TTF prices surged by over 25% today (August 10), hitting an intra-day high of over €40/MWh.

This strong growth was driven by a number of factors, including:

(1) Corpus Christi outage in the US: the plant is currently running 15% below its average utilisation rates;

(2) Peru LNG seems to be offline, with no cargo loaded since 25 July;

(3) in Australia strikes are set to impact the North West Shelf giant LNG plant;

(4) in Japan LNG stocks keep declining, now standing almost 7% below their 5y average;

(5) in France EDF announced 10 day delay for the Flamanville 1 and St Alban 1 reactors.

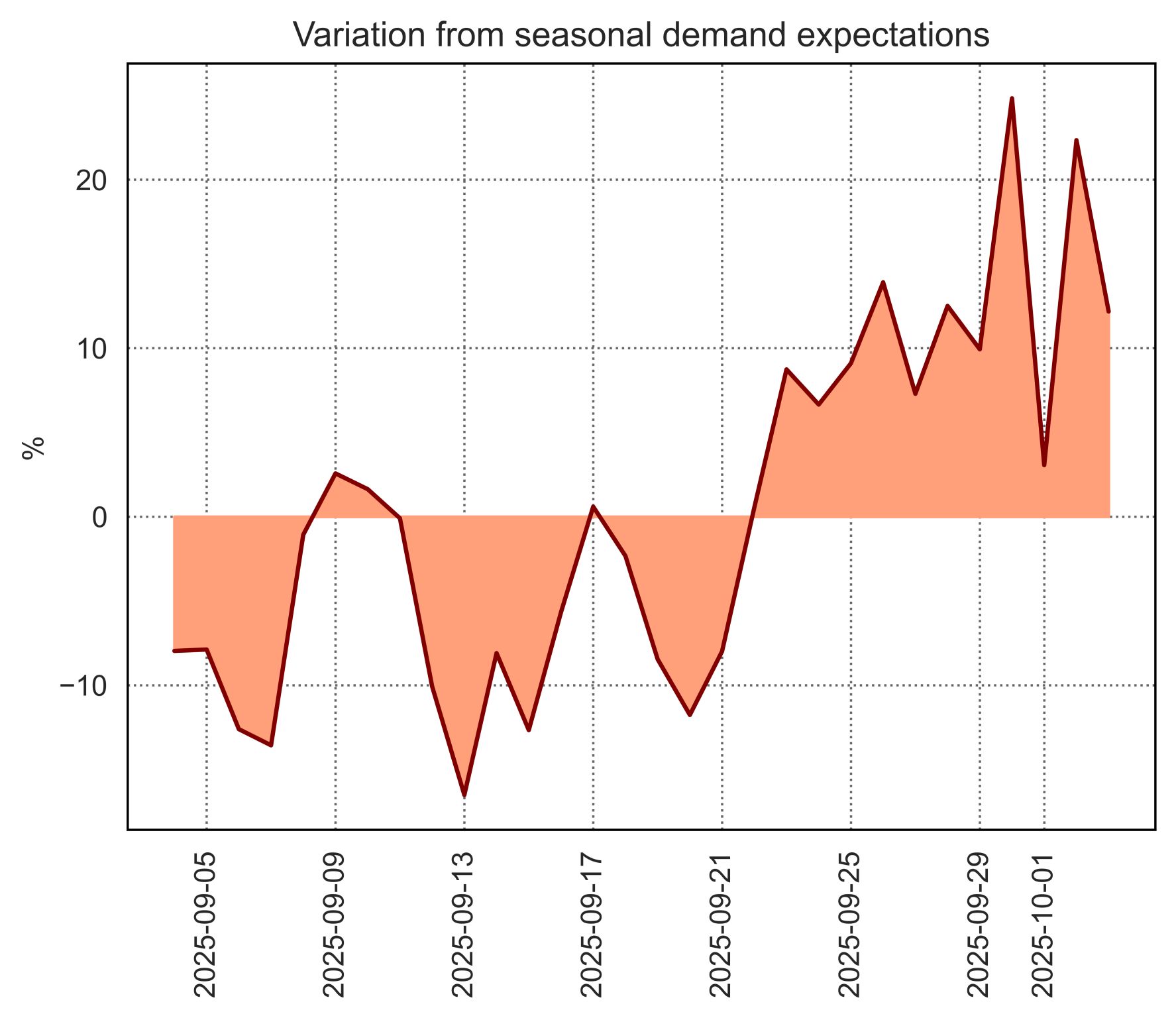

Today’s price surge is a stark reminder on the fragility of the current gas balance and that price volatility could easily return amidst tighter supply conditions.

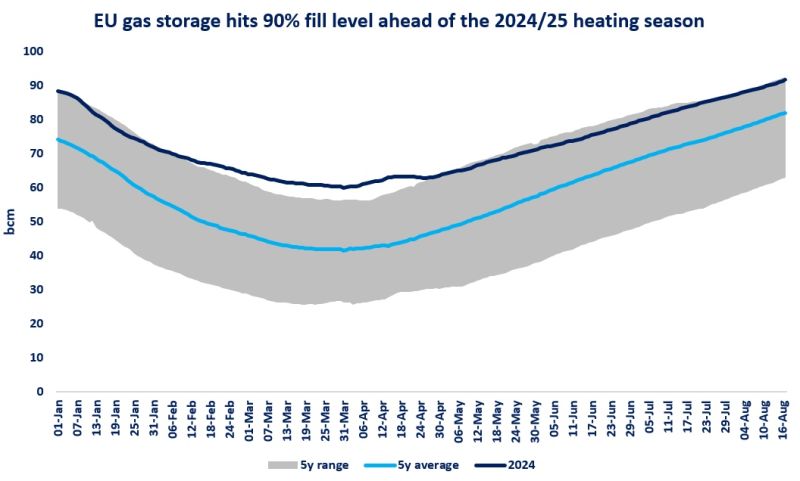

This being said, the overall near-term outlook remains bearish, with EU storage sites almost 90% full.

What is your view? How will gas markets evolve through the remainder of the gas summer. could we see more price hiccups?

Source: Greg MOLNAR