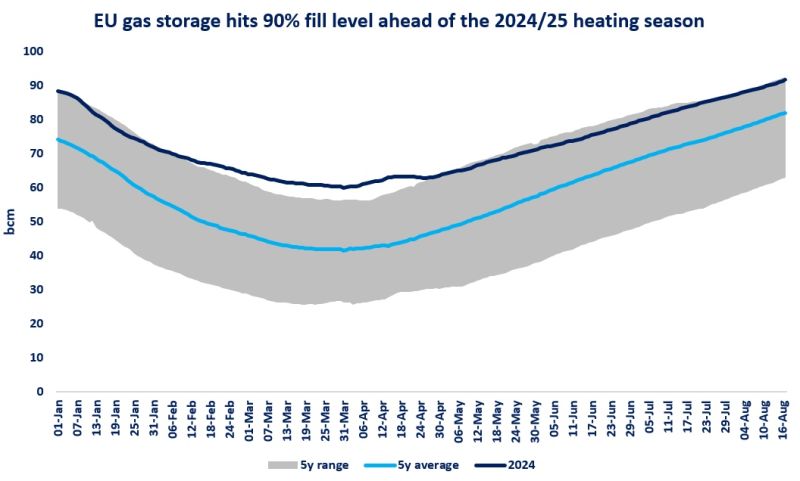

Drying up: European gas trading fell by 25% yoy in Q3 2022, largely driven by the steep declines recorded on TTF (-30%), Europe’s leading and most liquid gas hub.

The decline was the sharpest in September, when TTF recorded a drop of 44% yoy, both on volumes traded via exchanges and on OTC.

Other European hubs were more resilient, some of them even increasing traded volumes (PEG, Mibgas, THE) in Q3, but of course not enough to offset the losses on TTF, which alone accounts for ~80% of gas traded in Europe.

Traded volumes declining more sharply than gas demand is driving down the liquidity of the European market, with the churn ratio declining by 20% in Q3 and by 30% in September.

The record high gas prices, accompanied by extreme volatility lead to a sharp increase in margin call and costs associated with risk management/hedging.

It seems that many players simply don’t have enough financial backing to manage the current price and volatility environment.

The result is a less liquid market, with a lower number of active market participants, which is by definition more prone to larger price swings and grater volatility… a vicious circle.

What is your view? How will European trading evolve this winter season? Liquidity is crucial to ensure cost- and time-efficient trading…

Source: Greg Molnar