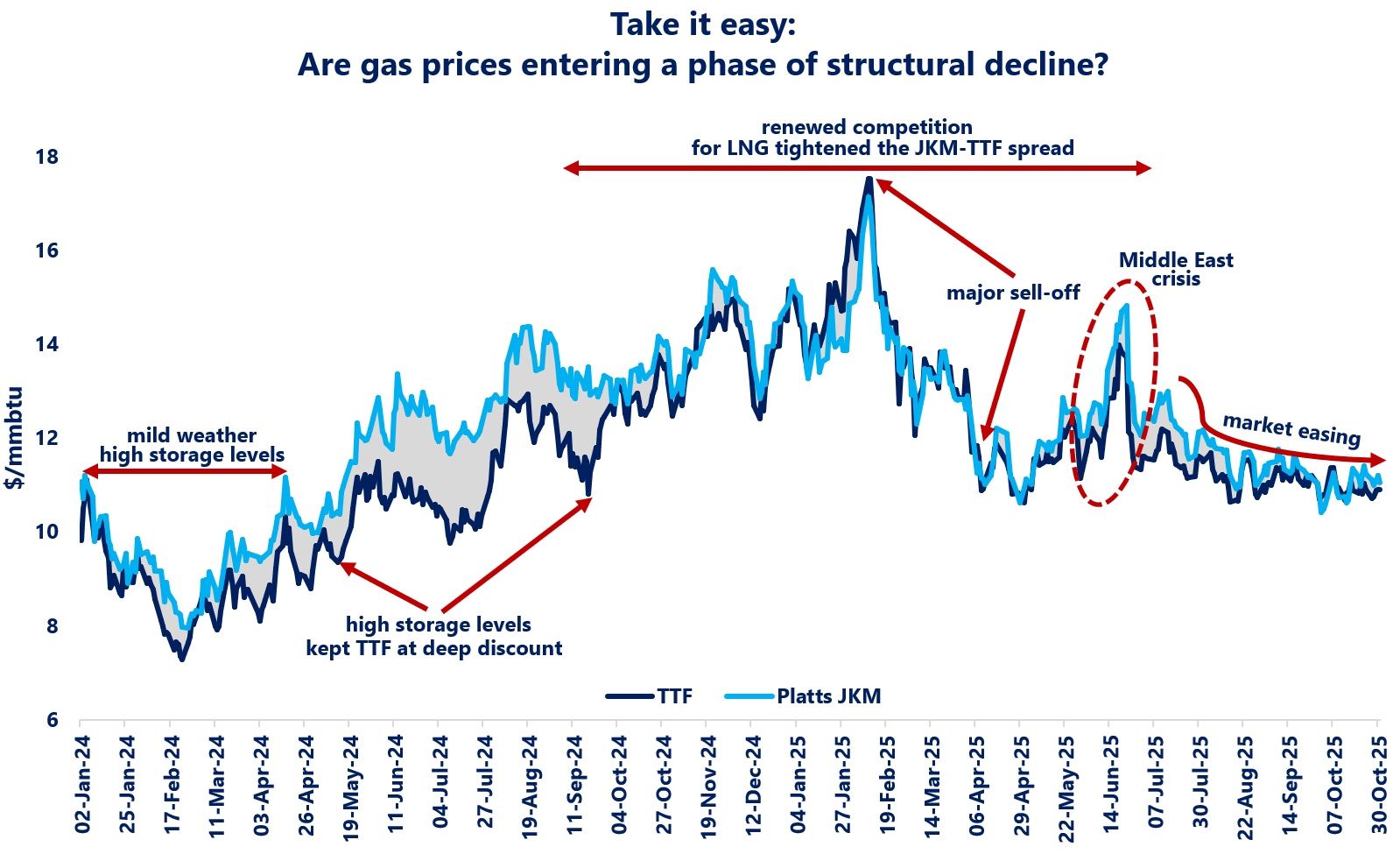

Middle East tensions, together with renewed uncertainties around Russian gas and lower Norwegian piped gas deliveries all supported higher TTF prices in recent months -despite plummeting gas-fired generation and high storage levels.

TTF and carbon prices displayed an almost perfect correlation since the beginning of the year, with an average of around 0.9.

The coal/gas switching corridor remains the most important reason behind this intimate relationship: higher gas prices are pulling up emission allowances, supporting the cost-competitiveness of gas-fired power plants against coal-based generation.

But other reasons could have strengthened further this relationship, including the rise of algo trading and hedging strategies which tend to pair TTF/EUA futures.

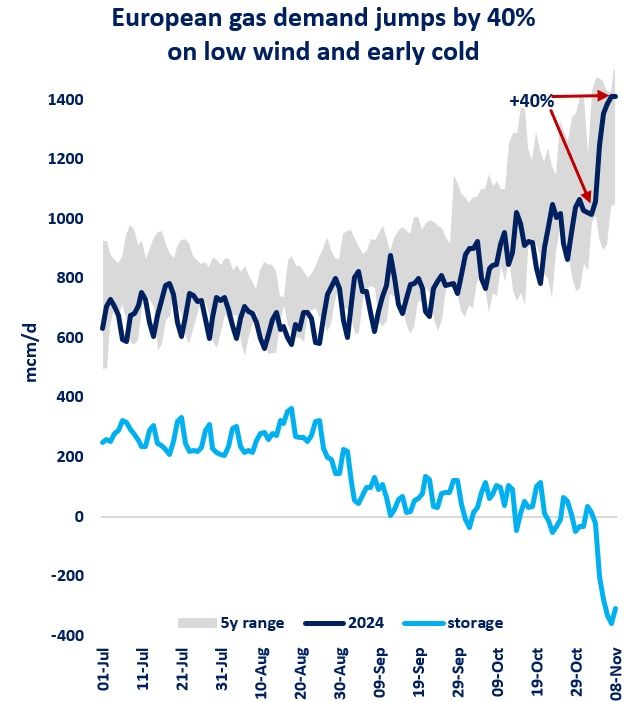

The strong increase in gas and carbon prices is ultimately supporting higher electricity prices, with Germany’s month-ahead up by almost 40% since the start of April.

Source: Greg Molnar (LinkedIn)