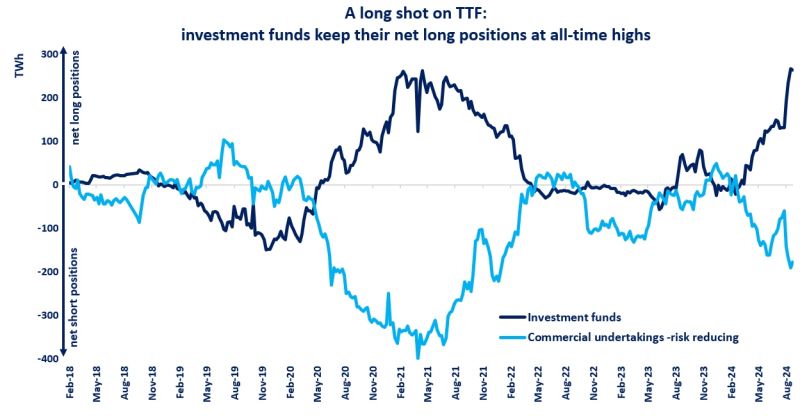

The net long position of investment funds more than doubled since early June to reach an all time high of over 250 TWh in the last two weeks.

This essentially means that money managers are betting on higher gas prices along the forward curve. This is driven by a number of considerations, including:

(1) the non-renewal of the Ukrainian transit contract would lead to tighter fundamentals and would make more difficult storage refill in summer 2025;

(2) delay of LNG projects: some of the projects announced for 2024/25 are running behind their schedules, including Tortue FLNG and Golden Pass;

(3) Middle East tensions are fuelling uncertainty and volatility across all commodities, including natural gas and LNG.

In contrast, commercial undertakings are taking very much the opposite view, with their net short positions indicating that they are betting on softening of gas prices. this is supported by: (1) very high storage levels and (2) weak demand in Europe.

And before some of us start to cry a river on how investment funds led to the recent increase in gas prices, two considerations: (1) trading on TTF is still very much dominated by physical players: accounting for almost 65% of positions; (2) investment funds are just offering a counter-position to traders who are taking a different position on the market.

What is your view? What is next for the European market ahead of the winter season? And how will the role of non-physical players evolve in the coming years? More speculation ahead?

Source: Greg MOLNAR