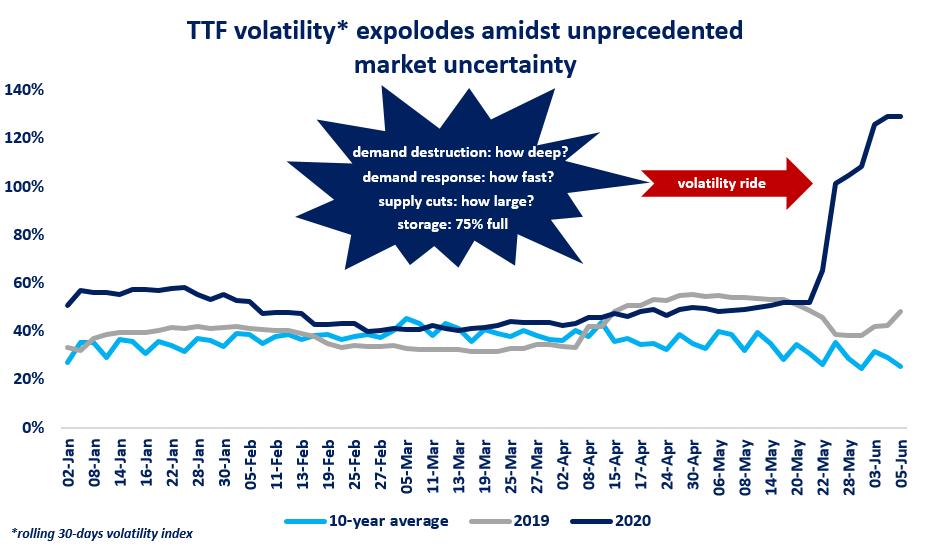

Who is up for a wild volatility ride? TTF has been jumping all over the place through the last couple of weeks: first plunging below $1/mmbtu in mid-May before a massive bull ride since 1st of June, gaining over 40%.

Whilst this price variance is not unusual on the spot, it is staggering to see how it filters through the forward, with both month-ahead and MA+1 contracts displaying a volatility well over 100% -around 5 times higher than the usual at this time of the year.

This highlights very well the unprecedented market uncertainty we are heading into this summer: how long-lasting is demand destruction? and when will we see some substantial demand response to the historically low spot prices? how large will be supply cuts? piped supplies have been down since the beginning of the year and we see that US LNG is starting blinking as well… will be that sufficient?

Meanwhile storage sites are rapidly filling up, over 75% full in Europe, meaning not only less storage space but also slower injection rates, so less market flex which is naturally increasing price volatility.

And these uncertainties, are here to stay for the summer, with some likely to gain further prominence..

What is your view? Are we up for a bumpy jumpy summer, with volatility high up to the sky?

Source: Greg MOLNAR

Connect with Greg on Linkedin